TL;DR:

- HPE and Dell have differing AI strategies despite both recognizing AI as a key driver of IT revenue growth.

- Dell extends AI inferencing to PCs, while HPE focuses on supercomputers.

- HPE emphasizes its value in the AI market through IP, expertise, and supercomputing leadership.

- HPE forecasts growth in edge, hybrid cloud, and AI markets.

- The storage sector shows signs of slowing growth.

- HPE aims to gain market share in the hybrid cloud, focusing on data transformation and modernizing IT infrastructure.

- HPE invests in its own IP for high-end AI training models.

- Dell forecasts higher AI-driven revenue growth compared to HPE.

Main AI News:

In the ever-evolving landscape of IT infrastructure, HPE and Dell, two tech giants, stand at the forefront with divergent approaches to harness the power of artificial intelligence (AI). Both companies recognize AI as the primary catalyst for driving revenue growth in the IT sector over the coming years. Their strategies encompass a broad spectrum, spanning from edge computing to hybrid cloud data centers. Yet, it’s in the finer details that these industry titans part ways.

Both HPE and Dell acknowledge the role of x86 servers in AI inferencing, but here’s where their paths diverge. Dell extends its AI inferencing capabilities all the way down to personal computers, a market segment it actively participates in, whereas HPE refrains from this arena. Conversely, HPE’s strategy reaches skyward into the realm of supercomputers, a domain where it excels but where Dell does not tread.

This dichotomy has significant implications for their customers. Dell clients seeking large-scale AI training must seek access to Nvidia GPU server systems, while HPE boasts its Cray systems as the solution for such demands. HPE asserts that its differentiation lies in its ability to extract substantial value from the burgeoning AI market, capitalizing on its intellectual property, trusted expertise, and longstanding dominance in supercomputing.

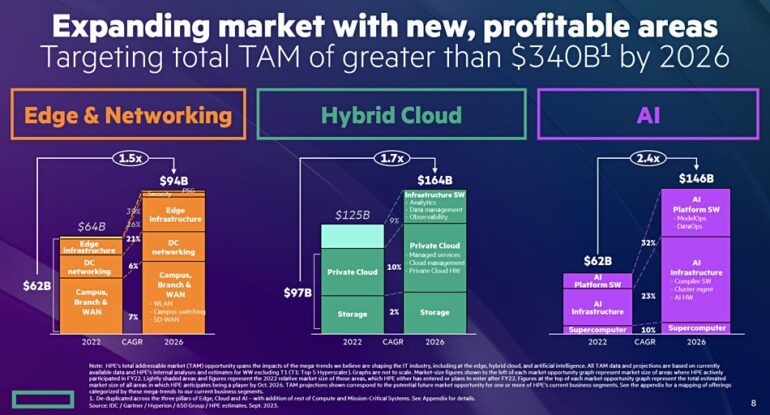

HPE’s President and CEO, Antonio Neri, paints an optimistic picture, emphasizing the company’s expanding Total Addressable Market (TAM) across three key components:

- Edge and Networking: Projected to surge 1.5 times from $62 billion in 2022 to a robust $94 billion by 2026.

