- Zama secures $73 million in Series A funding, with a valuation nearing $400 million.

- Homomorphic encryption’s potential for data security attracts investors despite scalability challenges.

- Zama focuses on R&D and expanding its engineering team to address blockchain and AI data exchange.

- The startup has already inked contracts worth over $50 million within six months of commercialization.

- Founders Rand Hindi and Pascal Paillier’s expertise has driven Zama’s pioneering efforts since 2016.

- Despite transaction speed challenges, Zama’s solutions resonate with blockchain developers.

- Specialized chips and algorithmic advancements hint at broader adoption of homomorphic encryption.

- Zama prioritizes market expansion over competition, fostering collaboration within the encryption landscape.

Main AI News:

In the realm of data security, homomorphic encryption stands out as a beacon of promise, offering a robust shield against data leaks and malicious cyber activities. Despite its intricate nature, which historically hindered mass scalability, startups persist in their pursuit to render it accessible and effective.

Paris-based startup Zama recently secured $73 million in Series A funding, spearheaded by Multicoin Capital and Protocol Labs, catapulting its valuation close to $400 million. Notable among its backers is Metaplanet, an Estonian deep tech investor renowned for early investments in pioneering ventures like DeepMind.

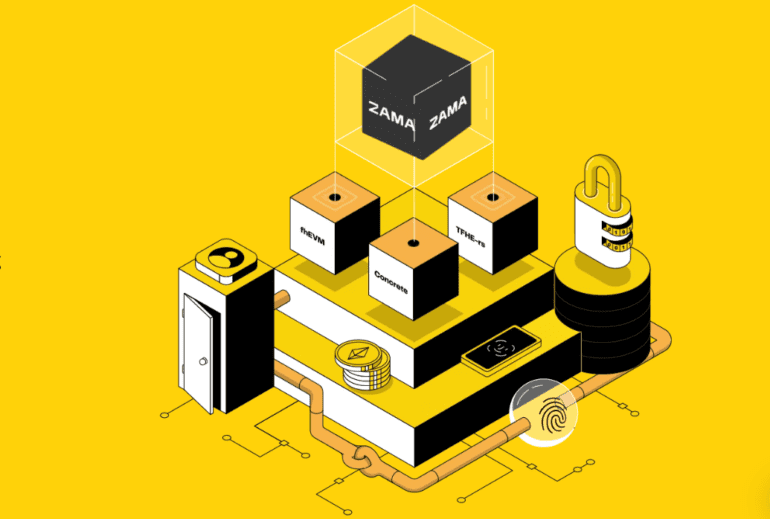

This marks the most substantial investment in homomorphic encryption worldwide, underscoring Europe’s burgeoning deep tech landscape amid a global funding downturn. Zama plans to channel these funds into further research and development, expanding its engineering team to capitalize on two key market opportunities: blockchain transactions and data exchange for AI applications.

Zama’s strategic move to commercialize its offerings has already yielded significant returns, with contracts exceeding $50 million in value within a span of six months. While the long-term vision emphasizes machine learning applications, initial traction predominantly stems from the blockchain sphere.

Founder and CEO Rand Hindi, a polymath with a background in computer science and bioinformatics, alongside cryptography expert Pascal Paillier, embarked on Zama’s journey in 2016. Their breakthrough in 2019, accelerating calculations by 100x, paved the way for commercial viability.

Despite the persistent challenge of sluggish transaction speeds, particularly in blockchain operations, Zama’s solutions resonate with developers seeking enhanced privacy and security features. The advent of specialized chips and ongoing algorithmic advancements augur well for the mainstream adoption of homomorphic encryption.

Zama’s library offerings and collaborative ethos underscore a collective endeavor to fortify the encryption landscape. While competition looms in the form of startups like Ravel, Duality, and Enveil, Zama prioritizes market expansion over rivalry, envisioning a future where cooperation precedes competition.

In navigating the intricate terrain of data security, Zama emerges not only as a trailblazer but as a catalyst for industry-wide collaboration and innovation. As the quest for privacy and security intensifies, Zama’s ascent signifies a paradigm shift towards a more resilient, privacy-centric digital ecosystem.

Conclusion:

Zama’s substantial funding and strategic focus underscore a growing recognition of homomorphic encryption’s pivotal role in safeguarding data integrity. The startup’s trajectory reflects a burgeoning market appetite for privacy-centric solutions amidst escalating cybersecurity threats. As Zama continues to innovate and collaborate, its journey signifies a broader shift towards a more resilient and secure digital ecosystem.