TL;DR:

- Digital shift spurs a rise in fraud, targeting digital wallets and A2A payments.

- Global card fraud losses reached $32.34B in 2021, set to total $397B by 2031.

- Brighterion and Fintech Nexus report: 63% of institutions link AI investment to fraud detection enhancement.

- Reality check: Despite the intent, less than half currently use AI for fraud detection.

- P2P A2A payments and digital wallets gain popularity, becoming prime fraud targets.

- Encryption in digital wallets offers protection, but hackers exploit vulnerabilities.

- Account takeovers risk exposes all connected cards.

- A2A payments lack traceability, enabling swift fraudulent transactions.

- AI emerges as a key solution, but adoption faces barriers: time, resources, complexity.

- Ready-made AI solutions are crucial for overcoming deployment challenges.

- The market demands accessible AI resources for robust fraud prevention.

Main AI News:

The digital transformation has ushered in a wave of fraudulent activities that financial entities must grapple with. As the utilization of digital wallets and the prominence of A2A (account-to-account) payments have soared, cunning fraudsters have leveraged cutting-edge technologies to exploit unsuspecting consumers.

In the year 2021 alone, global losses due to card fraud surged to an astounding $32.34 billion, marking a notable 13.8 percent increase from the preceding year. Forecasts for the upcoming decade paint a grim picture, projecting an aggregate worldwide loss of $397 billion within the industry, of which $165 billion will be attributed to the United States.

Against this backdrop, financial institutions have turned their attention even more intently toward the looming peril of fraud in this digital age. A recent joint study undertaken by Brighterion and Fintech Nexus disclosed that a considerable 63% of these institutions believed that enhancing fraud detection capabilities would be a key driver for their investments in artificial intelligence (AI).

Regrettably, the present reality falls short of this pressing demand. However, a substantial 93% of the surveyed entities expressed intentions to allocate resources for AI development over the forthcoming years, fewer than half had currently deployed this technology for fraud detection purposes. In a landscape where A2A payments are rapidly gaining favor as a favored mode of transaction, this delay in implementation could potentially lead to dire repercussions.

The Escalating Perils of Alternative Payments in the Face of Fraud

The comprehensive report jointly produced by Brighterion and Fintech Nexus unearthed a rather disconcerting revelation. Apart from traditional card-based transactions, real-time peer-to-peer (P2P) A2A payments, exemplified by platforms like Zelle, emerged as the favored choice of payment. Digital wallets, too, held their ground, being favored by 38% of the respondents. Additionally, a noteworthy 30% of the participants, although not yet offering A2A payment channels, expressed intentions to incorporate them in their future offerings.

Both P2P payments and digital wallets are witnessing an impressive surge in popularity. The report anticipates that by 2026, more than 5 billion individuals, constituting roughly 60% of the global population, will have embraced digital wallets.

While digital wallets boast robust encryption measures to safeguard users’ sensitive data, their virtual nature renders them alluring targets for cyber malefactors. Account takeovers present a palpable risk, potentially compromising all payment cards linked to an individual’s wallet. Furthermore, the encryption process within digital wallets involves the creation of tokens representing the accounts within, rendering the detection of credit card fraud significantly more challenging. Fraudsters can easily associate compromised cards with their personal wallets, swiftly shifting to different accounts if their initial attempts are thwarted. This seamless transition has significantly fueled the surge of payment fraud through digital wallets, a trend that experienced a marked escalation in the previous year.

Similarly, A2A payments are not immune to vulnerabilities. The lack of traceability inherent to these transactions facilitates fraudsters’ ability to sever connections with their accounts immediately after funds are received.

The Imperative of Advanced Fraud Detection: AI Takes Center Stage

Amidst these escalating risks, the pressing need for enhanced and expedited fraud detection mechanisms has become increasingly evident. This has propelled artificial intelligence to the forefront of technological solutions in this arena.

Prepackaged Solutions: The Catalyst for Wider Adoption

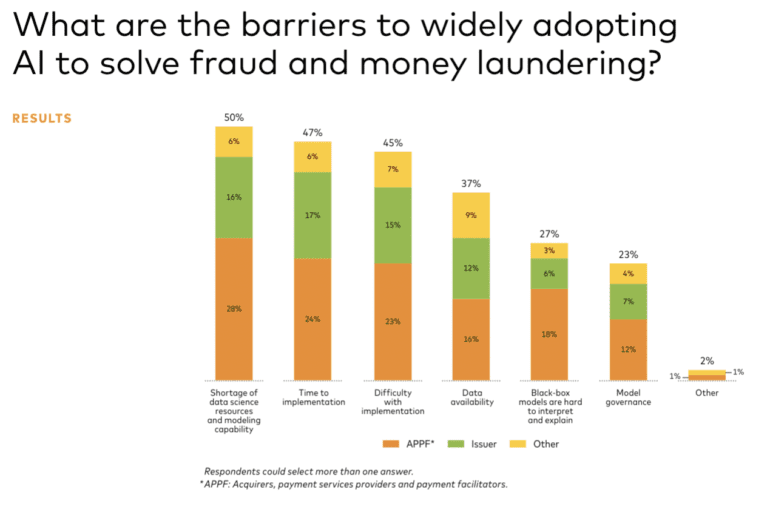

Financial institutions grappling with the formidable task of constructing their AI-based fraud detection systems find themselves constrained by both time and a dearth of data science resources. According to insights from the Brighterion survey, these factors present the most formidable obstacles to the integration of AI in fraud prevention. These challenges are closely followed by the complexity inherent in the task itself.

A significant portion of respondents attested that the ease of deployment would significantly influence the trajectory of their organization’s AI infrastructure. While a resounding 65% acknowledged the potency of AI in uncovering and thwarting fraud within alternative payment channels, the formidable barriers to in-house implementation have hindered progress. Respondents clearly conveyed that greater accessibility to this technology would pique their interest in addressing the burgeoning issue of fraud.

Conclusion:

The surge in digital fraud presents a pressing challenge for financial institutions. While AI holds promise for fraud detection, its adoption is hindered by operational complexities and resource limitations. The market’s call for prepackaged AI solutions underscores the need for accessible, advanced tools to combat evolving fraud risks and safeguard the digital financial landscape.