TL;DR:

- Hexa, a Paris-based startup studio, has secured €20 million in a recent funding round.

- This capital injection comes from a diverse group of contributors, including entrepreneurs and Hexa alumni.

- Hexa aims to launch 30 new companies annually by 2030, expanding into healthtech and AI sectors.

- The organization also plans to explore opportunities in climate, education, proptech, agritech, and cybersecurity.

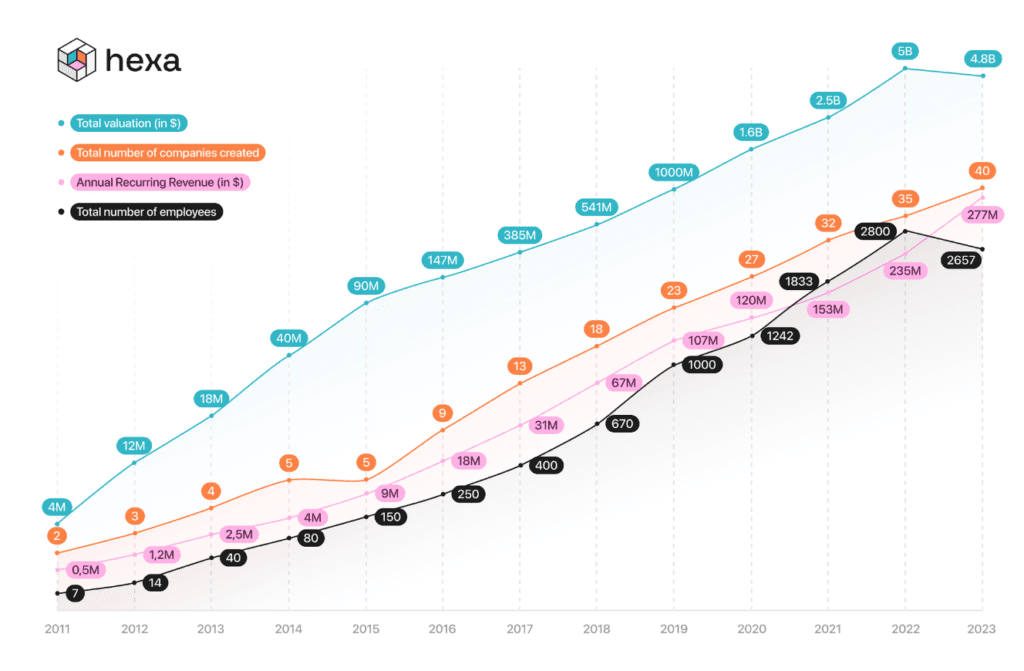

- Hexa’s current portfolio boasts a total valuation of approximately $4.5 billion with $277 million in ARR.

- A portion of the funds will support Hexa’s move to a new office space called La Cristallerie, designed to be a hub of innovation and entrepreneurship in Paris.

Main AI News:

In 2011, Paris-based eFounders introduced a groundbreaking approach to entrepreneurship – the startup studio. Distinct from traditional accelerators or incubators, eFounders’ model focuses on simultaneously building multiple companies as a cohesive team. This innovative methodology found its niche in the B2B software sector, ultimately leading to the creation of more than 40 successful enterprises, including well-known names like Front, Aircall, Spendesk, Swan, and Yousign.

Fast forward to 2022, and eFounders founders Amaury Sepulchre, Quentin Nickmans, and Thibaud Elziere recognized the need to broaden their horizons. They established Logic Founders, a fintech-focused studio, and 3founders, a web3-focused outfit. These three entities now operate under a single umbrella known as Hexa.

A Milestone Achievement: €20 Million Raised

Hexa has made a resounding mark in its financial journey. After securing approximately €5.5 million in 2015 and an additional €5 million in late 2016, the company has recently announced a significant milestone with a remarkable €20 million fundraising round. Quentin Nickmans, one of Hexa’s key figures, expressed his enthusiasm, stating, “This might be the most significant announcement for us since the creation of eFounders.”

This substantial infusion of capital comes from a diverse group of contributors, including prominent entrepreneurs and Hexa alumni like Luc Pallavidino (Yousign), Adrien Van Den Branden (Canyon), Paul Vidal (Collective), Arnaud Schwartz (Marble), as well as several family offices.

Setting a Bold Vision: 30 Companies by 2030

With a track record of launching approximately 40 companies in the past 12 years, Hexa now possesses a significantly augmented war chest. Armed with these resources, the organization has set an audacious goal – to launch 30 new companies each year by 2030. In pursuit of this ambition, Hexa plans to expand its studio offerings by incorporating healthtech and AI verticals, while also exploring opportunities in sectors such as climate, education, proptech, agritech, and cybersecurity.

Hexa reports that its current portfolio boasts a total valuation of approximately $4.5 billion, with an impressive $277 million in annual recurring revenue (ARR).

Investing in a Visionary Workspace: La Cristallerie

To further bolster its operational capabilities, Hexa has allocated a portion of its recent capital infusion to support its relocation to a new office space, aptly named La Cristallerie. Thibaud Elziere, a founding partner at Hexa, shared his excitement, stating, “Designing one’s own office space is the dream of any entrepreneur. After 20 years, I’m thrilled to realize this with La Cristallerie. More than just an office, La Cristallerie is set to become a hub of innovation and entrepreneurship in Paris. It will not only host public events focusing on entrepreneurship, impact, and creativity but will also serve as a meeting ground for the local and international tech community.”

Source: Uncredited

Conclusion:

Hexa’s successful €20 million fundraising and its ambitious goal of launching 30 companies annually by 2030 signal a strong commitment to fostering innovation in various sectors. This development showcases a growing appetite for venture capital in the startup studio model and highlights Hexa’s potential to be a major player in shaping the future of entrepreneurship. The organization’s diversification into healthtech and AI, along with its exploration of new sectors, underscores its adaptability and readiness to seize emerging market opportunities.