TL;DR:

- Nvidia is set to unveil three AI chips designed exclusively for the Chinese market.

- These chips are based on the design of Nvidia’s flagship H100 product.

- Chinese firms are expected to receive these AI chips in the coming days.

- The move follows increased export restrictions by the US to limit China’s access to advanced semiconductors.

- Nvidia shares experienced a 1.9% increase in premarket trading.

- The Biden administration’s efforts to restrict advanced chip exports have affected Nvidia’s product development and customer supply chain.

- Nvidia’s A800 and H800 series, tailored for Chinese firms, were among the targeted products.

- The new US export control rules have prevented Nvidia from shipping its top-tier gaming graphics card, the RTX 4090, to China.

- Intel Corporation is also planning to release a new AI chip for the Chinese market.

Main AI News:

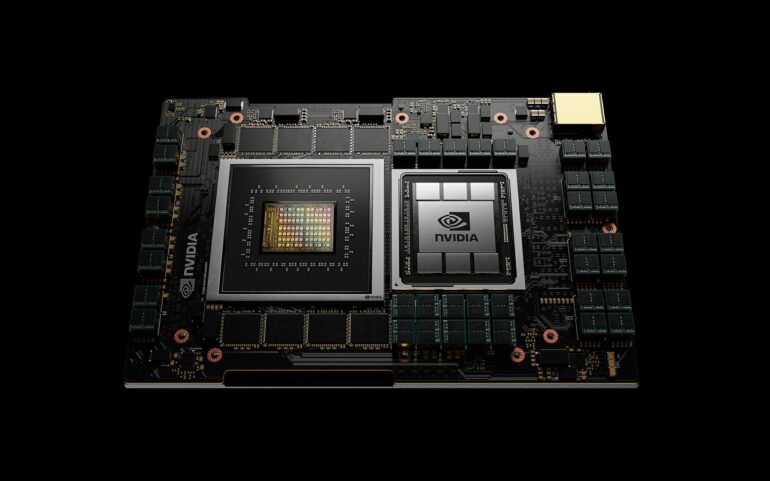

In a strategic response to heightened export restrictions, Nvidia Corporation is poised to introduce three groundbreaking artificial intelligence chips tailored exclusively for the Chinese market. This pivotal development comes in the wake of the United States’ recent escalation of measures aimed at limiting China’s access to advanced semiconductor technology.

Drawing inspiration from its flagship H100 product, Nvidia’s latest AI chips are poised to make a significant impact in the Chinese tech landscape. According to exclusive insights from Chinastarmarket, a state-affiliated news outlet, Chinese companies are set to take delivery of these cutting-edge chips in the coming days. Unnamed supply chain sources have added credibility to this report. Following this revelation, Chinese server supplier IEIT Systems Co. experienced a remarkable surge, closing up with a daily limit gain of 10%.

Nvidia, a pioneer in AI technology, has chosen to remain tight-lipped about this strategic move. As anticipation builds, Nvidia’s shares exhibited a promising 1.9% increase in premarket trading on the New York Stock Exchange.

This development comes in the wake of Nvidia grappling with its worst stock decline in several months. The catalyst for this decline was the Biden administration’s intensified efforts to curtail the flow of advanced chips into China. These efforts included the imposition of restrictions on the sale of AI processors designed specifically for the Chinese market. Nvidia had earlier warned of potential disruptions to its product development and customer supply chain due to these latest restrictions.

Among the products that Washington had squarely targeted in its efforts were Nvidia’s A800 and H800 series. These specialized AI accelerators had been meticulously crafted for Chinese enterprises. American officials had initially introduced restrictions on AI accelerators for China in 2022 out of concerns that these technologies could potentially be leveraged to enhance Beijing’s military capabilities.

The recent US export control regulations have placed Nvidia in a challenging position, preventing the company from shipping even its top-tier consumer gaming graphics card, the RTX 4090, to China—the world’s largest semiconductor market. While Nvidia has expressed confidence in its short-term financial resilience, there have been reports suggesting that the company may have to cancel orders worth billions of dollars from prominent Chinese tech firms.

In parallel developments, Intel Corporation has also disclosed its plans to launch a new AI chip tailored for the Chinese market. Local media outlet 21st Century Business Herald reported on this significant move by Intel, underscoring the competitive landscape in the realm of AI chip technology.

Conclusion:

Nvidia’s strategic launch of AI chips tailored for the Chinese market is a significant response to the escalating export restrictions imposed by the US While it provides Nvidia with an avenue to continue its business in China, it underscores the challenges posed by geopolitical tensions on the semiconductor industry. The competition in this space is intensifying, with Intel also entering the market, and the long-term impact on Nvidia’s global operations remains uncertain.