TL;DR:

- Ashton Kutcher raised funds for his new AI fund in just five weeks.

- The fund plans to invest $243 million in AI startups.

- Sound Ventures LLC now manages approximately $1 billion in assets.

- The portfolio includes investments in AI startups like OpenAI, Stability AI Ltd., and Anthropic.

- Kutcher believes AI will bring about the next major transformation in technology.

- He sees the launch of GPT as a significant breakthrough.

- Kutcher acknowledges the hype cycle in technology investing, including the recent rush into crypto.

- He highlights the value of blockchain technology but warns against excessive tokenization.

- Kutcher emphasizes the need for regulation in both the AI and crypto industries.

Main AI News:

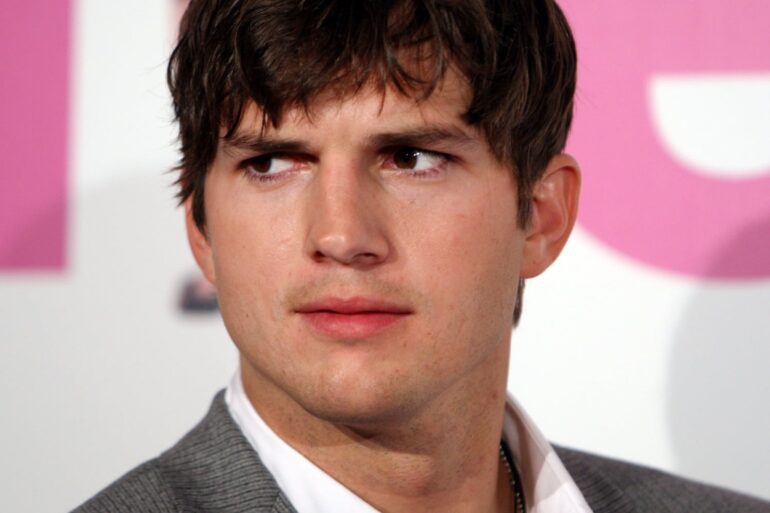

Ashton Kutcher, the renowned Hollywood actor and venture capital investor, swiftly secured the funds for his firm’s latest AI fund. In a recent interview with Bloomberg Television, Kutcher revealed, “We managed to assemble the fund in a mere five weeks. Our long-standing limited partners have been steadfast supporters throughout the years.”

The primary focus of Kutcher’s new fund lies in allocating a staggering $243 million toward emerging artificial intelligence startups, which currently reign as the tech industry’s most sought-after category. Notable additions to the portfolio include investments in esteemed AI startups such as OpenAI, Stability AI Ltd., and Anthropic.

The influx of the new fund has propelled Sound Ventures LLC, based in Los Angeles, to oversee approximately $1 billion in assets under management. Kutcher elaborated on the firm’s proactive approach, stating, “We extensively surveyed our portfolio companies to gauge their integration of AI, and it became evident that this sector will spearhead the next technological revolution.”

Kutcher emphasized his firm’s seven-year involvement in AI investments, expressing his epiphany upon witnessing the groundbreaking launch of GPT. Recognizing its monumental impact, he proclaimed, “We recognized that GPT was an absolute game-changer.”

Acknowledging the cyclical nature of technology investments, Kutcher drew parallels to the recent surge in cryptocurrency investments, an area in which Sound Ventures has also actively participated. While acknowledging the inherent value of blockchain technology within the cryptocurrency realm, he cautioned against excessive tokenization in various sectors, suggesting that certain boundaries had been overstepped.

Kutcher stressed the urgent need for regulation in the AI industry, paralleling the necessity for regulatory measures within the crypto industry. He believes that robust regulations are crucial to ensure responsible and ethical development and deployment of AI technologies.

Conlcusion:

Ashton Kutcher’s swift fundraising for his new AI fund, coupled with his firm’s substantial investments in AI startups, signifies the growing momentum and potential within the AI market. With a significant injection of funds into this hot sector, combined with Kutcher’s recognition of AI as the next transformative technology, it is evident that the market for artificial intelligence is poised for further expansion.

The involvement of high-profile investors and the focus on regulation also underscores the increasing maturity and recognition of AI as a critical driver of innovation. As the market continues to evolve, it is expected to attract more capital, talent, and regulatory scrutiny, setting the stage for continued advancements and breakthroughs in the field of AI.