TL;DR:

- Stability AI secures significant financing led by Intel Corp., totaling nearly $50 million.

- The funding arrives at a crucial juncture for the artificial intelligence startup.

- Intel is building an AI supercomputer with Stability AI as its anchor customer.

- The company has witnessed high-level employee departures and board disputes.

- Coatue Management and Lightspeed Venture Partners’ Gaurav Gupta leave the board.

- Stability AI’s valuation has faced challenges despite achieving unicorn status.

- The startup’s expenses outpace its revenue, but it claims a tenfold revenue increase.

- CEO Emad Mostaque’s leadership style has drawn attention and controversy.

- The company remains optimistic about its future.

Main AI News:

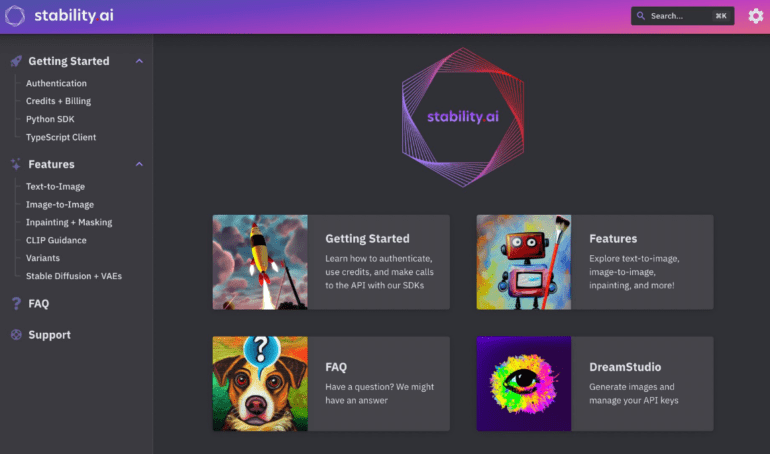

In a significant development, Stability AI, the renowned artificial intelligence startup recognized for its groundbreaking Stable Diffusion image-generation software, has successfully raised substantial financing, spearheaded by the prominent chipmaker, Intel Corp. This financial injection arrives at a pivotal juncture for the company, positioning it to navigate critical challenges and seize growth opportunities.

Sources familiar with the matter reveal that Stability AI secured just under $50 million through a convertible note arrangement in a deal that concluded in October. These sources, who have requested anonymity due to the sensitive nature of the information, have shed light on this milestone.

Responding to inquiries regarding the financing, a spokesperson from Stability AI disclosed, “We have received repeated interest over the last few months in fundraising from both major venture capital and strategic investors.” In an official statement, Stability’s Chief Executive Officer, Emad Mostaque, also shared insights: “We closed strategic funding ourselves last month (announcements soon).“

Notably, Intel declined to comment on the specifics of the financing deal. This development comes on the heels of Intel’s announcement in September, wherein the chipmaker unveiled its ambitious plans to construct an AI supercomputer, leveraging its Xeon processors and a formidable array of 4,000 Gaudi2 AI processors. Intel had identified Stability AI as the “anchor customer” for this groundbreaking endeavor.

These recent strides in financing follow a period of transition for Stability AI, marked by the departure of several senior employees, including the head of human resources, as previously reported by Bloomberg. The company, however, maintains that such turnover is par for the course within the startup landscape.

Stability AI has also weathered disagreements with some of its board representatives. Coatue Management, a major supporter of the company, has encountered challenges in its relationship with Stability AI’s leadership, sources familiar with the situation have revealed. At one juncture, Coatue sought to introduce a co-CEO or president, reflecting the complexities of the discussions.

While Coatue Management declined to comment on its connection with the startup, Stability AI emphasized its commitment to its board members, highlighting their contributions to the company’s product roadmap and future direction.

Earlier this year, Coatue General Partner Sri Viswanath, who held a seat on Stability AI’s board, reportedly did not attend a pivotal board meeting, and a Coatue attorney attended on his behalf. The circumstances surrounding this meeting remain undisclosed. In October, Coatue officially departed from Stability AI’s board, a move reportedly linked to Intel’s investment in the company, given Coatue’s substantial stake in Intel competitor Advanced Micro Devices Inc.

Another noteworthy exit from Stability AI’s board was Lightspeed Venture Partners’ Gaurav Gupta, who served as a board observer. Gupta’s departure stemmed from differences of opinion with the management team regarding the company’s strategic direction, according to insiders. Lightspeed Venture Partners declined to comment on behalf of Gupta and the firm.

In response to these developments, Stability AI offered a concise statement, declaring, “We do not disclose information about confidential board business or engage in harmful speculation.”

Last October, Stability AI achieved unicorn status in the startup realm, following a $101 million seed funding round that valued the company at $1 billion. However, subsequent efforts to secure additional funding at a higher valuation encountered challenges, leading to a smaller convertible note round in the spring.

The London-based startup has incurred significant monthly expenses, including computing costs and personnel salaries, estimated at approximately $8 million per month, sources familiar with the matter have disclosed. Despite these expenses, the company’s revenue has yet to match its expenditure.

Stability AI’s CEO, Emad Mostaque, acknowledged a shift in focus toward research and development, which has impacted revenue projections. Nevertheless, the company asserts that its revenue has witnessed a tenfold increase over the past year and remains on track for further growth as it introduces new products.

Emad Mostaque’s leadership style has not been without controversy, with reports of statements that have stretched the bounds of belief and ambitious discussions about partnerships and products before formal agreements were reached. Additionally, the startup faced legal action from co-founder Cyrus Hodes, who alleged being misled into selling shares at an undervalued price shortly before Stability AI reached its billion-dollar valuation. The startup vehemently refuted the allegations, stating that the lawsuit lacked merit.

In recent social media posts, Mostaque expressed optimism about Stability AI’s future, alluding to forthcoming announcements and emphasizing the company’s commitment to innovation and progress. The challenges faced by the company are substantial, but with Intel’s backing and a dedicated leadership team, Stability AI remains poised for a promising trajectory.

Conclusion:

Stability AI’s recent financing secured with Intel’s backing positions the company for strategic growth amid challenges. The departure of key employees and board disputes highlight internal dynamics, while the company’s valuation struggles despite achieving unicorn status underscore market competitiveness. The startup’s commitment to innovation and expansion remains strong, supported by a substantial increase in revenue and a dedicated leadership team. These developments suggest that Stability AI is determined to navigate the evolving AI landscape and maintain its competitive edge in the market.