TL;DR:

- H&R Block introduces AI Tax Assist, a conversational AI chatbot for tax-related queries.

- Accessible through premium versions of H&R Block’s tax software.

- Offers information on tax rules, exemptions, and more, guiding users through the tax filing process.

- Users can connect with human tax experts for personalized advice.

- H&R Block aims to build trust with transparency, clarifying when AI is used.

- AI Tax Assist is designed to enhance users’ understanding of tax filing intricacies.

- Pricing for AI Tax Assist starts at $35, maintaining accessibility.

- Developed with models from OpenAI and Microsoft, trained exclusively on H&R Block’s tax laws.

- Human experts are available to address concerns or verify AI-generated answers.

- AI Tax Assist aligns with industry trends as AI is used to optimize tax preparation processes.

Main AI News:

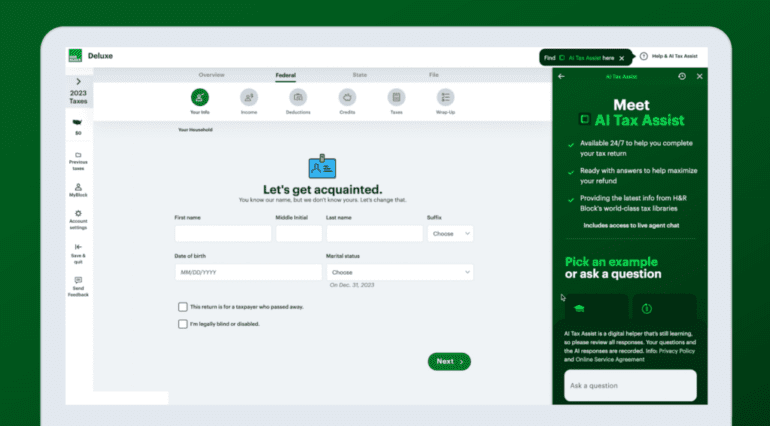

In a strategic move to enhance the tax preparation experience, H&R Block has unveiled its latest innovation: an advanced conversational AI chatbot named AI Tax Assist. This groundbreaking technology is poised to revolutionize the way taxpayers navigate the intricacies of tax rules and regulations. Available exclusively to users of H&R Block’s premium DIY tax software, AI Tax Assist is a game-changer that provides insightful answers to a wide array of tax-related queries.

AI Tax Assist is designed to offer clarity on tax regulations, potential exemptions, and various tax-related matters. It serves as a trusted companion, allowing users to seek guidance on intricate tax filing processes. Furthermore, it has the capacity to connect users with human tax experts for personalized advice. H&R Block is also actively working on enhancing the AI’s capabilities to provide tailored, AI-driven advice in the near future.

During a demonstration, H&R Block showcased how AI Tax Assist can significantly simplify the tax filing process for individuals with complex filing statuses, such as gig workers. For instance, a rideshare driver can inquire about deductible business expenses by asking questions like, “What can I deduct as business expenses as an Uber driver?” The AI promptly generates a comprehensive list of permissible deductions, empowering users to make informed decisions for their final filings.

To ensure transparency and build trust with users, H&R Block will display a banner indicating that the feature is AI-powered, accompanied by sample prompts. The company recognizes that customers value transparency when AI is involved in their tax preparation process. This trust is cultivated through the longstanding relationship that customers have established with H&R Block.

H&R Block has identified that taxpayers don’t merely desire instructions for their taxes but crave an understanding of the intricacies of tax filing. AI Tax Assist fills this knowledge gap by providing information on various tax exemptions and shedding light on the treatment of assets such as cryptocurrency within the tax code.

Chris Linderwell, Vice President of Consumer Tax Products at H&R Block, emphasized the importance of retaining users on H&R Block’s platform when seeking tax-related guidance. He explained, “We want to empower customers to ask questions as deeply as they want, and over time, we can give more personalized answers to their questions on our platform through AI Tax Assist.“

It’s noteworthy that AI Tax Assist is available exclusively to users of H&R Block’s paid subscription tiers, with pricing starting at $35. H&R Block’s commitment to accessibility ensures that this innovative conversational AI platform does not come at an additional cost to its valued customers.

H&R Block’s development of AI Tax Assist was a collaborative effort that leveraged models from OpenAI and Microsoft. Importantly, the AI was trained exclusively on H&R Block’s extensive library of tax laws and meticulously refined with input from a team of experienced accountants, lawyers, and tax professionals. The model does not draw information from the internet, ensuring that all responses are tailored to H&R Block’s trusted content. This approach reflects H&R Block’s dedication to delivering an experience akin to conversing with their human accountants. In cases where users have concerns about AI-generated answers, H&R Block’s team of live human experts is readily available to provide assistance via phone.

Acknowledging the possibility of errors in AI-generated information, especially in the realm of tax preparation, H&R Block assures users that they can cross-verify details with a human expert. The company maintains a vigilant team that monitors the AI model’s accuracy and ensures it adheres to its intended purpose.

In a competitive landscape, other tax preparation apps, such as Intuit’s TurboTax, are also harnessing AI capabilities to identify missing information in tax filings and offer recommendations for optimizing deductions. This development signals a shift in the industry towards leveraging AI to enhance user experiences and improve tax-related outcomes.

Traditionally, filing taxes has been a daunting and complex process. Companies like H&R Block and Intuit have thrived in this space while simultaneously advocating against simplifying or reducing the cost of the process. However, it’s important to note that the government is exploring its own direct tax filing software. Despite this, many individuals will continue to rely on private platforms like H&R Block in the coming months for their tax preparation needs.

Conclusion:

H&R Block’s introduction of AI Tax Assist represents a strategic move to enhance the tax preparation market. By providing users with an AI-driven tool that fosters understanding and transparency, H&R Block aims to solidify its position as a trusted tax preparation service. This innovative approach aligns with broader industry trends where AI is being leveraged to improve tax-related outcomes and user experiences.