TL;DR:

- Microsoft exceeded Q2 earnings expectations with an adjusted EPS of $2.93 on revenue of $62 billion.

- Cloud revenue reached $33.7 billion, beating estimates, and Azure contributed significantly.

- AI services accounted for 6 percentage points of growth in Azure revenue.

- Microsoft’s market capitalization surpassed $3 trillion, making it the world’s wealthiest company.

- Productivity and Business Processes revenue was $19.25 billion, slightly exceeding estimates.

- Microsoft’s commitment to AI is evident across its business segments, including the Copilot platform.

- Google and Amazon are also intensifying their AI investments.

- Generative AI technology faces challenges related to deepfake images and videos.

- Despite challenges, generative AI continues to gain momentum in the market.

Main AI News:

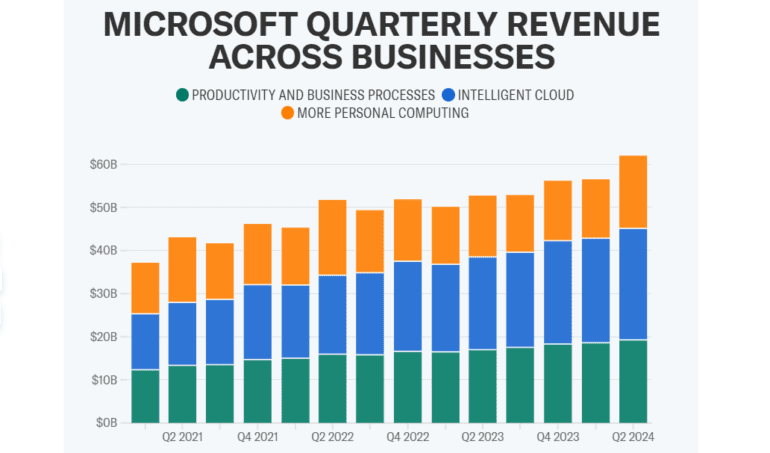

In a commanding display of financial prowess, Microsoft unveiled its second-quarter earnings report on Tuesday, leaving market analysts astounded as the tech giant exceeded expectations on both revenue and earnings per share. The company reported adjusted earnings per share of $2.93 on a staggering revenue of $62 billion, surpassing the anticipated adjusted EPS of $2.78 and revenue of $61.1 billion.

Despite this impressive performance, investors seemed somewhat unimpressed, leading to a slight dip of around 1% in the stock’s premarket trading on Wednesday. However, Microsoft’s real star was its cloud division, which continued to outshine, with all-important cloud revenue soaring to $33.7 billion, surpassing estimates of $32.2 billion. Within the Intelligent Cloud sector, Azure, Microsoft’s cloud computing service, raked in a remarkable $25.8 billion, surpassing expectations of $25.3 billion. Notably, AI services played a pivotal role, contributing 6 percentage points of growth to Azure revenue, a significant leap from the previous quarter’s 3 percentage points.

Microsoft’s CEO, Satya Nadella, emphasized the company’s transition from merely discussing AI to its widespread application, stating, “We’ve moved from talking about AI to applying AI at scale. By infusing AI across every layer of our tech stack, we’re winning new customers and helping drive new benefits and productivity gains across every sector.”

The company’s strategic investments in AI have paid off handsomely, propelling its stock price to a remarkable 50% increase over the past year and elevating Microsoft’s market capitalization to over $3 trillion, making it the world’s wealthiest company by market cap as of Tuesday.

In contrast, long-standing rival Apple has faced challenges, grappling with stock downgrades attributed to concerns about sluggish iPhone sales in China.

On the productivity front, Microsoft’s Productivity and Business Processes revenue reached $19.25 billion, slightly ahead of estimates pegged at $19.03 billion. The More Personal Computing business, which encompasses Windows software sales and the Xbox gaming division, generated an impressive $16.89 billion.

Microsoft’s commitment to AI is evident throughout its diverse business segments. The company has monetized its AI initiatives through generative AI cloud services, its Copilot for Microsoft 365 productivity platform, and Copilot Pro for consumers. Notably, Microsoft has expanded access to Copilot for Microsoft 365, making it available to all businesses, eliminating the previous requirement of a minimum of 300 employees. The service is priced at $30 per user per month. For consumers seeking advanced features, Copilot Pro is available for $20 per month per user.

Microsoft, along with rivals Google and Amazon, has invested billions in AI initiatives, intensifying the race to establish supremacy in the AI software domain. While Microsoft initially gained a competitive edge through its investment in ChatGPT developer OpenAI, both Google and Amazon have been catching up. Google introduced its powerful Gemini AI model in December, and in September, Amazon announced a substantial $4 billion investment in AI firm Anthropic, securing a minority ownership stake.

Nevertheless, generative AI technology has faced criticism following incidents of users sharing AI-generated explicit images, notably of Taylor Swift. Such incidents have triggered calls for legislation to address the issue of deepfake images and videos.

Despite these challenges, the momentum of AI development remains unshaken. Companies continue to unveil products related to this technology, and PC and smartphone manufacturers are introducing their own devices capable of running generative AI software, reaffirming the undeniable influence of generative AI throughout 2024.

Conclusion:

Microsoft’s remarkable Q2 earnings, driven by AI and cloud success, reaffirm its dominance in the tech industry. The company’s strategic investments in AI, particularly in Azure, have paid off handsomely, propelling its market capitalization to new heights. However, it faces stiff competition from Google and Amazon in the race to lead the AI software market. Despite recent controversies, generative AI’s influence is expected to remain strong throughout 2024, promising continued growth and innovation in the sector.