TL;DR:

- Oxford’s research team introduces JAX-LOB, a GPU-accelerated limit order book (LOB) simulator.

- JAX-LOB leverages Google’s JAX for training high-performance AI systems on financial data.

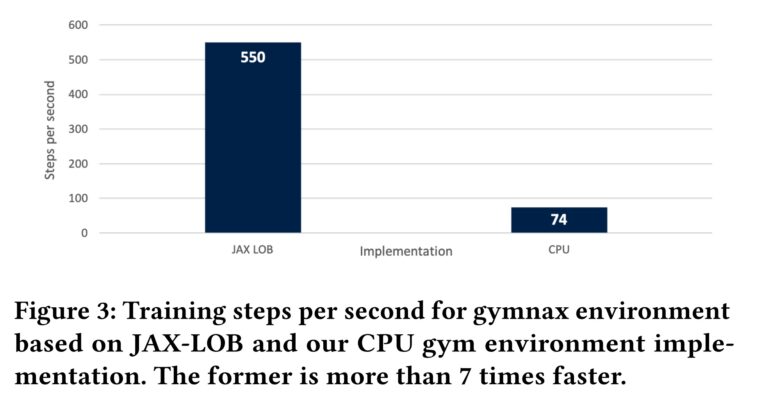

- By running LOB simulations on GPUs, AI models experience up to a 7x speed boost.

- LOB dynamics, critical in finance, benefit from more accurate AI models.

- The potential impact of JAX-LOB on AI and fintech is substantial, as it may enable AI-driven financial experiments.

Main AI News:

In a pioneering endeavor, a multidisciplinary research team hailing from the prestigious University of Oxford has unveiled a groundbreaking GPU-accelerated limit order book (LOB) simulator, christened JAX-LOB. This cutting-edge development marks a historic milestone as the first of its kind in the realm of financial technology.

JAX, a formidable tool meticulously crafted by Google for the training of high-performance machine learning systems, now finds its application in the context of a LOB simulator. This ingenious integration empowers artificial intelligence (AI) models to undergo training directly on intricate financial data.

What sets the Oxford research team’s achievement apart is their novel approach to harnessing the power of JAX for running a LOB simulator exclusively on graphics processing units (GPUs). Traditionally, LOB simulations have relied on the computational prowess of central processing units (CPUs). However, by orchestrating these simulations on a dedicated GPU chain strategically aligned with the modern milieu of AI training, the models enjoy a significant advantage. As outlined in the Oxford team’s pre-print research paper, this transformation yields a staggering speed increase of up to 7 times the conventional pace.

LOB dynamics stand as a focal point in the multifaceted world of finance, subject to extensive scientific scrutiny. In arenas like the stock market, LOBs facilitate the indispensable role of maintaining liquidity for full-time traders throughout their daily sessions. Moreover, in the dynamic landscape of cryptocurrencies, LOBs serve as a linchpin, revered and embraced at nearly every echelon by astute professional investors.

The challenge of training an AI system to decipher the intricate nuances of LOB dynamics cannot be understated. This formidable endeavor demands copious amounts of data and computational power, as the nature and complexity of financial markets necessitate reliance on sophisticated simulations. It is a well-established fact that the accuracy and potency of these simulations directly influence the efficacy and utility of the models they cultivate.

As succinctly put forth in the Oxford team’s paper, optimizing this critical process assumes paramount significance: “Due to their central role in the financial system, the ability to accurately and efficiently model LOB dynamics is extremely valuable. For example, it might allow a financial company to offer better services or may enable the government to predict the impact of financial regulation on the stability of the financial system.”

While JAX-LOB is still in its nascent stages, its potential implications are nothing short of transformative. The researchers, ever cognizant of the importance of continuous exploration, emphasize the need for further study in their paper. Nevertheless, experts are already beginning to anticipate the far-reaching impact this innovation may have on the realms of artificial intelligence and fintech.

Jack Clark, a luminary in the field and co-founder of Anthropic, aptly sums up the intrigue surrounding this pioneering software: “Software like JAX-LOB is interesting as it seems like the exact sort of thing that a future powerful AI may use to conduct its own financial experiments.”

Conclusion:

Oxford’s JAX-LOB represents a groundbreaking leap in AI-driven trading, leveraging GPU acceleration to significantly enhance simulation speed and accuracy. This innovation holds the potential to revolutionize AI and fintech industries, paving the way for more sophisticated and efficient financial models and applications. Its role in empowering future AI-driven financial experiments underscores its importance in shaping the market’s future.