TL;DR:

- Nvidia’s shares surge after Mizuho raises price target due to AI chip potential.

- The AI chips market could grow tenfold to $400 billion, with Nvidia eyeing 75% market share.

- Analysts foresee ~$300 billion in AI-specific revenue for Nvidia.

- Nvidia’s stock target price raised to $769, with a mid-point of $625 by 2027.

- Generative AI demand provides a significant opportunity for Nvidia’s GPU business.

- Nvidia joins the ‘Trillion Dollar Club’ with a remarkable market cap.

- Projected revenue for the current quarter exceeds Wall Street forecasts.

- Nvidia’s AI “supercomputer,” DGX, opens new opportunities in the AI-as-a-service market.

Main AI News:

Nvidia, the renowned tech giant, is witnessing a surge in its share prices, and for a good reason. Mizuho analysts have recently raised their price target for Nvidia, hinging on the immense potential of its new focus on AI chips. According to their projections, this strategic move could generate a staggering $300 billion in new revenues.

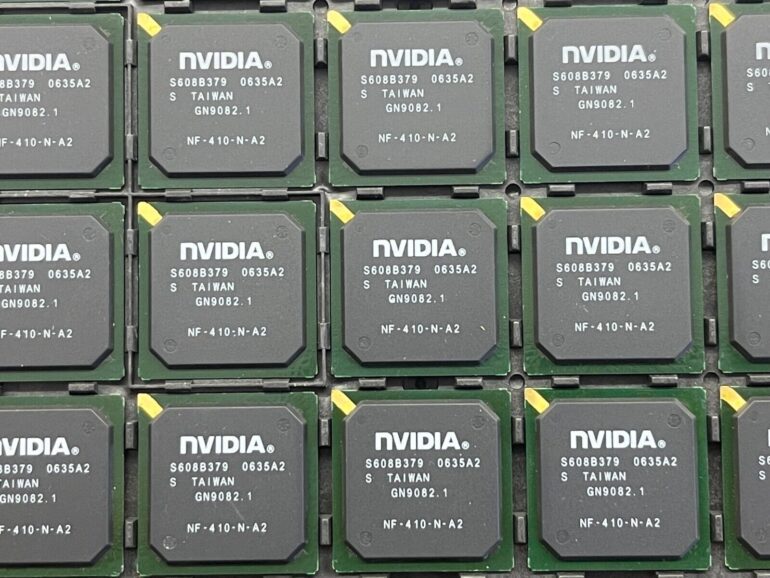

AI chips, also known as GPUs, are at the forefront of the technology revolution, and Mizuho believes their market could expand tenfold over the next five years, surpassing a colossal $400 billion. Despite the rising competition from the likes of Amazon, Google, Tesla’s ‘Dojo,’ Mizuho predicts that Nvidia will eventually command a dominating 75% market share, firmly establishing its position as a leader in the AI chip domain.

Mizuho’s analyst, Vijay Rakesh, is bullish on Nvidia’s prospects and envisions the stock reaching an impressive $769 per share, translating to an eye-watering market value of $1.9 trillion, if their most optimistic revenue gains materialize. Even their mid-point estimate of $625 per share by 2027 would be a significant boost from the current valuation. In light of these projections, Rakesh has raised Nvidia’s price target to $530 per share.

The growing demand for generative AI presents a vast opportunity for GPU supplier Nvidia. Rakesh points out that Nvidia’s solid AI roadmaps will further unlock the company’s value, enabling it to capitalize on the accelerating AI trend.

As of early Monday trading, Nvidia shares experienced a 1% hike, reaching $447.31 each. This impressive surge contributes to the stock’s outstanding year-to-date gain, standing at approximately 207%. The whole chip sector, represented by the Philadelphia Semiconductor Index, has also witnessed a significant uptrend, closing at an 18-month high of 3,712.77 points on Friday, with a year-to-date surge of around 46.1%.

Nvidia’s remarkable progress has earned it a spot in the elite ‘Trillion Dollar Club.’ Only five other U.S. companies, namely Meta Platforms, Amazon, Apple, Google, and Microsoft, have managed to surpass the remarkable $1 trillion market cap threshold.

Earlier, Nvidia announced its projected revenue for the current quarter, setting it around $11 billion, surpassing Wall Street’s estimates by more than 50%. With a gross margin of around 70%, the earnings are expected to be approximately $2.04 per share, nearly doubling the prior forecast. Additionally, Nvidia’s bottom line for the three months ending in April, with a profit of $1.09 per share on revenue of $7.19 billion, exceeded Wall Street expectations, fueled by strong data-center sales, especially in the generative AI and large language models sector.

Nvidia’s CEO, Jensen Huang, has recognized AI’s pivotal position as the world’s fastest-developing technology. With the introduction of their new AI “supercomputer,” Nvidia DGX, the company is poised to lead the AI-as-a-service market, potentially worth over $600 billion, catering to countless businesses worldwide.

Conclusion:

Nvidia’s strategic focus on AI chips presents an immense growth opportunity for the company. With projections of generating $300 billion in new revenues and holding a substantial market share, Nvidia is well-positioned to dominate the AI chip sector. The company’s advancements in AI technology, particularly the DGX platform, could propel it to unprecedented market valuation, making it a key player in the lucrative AI-as-a-service industry. As the demand for AI accelerates, Nvidia’s trajectory in the trillion-dollar club signifies a promising future for the market, where AI-driven technologies will play a central role in shaping various industries.