- Candor Technology introduces its PreQual product, utilizing AI to enhance mortgage prequalification.

- The tool offers instant borrower prequalification results for conventional and FHA loans.

- Key features include seamless integration with existing systems, rapid underwriting analysis, and immediate eligibility decisions.

- Benefits include reduced borrower walk-aways by 15%-18%, faster loan officer response times, and a superior borrower experience with near-instant decisions.

Main AI News:

Candor Technology, a prominent player in mortgage technology innovation, has announced the launch of its PreQual product—a cutting-edge solution designed to transform the mortgage prequalification process through artificial intelligence. This patented tool promises to deliver swift and insightful borrower prequalification across both conventional and FHA loans.

Traditional mortgage prequalification is often plagued by delays and inefficiencies, creating a cumbersome experience for both lenders and borrowers. Candor’s PreQual tool addresses these issues by streamlining the prequalification and conditional credit approval processes. Loan officers can now provide near-instant decisions, significantly improving the overall mortgage lending experience.

Key Features and Benefits of Candor’s PreQual Tool:

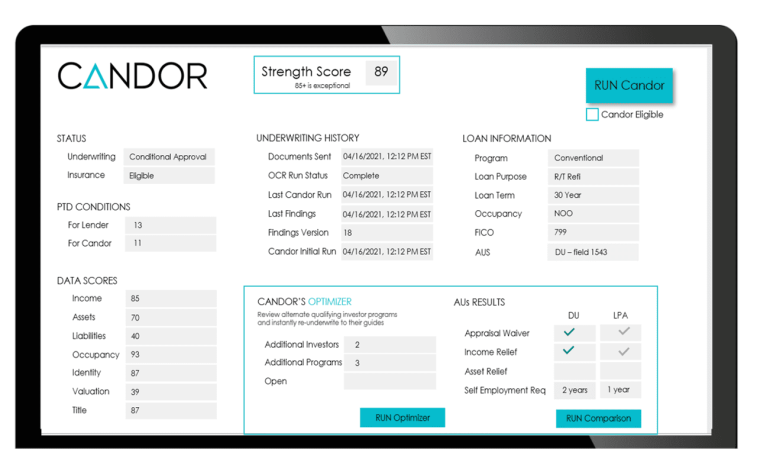

- Seamless Integration: The PreQual tool is designed to integrate smoothly with existing workflows, loan origination systems, and point of sale platforms.

- Immediate Results: Lenders receive initial eligibility decisions, a dynamic borrower-needs list, and FHA manual downgrade notifications, all within a minute.

- Rapid Underwriting Analysis: Within 30 minutes of submitting borrower documentation or digital verifications, lenders obtain full credit approval, income calculations, asset verifications, approval letters, and step-by-step processor guidance.

- Increased Efficiency: The tool enhances operational efficiency by eliminating the wait for loan processing and underwriting reviews. This results in a 15%-18% reduction in borrower walk-aways, faster response times, and the ability for loan officers to assist more qualified borrowers.

- Enhanced Borrower Experience: Borrowers benefit from near-instantaneous decisions, reducing the lengthy wait times and alleviating uncertainties associated with the homebuying process.

Mark Hinshaw, CEO of Candor Technology, expressed enthusiasm about the new product, stating, “We are thrilled to introduce Candor’s PreQual product to the mortgage lending industry. By harnessing the power of AI, we are empowering lenders to make faster, more informed decisions while providing borrowers with a seamless and stress-free experience.”

Candor’s PreQual tool represents a significant advancement in mortgage technology, promising to streamline operations and enhance the homebuying journey for all stakeholders involved.

Conclusion:

Candor Technology’s introduction of the AI-powered PreQual tool marks a significant shift in the mortgage industry. By leveraging artificial intelligence, the tool addresses longstanding inefficiencies in the prequalification process, resulting in faster, more accurate decisions and an improved experience for both lenders and borrowers. This advancement is likely to set a new standard for mortgage technology, compelling competitors to adopt similar innovations to stay relevant and meet evolving consumer expectations. The enhanced efficiency and reduced borrower dropout rates could drive increased market competitiveness and set a new benchmark for operational excellence in the mortgage sector.