- Formerly known as Climate Alpha, AlphaGeo introduces a revolutionary geospatial platform for resilient investing.

- The platform integrates diverse datasets to create a spatial index guiding investments in tangible assets and public markets.

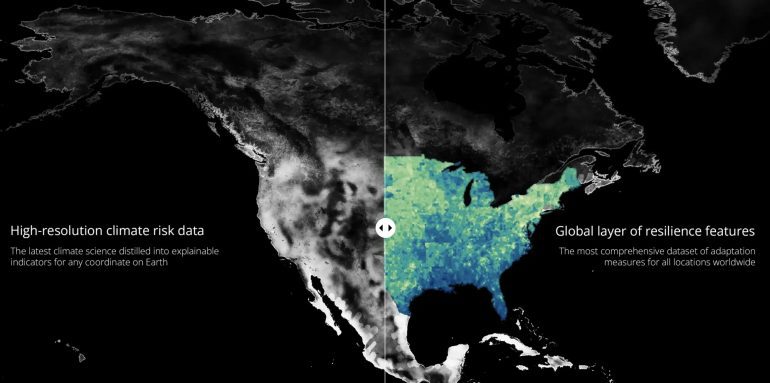

- Utilizing advanced machine learning, AlphaGeo refines climate hazard projections and maps adaptation infrastructure globally.

- Asset managers can assess location performance under various climate scenarios and temporal horizons up to 2100.

- AlphaGeo’s GeoSense offers customized tracking indices for equity markets, providing insights into climate-resilient companies.

- Founded by Dr. Parag Khanna in 2022, AlphaGeo aims to empower geographical arbitrage towards future markets and enhance resilience investments.

- The company’s clientele includes major players in real estate, private equity, financial markets, and insurance sectors.

Main AI News:

AlphaGeo, formerly known as Climate Alpha, has introduced a groundbreaking geospatial platform. This rebranding signifies a strategic pivot towards pioneering resilient investment strategies globally, underscored by the fusion of myriad datasets covering climate risks, socioeconomic parameters, market dynamics, policy landscapes, and demographic trends into a spatially-driven index. This index serves as a compass for savvy investment decisions spanning physical assets and public markets.

Powered by state-of-the-art machine learning algorithms, AlphaGeo refines climate hazard projections, including heatwaves, storms, floods, fires, droughts, and rising sea levels, for any geographic coordinate worldwide. Furthermore, it meticulously maps out critical adaptation infrastructure such as seawalls, levees, desalination plants, and fire stations. The result is an expansive repository housing over 50 billion data points, incorporating nearly 100 engineered features, across more than 40 million indexed locations. Armed with over a dozen actionable metrics, asset managers can assess and benchmark location performance across diverse climate scenarios and temporal horizons extending to 2100.

Highlighting the significance of resilience over mere risk assessment, Abraham Wu, Chief Technology Officer, asserts, “Our comprehensive, data-driven approach represents a quantum leap in quantifying the true resilience of any location globally.”

AlphaGeo introduces GeoSense, bespoke tracking indices tailored for equity markets that offer forward-looking insights into companies or ETFs and demonstrate genuine climate resilience. Dr. Michael Ferrari, AlphaGeo’s Chief Scientific and Chief Investment Officer, remarks, “Our predictive analytics engine capitalizes on escalating global volatility, transforming it into a catalyst for alpha-seeking investors.” Notably, AlphaGeo’s flagship Industrial Renaissance Tracker (IRT) correlates the burgeoning wave of eco-friendly corporate initiatives in the United States with location resilience, facilitating a nuanced evaluation of entities and communities poised for exponential growth.

Founded in 2022 by geopolitical strategist Dr. Parag Khanna, acclaimed author of several influential works, including “MOVE: Where People are Going for a Better Future,” AlphaGeo epitomizes innovation in the face of global complexity. “We empower strategic geographical arbitrage towards the burgeoning markets of tomorrow, while empowering governments and corporations to prioritize investments in resilience,” Khanna remarks.

With a clientele encompassing major players in real estate, private equity, sovereign wealth funds, pensions, financial markets, and insurance sectors, AlphaGeo has emerged as a trusted partner for discerning and sophisticated investors. Having secured seed funding in 2022, the company is poised for an A-round financing endeavor scheduled for mid-2024.

Conclusion:

AlphaGeo’s unveiling of an AI-driven geospatial platform marks a significant advancement in resilient investing. By providing comprehensive insights into climate risks and resilience factors, AlphaGeo empowers investors to make informed decisions in navigating volatile markets. This innovation underscores the growing importance of incorporating spatial intelligence and data-driven strategies in shaping investment portfolios for long-term success.