TL;DR:

- ComplyAdvantage has developed a groundbreaking AI solution to fight payment fraud.

- The solution uses advanced machine learning algorithms to identify and prevent fraudulent activities.

- Fraudulent transactions cause billion-dollar losses for consumers and businesses.

- ComplyAdvantage’s Fraud Detection tool empowers banks and financial institutions to monitor and intervene in criminal activities.

- The solution successfully identifies over 50 prevalent payment fraud scenarios.

- It generates comprehensive reports when suspicious activity is detected.

- Holvi, a digital banking service for small businesses, uses Fraud Detection as part of its financial crime risk detection strategy.

- The tool examines both monetary and non-monetary events to identify potential risk patterns.

- It can uncover “unknown unknowns” or fraud typologies that don’t match existing scenarios.

- Fraud Detection helps establish a strong first line of defense for payment providers, banks, and institutions.

- It protects customers and mitigates stress and losses caused by criminals.

- Valentina Butera from Holvi praises Fraud Detection for its cutting-edge technology and seamless implementation process.

Main AI News:

The growing concern of transaction-related fraud in the era of P2P and real-time payments has spurred the development of pioneering technology by ComplyAdvantage. This groundbreaking solution utilizes advanced machine learning algorithms to identify and prevent fraudulent activities, addressing the increasing ingenuity of fraudsters who exploit diverse channels. The consequences of such fraud extend to billion-dollar losses for consumers and businesses. ComplyAdvantage’s Fraud Detection tool empowers banks and financial institutions with an effective method to monitor daily transaction volumes and promptly intervene in criminal activities.

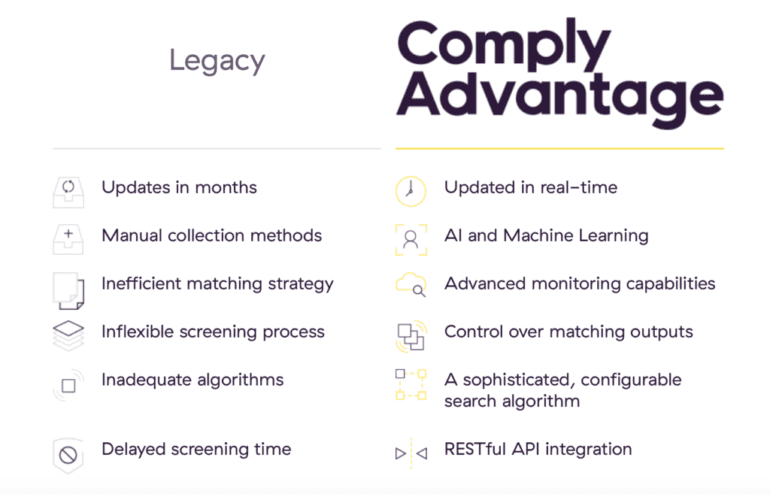

As a global leader in AI-driven financial crime risk data and fraud detection technology, ComplyAdvantage aims to mitigate risks associated with money laundering, terrorist financing, corruption, and other financial crimes. Their innovative Fraud Detection solution stands out by successfully identifying over 50 prevalent payment fraud scenarios. When suspicious activity is detected, the tool generates a comprehensive report, facilitating the swift resolution of the flagged transaction. This distinctive feature sets Fraud Detection apart from other similar products available in the market.

One notable organization utilizing Fraud Detection as part of its holistic financial crime risk detection strategy is Holvi, a digital banking service for small businesses. By employing AI and machine learning algorithms, ComplyAdvantage’s Fraud Detection thoroughly examines both monetary and non-monetary events to identify potential risk patterns. The tool’s sophistication is exemplified by its ability to uncover “unknown unknowns” or fraud typologies that do not match existing rule-based scenarios.

Oliver Furniss, Chief Product Officer at ComplyAdvantage, emphasizes the significant role of the Fraud Detection solution in enabling payment providers, banks, and institutions to establish a strong first line of defense. By protecting customers and mitigating the stress and losses caused by criminals, this technology proves invaluable. Valentina Butera, Head of AML and AFC Operations at Holvi, lauds the selection of Fraud Detection by ComplyAdvantage, citing the solution’s cutting-edge machine learning technology and seamless implementation process.

Conlcusion:

The groundbreaking AI solution developed by ComplyAdvantage to fight payment fraud represents a significant advancement in the market. With its advanced machine learning algorithms and ability to identify over 50 prevalent payment fraud scenarios, the solution provides banks and financial institutions with an effective tool to monitor and prevent fraudulent activities.

This technology not only mitigates risks associated with financial crimes but also protects customers and reduces the billion-dollar losses caused by fraud. By offering a comprehensive and cutting-edge solution, ComplyAdvantage has positioned itself as a leader in the market, enabling organizations to establish a strong first line of defense against payment fraud.