- Rillet, a Spanish-US fintech, secures $13.5 million in funding.

- The platform aims to modernize accounting for high-growth companies.

- Current options for accounting software are outdated and inadequate.

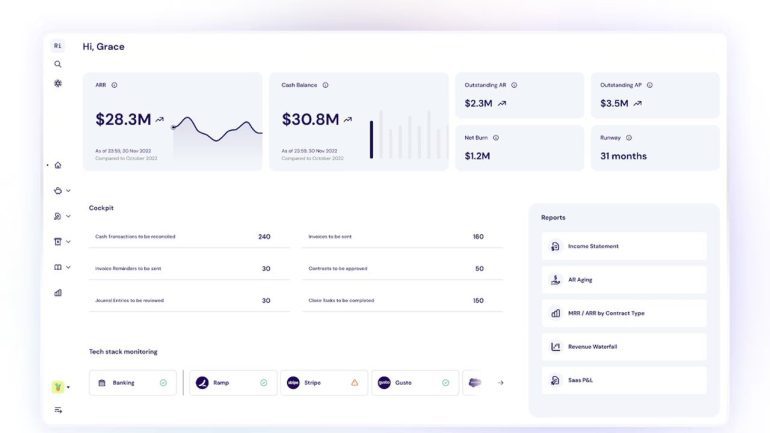

- Rillet’s ERP system automates financial workflows and integrates with payment processors and CRM tools.

- The platform uses AI to handle invoicing, book closing, and investor reporting.

- Rillet supports multiple entities, geographies, and currencies with a unified interface.

- The company has achieved 93 percent automation in journal entries.

- Investment led by Creandum and First Round Capital, with notable individual investors.

- The funds will be used for team expansion and exploring new verticals.

Main AI News:

Rillet, the Spanish-US fintech innovator, has secured $13.5 million in funding to advance its cutting-edge AI-powered accounting platform. High-growth companies are often trapped between outdated software options: either antiquated systems designed for small businesses, such as QuickBooks, or those built for large enterprises like NetSuite, neither of which effectively meets their evolving needs.

The result is a reliance on labor-intensive manual processes in spreadsheets for financial reconciliation and reporting. Adding to this challenge, the accounting profession has seen a significant decline, with 300,000 accountants exiting the field. Rillet’s solution is a next-generation ERP system that offers comprehensive automation tailored for fast-growing companies.

Addressing the complexities of startup accounting, Rillet integrates seamlessly with payment processors and CRM tools, streamlining revenue management. By leveraging metadata and AI, Rillet automates various financial workflows, including invoicing, book closing, and investor reporting. This platform simplifies managing multiple entities, geographies, and currencies, transforming a traditionally cumbersome process into a unified, user-friendly experience.

“Achieving 100 percent automation will accelerate decision-making, reduce manual tasks for accounting teams, and enable them to focus on strategic work rather than number reconciliation,” stated Nicolas Kopp, CEO of Rillet. He further added, “With advancements in AI technology, it’s a matter of when, not if, your accounting software will handle all the work while Controllers review exceptions. We aim to make this vision a reality in the coming years.”

Currently serving over 70 clients in SaaS and usage-based revenue sectors, Rillet has achieved 93 percent automation in journal entries. The funding round, led by Creandum and First Round Capital, saw participation from notable investors such as Chad Byers (Susa Ventures), Kevin Hartz (Eventbrite and Xoom founder), the former Chief Accounting Officer of Facebook and Stripe, and the Controller at Ramp.

Peter Specht, General Partner at Creandum, praised Rillet’s innovative approach: “Rillet has effectively addressed some of the most challenging issues in general ledger automation. This sector is primed for disruption, and Rillet’s solution is a standout in the industry.”

The investment will support team expansion and the platform’s reach into new verticals, from e-commerce to fintech.

Conclusion:

Rillet’s substantial funding reflects a significant shift in the accounting software market, highlighting the demand for advanced, AI-driven solutions that address the limitations of traditional systems. By automating complex financial processes and integrating seamlessly with various tools, Rillet is positioned to meet the evolving needs of high-growth companies. This move not only enhances operational efficiency but also indicates a broader trend towards leveraging AI to streamline and innovate within the accounting sector.