TL;DR:

- Datarails launches FP&A Genius, the world’s first generative AI tool for FP&A.

- FP&A Genius offers instant insights on budgets, forecasts, variance, and spending.

- Three powerful use cases: Fast Finance Requests, Executive Self-Service, and AI Storytelling Assistant.

- Finance teams benefit from increased speed, accuracy, and focus on strategic tasks.

- Executives gain self-service access to detailed financial information.

- AI-powered Storyboards transform complex data into compelling presentations.

Main AI News:

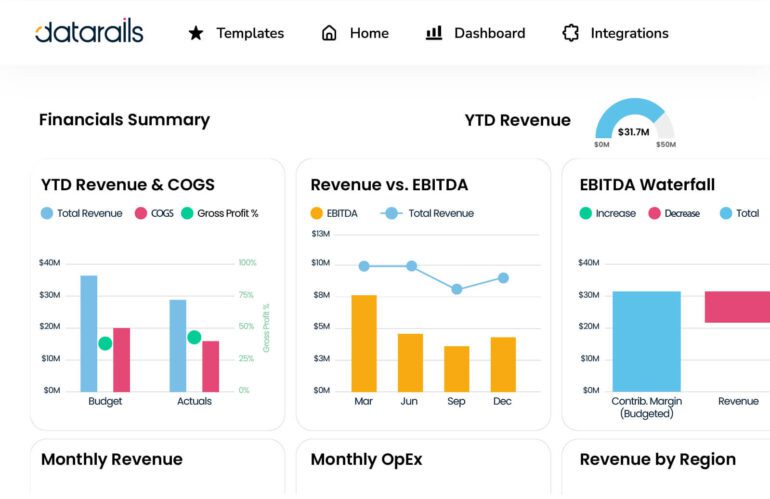

Datarails’ FinanceOS™ technology connects and standardizes financial and operational data.

Datarails, the leading FP&A platform tailored for Excel users, to announce the official launch of FP&A Genius, also known as “the ChatGPT,” specifically designed to revolutionize the CFO’s Office. As the world’s premier generative AI tool for FP&A, FP&A Genius provides unparalleled real-time insights into budgets, forecasts, variances, and expenditures, now readily available to new finance teams upon signing up with Datarails.

After extensive testing and iterative development alongside CFOs and FP&A leaders from various sectors, including manufacturing, technology, retail, and healthcare, Datarails has introduced three robust use cases for FP&A Genius.

At the core of the groundbreaking Datarails platform lie the following key features:

- Accelerated Financial Requests: By leveraging FP&A Genius, financial analysts can enhance the speed and accuracy of information provided to businesses. This empowers finance teams to redirect their focus towards long-term, value-adding strategic endeavors. Consider the scenario where FP&A professionals find themselves meticulously crafting a comprehensive board deck over the course of weeks. Unfortunately, it’s a common occurrence that the day before the board meeting, CFOs demand an additional five slides to address potential questions. Thanks to AI capabilities, analysts can leverage FP&A Genius to swiftly create and visualize such data in seconds, eliminating the need to cancel evening plans. Similarly, an FP&A partner participating in a meeting can promptly deliver detailed responses to critical business inquiries. This starkly contrasts with the previous norm, where it would take days or even weeks to retrieve essential information.

- Empowering Executive Self-Service: Finance teams can now grant executives the freedom to self-serve and obtain in-depth answers to their numerical inquiries. Instead of tying up finance teams for days on end, fulfilling these requests, CEOs and other company executives can directly access the information they seek. During the pilot phase, CFOs and CEOs tested a range of typical questions, such as “How does our revenue trend compare to last year?” or “Which customers contributed to the variance in revenue versus our budget last month?” By instantly receiving the information they require, CEOs and executives enable their finance teams to concentrate on value-added and strategically captivating tasks.

- AI Storytelling Assistant: With just a few clicks, complex financial data can now be transformed into engaging and actionable narratives that transcend mere numbers. Finance professionals have long faced the challenge of not simply understanding the numbers but also conveying them in a compelling manner. Datarails’ innovative AI storytelling assistant, known as “Storyboards,” employs AI algorithms to effortlessly convert dashboards into transformative presentations within seconds.

These advanced AI-driven features are built upon Datarails’ patented FinanceOS™ technology, which seamlessly connects and synchronizes previously disconnected spreadsheets and data sources within organizations. Consolidated in the cloud, FinanceOS provides a standardized view of data from a company’s financial systems, operational systems, and payroll. Leveraging AI capabilities, this comprehensive financial picture empowers the CFO’s office in small and medium-sized businesses to access critical insights effortlessly.

CEO and Co-Founder of Datarails, Didi Gurfinkel, predicts that within the next year, FP&A teams will experience a rapid transformation, unlike anything witnessed in the past two decades. Gurfinkel highlights that many small and medium-sized businesses find themselves trapped in a hamster wheel when it comes to FP&A, hindered by growing manual tasks and an inability to focus on value-added activities. The exciting and swift evolution of AI now liberates finance professionals, enabling them to dedicate their time to more intricate analyses, strategic decision-making, and crafting more compelling narratives around financial figures. Moreover, CEOs, CFOs, and finance teams collectively embrace the newfound ability to identify patterns and trends, empowering them to make informed decisions more swiftly and effectively.

Conclusion:

The introduction of Datarails’ FP&A Genius represents a significant development in the market. By combining advanced AI capabilities with finance and analytics, Datarails empowers CFOs and finance teams to enhance their efficiency, accuracy, and strategic decision-making. The AI-driven features of FP&A Genius address common pain points in financial planning and analysis, enabling teams to focus on value-added tasks while providing executives with self-service access to critical insights. With the accelerated transformation of FP&A teams, driven by AI technology, the market can expect to witness increased productivity, improved financial storytelling, and faster, more informed decision-making across industries.