TL;DR:

- DataVisor, a leading AI-driven fraud prevention platform, introduces AI Co-Pilot, a revolutionary solution.

- AI Co-Pilot outperforms traditional methods with a 20x increase in speed and precision for fraud detection.

- DataVisor’s reputation is built on comprehensive fraud prevention solutions using advanced AI and machine learning.

- The company’s mission is to proactively identify evolving fraudulent patterns in real-time.

- AI Co-Pilot enhances fraud detection capabilities, reduces false positives, and improves user experiences.

- It is particularly valuable in the context of instant payment systems like FedNow, aiding financial institutions.

Main AI News:

DataVisor, the globally acclaimed leader in AI-driven fraud and risk management, has once again taken center stage in the fight against financial fraud.

In a groundbreaking move to elevate fraud detection capabilities, DataVisor has unveiled AI Co-Pilot, a solution that redefines the landscape, outperforming traditional methods by a staggering twentyfold in speed and precision.

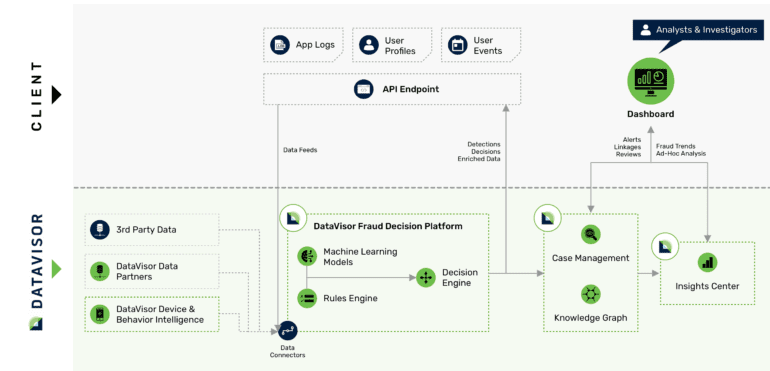

DataVisor’s sterling reputation is built on its unparalleled suite of fraud and financial crime prevention solutions, leveraging cutting-edge AI and advanced machine learning. The company’s overarching mission centers on proactive protection, swiftly identifying evolving fraudulent patterns in real-time. With a data-centric and adaptive approach, DataVisor ensures businesses remain resilient in the ever-evolving digital ecosystem.

AI Co-Pilot, the latest jewel in DataVisor’s crown, empowers financial institutions with unparalleled fraud detection prowess. By significantly reducing false positives and enhancing the user experience, this technology delivers real-time efficiency that is indispensable in today’s financial landscape. With the recent introduction of FedNow and the continued expansion of instant payment systems, AI Co-Pilot emerges as an essential tool, equipping financial institutions to fully capitalize on instant payment opportunities while deftly managing associated challenges.

Yinglian Xie, CEO of DataVisor, emphasizes the vital role of innovation in combating fraud in the payments and banking sector: “Innovation in payments and banking demands continued innovation in fraud prevention. Built on groundbreaking Generative AI technology, DataVisor’s AI Co-Pilot provides financial institutions with superior intelligence and automation for more effective fraud detection and prevention. This innovative solution boasts unparalleled accuracy, responds rapidly to emerging fraud trends, enhances user experiences, and elevates customer support. Simultaneously, it substantially reduces the reliance on analyst resources. This advancement marks a pivotal stride towards enhanced security and efficiency across the industry.“

Conclusion:

DataVisor’s AI Co-Pilot is set to reshape the fraud prevention landscape. With its remarkable speed and precision, it enhances the efficiency and security of financial institutions, especially in the era of instant payments. This innovation signifies a major leap forward for the market, offering better intelligence, automation, and enhanced user experiences in the fight against financial fraud.