TL;DR:

- Euclidean Technologies, a Seattle firm known for its machine learning-powered stock strategy, is launching an ETF.

- The firm is converting its private hedge funds into an exchange-traded fund structure to serve retail investors.

- Machine learning enables Euclidean to discover complex relationships and improve equity investing.

- Euclidean’s model has outperformed the S&P 500 total returns by approximately 3% since its deployment.

- The company is researching the use of machine learning-based language models to analyze company-related written or spoken language.

- Euclidean is expanding its team and aims to capitalize on the opportunities presented by its machine learning approach.

- The founders have a successful background in the HR software space, and the late Tom Alberg, a respected figure in the Seattle tech community, influenced John Alberg’s career.

Main AI News:

Euclidean Technologies, a Seattle-based firm renowned for its machine learning-driven stock strategy, is bringing its expertise to a broader investor base. Originally managing private hedge funds for accredited or high net worth investors, the company is now converting its successful hedge funds into an exchange-traded fund (ETF) structure. With the introduction of the Euclidean Fundamental Value ETF on the New York Stock Exchange, Euclidean aims to expand its business and offer retail investors the opportunity to benefit from its machine learning-powered approach.

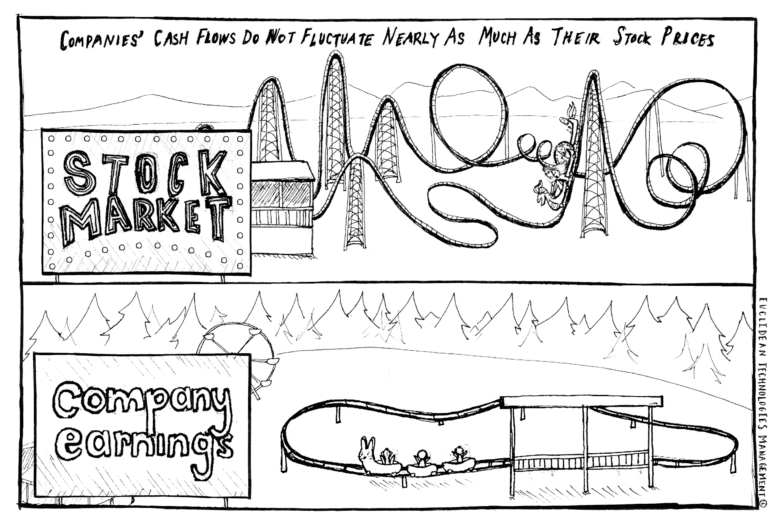

Applying advanced mathematical algorithms and computational techniques to stock selection is not entirely new. However, Euclidean differentiates itself by utilizing machine learning technology capable of uncovering complex, non-linear relationships within high-dimensional data. According to John Alberg, co-founder and managing partner at Euclidean, their research has shown that applying machine learning to identify sound long-term investments can outperform traditional quantitative equity investing strategies.

Euclidean has been at the forefront of innovation in this space, integrating “sequence-to-sequence” learning—commonly used in natural language processing tools like ChatGPT—into their quantitative investing framework. Since deploying their model in March 2020, Euclidean’s core fund has outperformed S&P 500 total returns by approximately 3%. Recognizing the potential of machine learning-based language models, the firm is now exploring ways to leverage these models to rapidly analyze written or spoken language related to company performance. This includes analyzing SEC filings, earnings transcripts, news articles, analyst reports, and investor presentations.

As Euclidean generates revenue through asset management fees, the firm is poised for growth and actively expanding its team in Seattle. Co-founders John Alberg and Michael Seckler previously experienced success in the HR software space with Employease, a company acquired by ADP in 2006. John Alberg, whose late father was Tom Alberg, the co-founder of Madrona Venture Group and a revered figure in the Seattle tech community, attributes his career and life’s accomplishments to his father’s profound influence.

Euclidean’s foray into the ETF market with its machine learning-driven approach marks a significant milestone. By leveraging the power of machine learning and advanced algorithms, Euclidean Technologies aims to unlock new investment opportunities and deliver superior long-term returns to retail investors seeking innovative strategies in the ever-evolving financial landscape.

Conlcusion:

The launch of Euclidean Technologies’ machine learning-powered ETF marks a significant development in the market. By converting its successful hedge funds into an accessible exchange-traded fund structure, Euclidean expands its reach to retail investors, offering them the opportunity to benefit from its advanced stock selection strategy.

Leveraging machine learning algorithms to uncover complex relationships and improve equity investing, Euclidean has demonstrated promising results, outperforming the S&P 500 total returns. The firm’s research into machine learning-based language models further showcases their commitment to innovation. As Euclidean expands its team and capitalizes on the opportunities presented by its unique approach, the market can expect increased interest in machine learning-driven investment strategies and potential advancements in the application of AI technology within the financial sector.