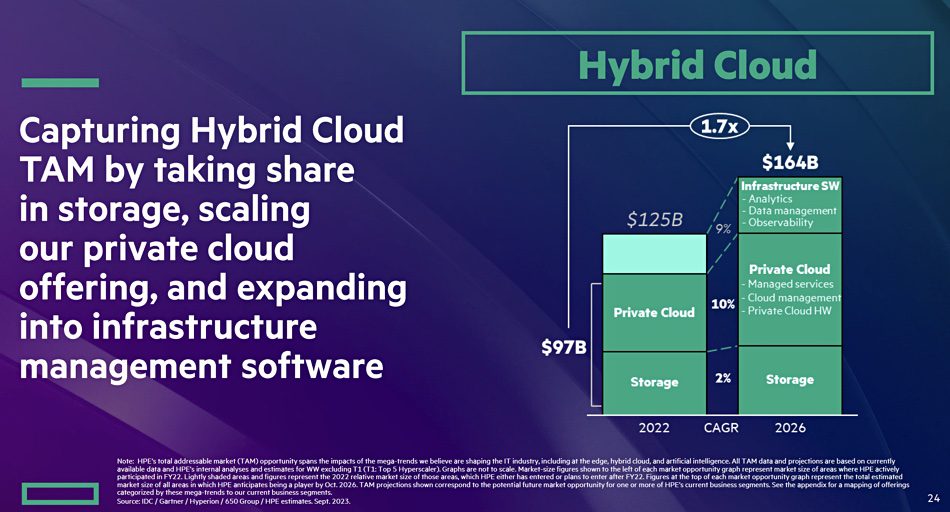

- Hybrid Cloud: Expected to experience a 1.7-fold increase from $97 billion in 2022 to a staggering $164 billion.

- AI: Anticipated to witness remarkable growth, soaring 2.4 times from $62 billion in 2022 to an impressive $146 billion in 2026.

Within the realm of hybrid cloud, storage appears to be a cornerstone, albeit with some hints of deceleration. Although the chart bars merely serve as indicators and not precise scales, the trajectory suggests a slowing growth rate. Additional insights reveal the actual storage TAM at $58 billion in fiscal 2022, projected to reach $66 billion in 2026.

While storage is integral, HPE’s presentation focuses on the Edge & Networking sector, highlighting GreenLake’s management of over 2 exabytes of data. However, storage finds its spotlight in the hybrid cloud section.

Source: Situation Publishing

Fidelma Russo, EVP for Hybrid Cloud and CTO, articulates HPE’s ambition to claim a substantial market share in hybrid cloud, with a particular emphasis on storage. Three key challenges emerge data transformation, IT infrastructure modernization, and streamlined hybrid cloud operations.

The transformation through data strategy centers on Alletra series, bolstered by Alletra MP’s block and file storage platform, featuring VAST Data’s software technology. This forms a scalable, cloud-native architecture with AIOps support.

Modernizing IT infrastructure aligns with cloud-like operations through GreenLake, incorporating hybrid cloud orchestration, private clouds, and AI-optimized infrastructure.

The section on Simplifying Hybrid Cloud Operations introduces GreenLake for Backup and Recovery and Zerto (DR), resonating with the overarching theme of Software as a Service (SaaS).

In the AI segment, presented by Justin Hotard, EVP and GM for HPC, AI & Labs, HPE’s focal point revolves around investing in its own IP in supercomputing and AI. HPE aspires to host high-end AI training models on its Cray hardware, projecting a substantial 22 percent Compound Annual Growth Rate (CAGR) for x86-based compute AI Inference TAM from 2022 to 2026, contrasting with the 2 percent CAGR in non-AI x86 compute TAM.

Nvidia GPUs prominently feature as accelerator components within HPE’s AI compute portfolio, joined by GPUs from AMD and Intel, albeit to a lesser extent.

SVP and interim CFO Jeremy Cox offers a financial perspective, highlighting HPE’s intention to shift its portfolio mix towards margin-rich, owned-IP offerings in the hybrid cloud storage domain. This shift poses potential challenges for storage partners such as Scality, Weka, and Qumulo, who represent non-HP-owned IP.

Cox further elaborates on HPE’s expansion plans, venturing into new addressable markets like file and object storage, alongside an extended SaaS portfolio. This growth strategy aligns with market trends, a departure from Russo’s pursuit of storage market share.

Source: Situation Publishing

Conclusion:

The clash of AI strategies between HPE and Dell reflects their distinct market approaches. While HPE capitalized on its supercomputing prowess and trusted IP, Dell’s focus on AI inferencing in PCs could potentially lead to higher AI-driven revenue growth. The market can expect increased competition and innovation as these tech giants navigate the evolving landscape of AI and IT infrastructure.