- Omdia forecasts the prefabricated modular and micro data center market will reach $11.7 billion by 2027.

- Peak growth is anticipated in 2023 and 2024, spurred by the AI boom.

- The prefabricated modular data centers (PMDC) segment is expected to generate $8.6 billion in sales by 2027.

- Prefabricated power modules are the fastest-growing segment within the PMDC market.

- Micro-modular data centers (micro-DCs) are projected to account for $3.1 billion in sales by 2027.

- Micro-DCs are popular among cloud service providers and enterprises for their rapid deployment advantages.

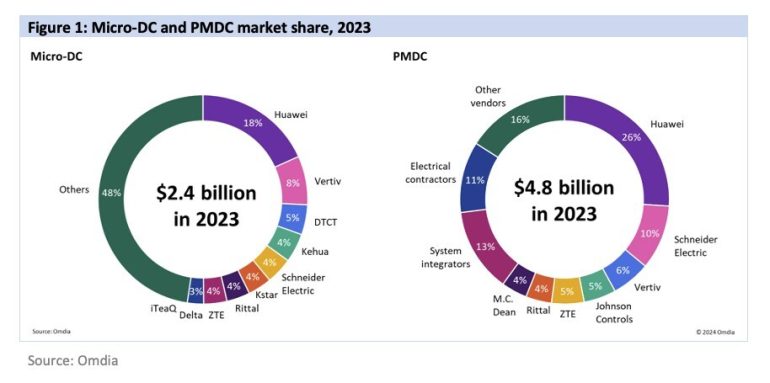

- Key market leaders include Huawei, Schneider Electric, Vertiv, Johnson Controls, and Rittal.

- Innovations are expected to focus on high power density, liquid cooling, and advanced battery solutions.

Main AI News:

Omdia’s latest research forecasts a dramatic rise in the market for prefabricated modular and micro data centers, reaching an anticipated $11.7 billion by 2027. The peak in market growth is expected to occur in 2023 and 2024, driven largely by the rapid expansion in data center requirements stemming from the AI revolution.

The prefabricated modular data centers (PMDC) market, which includes both single and multi-module structures for specific or all-inclusive data center functions, is set to see $8.6 billion in sales by 2027. Among these, prefabricated power modules are identified as the fastest-growing segment, crucial for both new builds and the enhancement of existing facilities’ power capacities.

Micro-modular data centers (micro-DCs), comprising pre-integrated single and multi-module designs, are projected to generate $3.1 billion in sales by 2027. Vlad Galabov, Cloud and Data Center Research Director at Omdia, emphasized the appeal of micro-DCs to cloud service providers and enterprises alike. He noted that hyperscale cloud providers have already adopted multi-rack micro-DCs for their efficiency in accelerating on-site installations. Insights from Omdia’s recent visit to Tencent’s data center in Tianjin, China, revealed the large-scale deployment and growing adoption of these solutions.

Huawei leads the global PMDC market, with Schneider Electric and Vertiv also prominent players. In North America, Johnson Controls, Schneider Electric, and M.C. Dean are key vendors. Western Europe sees Vertiv and Rittal leading, while Huawei dominates in Asia & Oceania and the Rest of EMEA. The micro-DC sector is notably diverse, with Huawei at the forefront and Vertiv and DTCT closely trailing.

Siraj Aziz, the analyst overseeing Omdia’s PMDC and micro-DC research, anticipates ongoing innovation focused on high power density to meet AI workload needs. Key areas of expected advancement include the integration of liquid cooling and advanced battery solutions.

Conclusion:

The projected growth of the prefabricated modular and micro data center market highlights a significant shift driven by the rapid expansion of AI technologies. As data center requirements surge, the market is expected to see substantial investment in PMDC and micro-DC solutions. The emphasis on high power density and innovative cooling and battery technologies will be crucial in meeting the demands of increasingly complex AI workloads. This shift presents substantial opportunities for leading vendors and innovators, positioning them to capitalize on the evolving needs of the global data center industry.