TL;DR:

- Finpilot, an AI startup, aims to enhance financial analysis with its chatbot tool.

- The tool utilizes artificial intelligence to search publicly available business filings and provide research answers in natural language.

- Led by experienced CEO Lakshay Chauhan and advisory board member John Alberg, Finpilot secured significant investment from Madrona Venture Labs and Ascend.

- The startup’s ChatGPT-like interface allows users to write queries in plain language and access original source documents.

- Finpilot differentiates itself by enabling data interaction, visualization, and source verification.

- The platform is tailored for the finance industry and is actively being tested by multiple customers.

- Finpilot’s launch coincides with increasing Wall Street investments in AI tools, with banks recognizing the potential for enhanced data processing and risk modeling.

- However, concerns exist about AI chatbots providing inaccurate information and the challenges of tracing training data.

- Finpilot addresses these concerns by prioritizing accuracy, speed, and reliability.

- The startup’s innovation has the potential to transform financial analysis and empower analysts with efficient, intuitive tools.

Main AI News:

In the fast-paced world of finance, time is money. Recognizing this, a groundbreaking startup is set to revolutionize the way financial analysts operate by introducing a cutting-edge chatbot tool. Leveraging the power of artificial intelligence (AI), this tool efficiently scours publicly available business filings, employing natural language processing to provide insightful research answers. This game-changing startup, Finpilot, boasts a leadership team consisting of CEO Lakshay Chauhan, a seasoned machine learning engineer from Seattle hedge fund Euclidean, and John Alberg, the fund’s co-founder, who will serve as a key advisor. Both Chauhan and Alberg bring a wealth of experience and expertise to the table, establishing themselves as founding board members.

Venturing into uncharted territory, Finpilot has secured a significant investment of $500,000 in convertible security from renowned investors Madrona Venture Labs and Ascend. These notable backers have displayed a strong commitment to supporting AI-driven companies. Mike Fridgen, Managing Director of Madrona Venture Labs, expressed his confidence in Finpilot, stating, “We were drawn to Lakshay and John’s deep understanding of the problems financial analysts face and the clarity of their product solution, which enables world-class research and reporting in a fraction of the time as existing tools,” in an interview with GeekWire.

Although Euclidean has made impressive strides in the field of machine learning, it is important to note that Finpilot will operate as an independent entity. Euclidean specializes in using machine learning algorithms to identify promising stocks and recently made headlines with the launch of its own exchange-traded fund (ETF).

At the core of Finpilot’s innovation lies its ChatGPT-like interface, which harnesses the capabilities of a large language model (LLM). This advanced tool meticulously sifts through a vast array of publicly available financial data, including Securities & Exchange Commission filings, earnings transcripts, and investor presentations. This novel approach addresses a common pain point in the information-gathering process, where the traditional method relies on manual keyword searches using the Ctrl+F function. By leveraging the power of Finpilot, research and reporting projects that previously required days or even weeks can now be completed within a matter of hours.

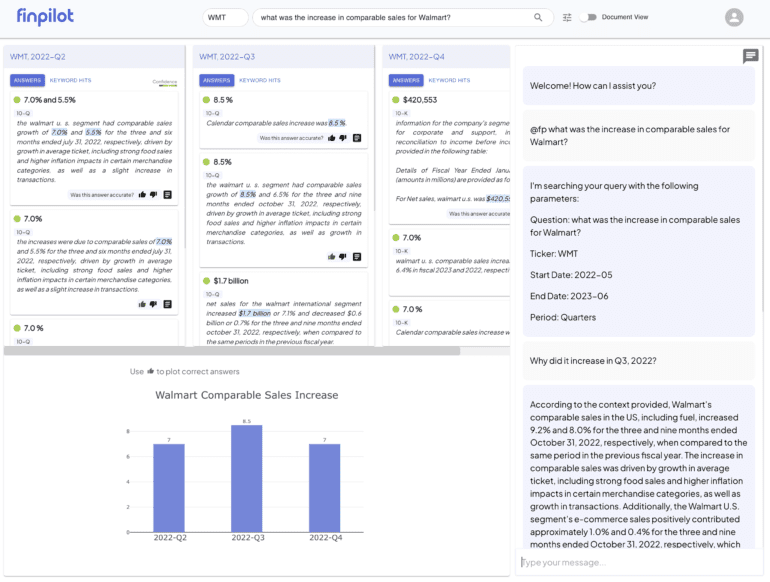

The uniqueness of Finpilot’s solution lies in its ability to process natural language queries from analysts. For example, a user can ask the chatbot about Walmart’s increase in comparable sales over the past year using plain, conversational language. In response, the tool provides a comprehensive answer, complete with links to the original source documents. Analysts can seamlessly continue their conversations by asking follow-up questions, enabling them to delve deeper and extract more detailed insights.

Distinguishing itself from other language models like ChatGPT, Finpilot allows users to interact with data, visualize it, and verify sources. This unparalleled functionality sets it apart as an indispensable tool for investors and financial analysts. John Alberg emphasizes the significance of this feature, having long advocated for the use of machine learning in investment strategies.

Finpilot’s state-of-the-art technology is built upon a custom-built LLM specifically tailored for the finance industry. Additionally, the platform incorporates various LLM-based APIs and a web-app stack for seamless app deployment. Currently, in the development phase, the company intends to offer its groundbreaking solution through a software-as-a-service (SaaS) license. With multiple customers actively testing the platform, Finpilot aims to refine and optimize its offering before its official launch.

While established players such as Factset, Bloomberg, and Alpha Sense offer financial data tools, their traditional approaches pale in comparison to the ingenuity of Finpilot, while the SEC’s EDGAR advanced search tool allows users to search electronic filings dating back to 2001 using specific keywords and names, Finpilot goes above and beyond by enabling companies to analyze data, generate reports, and visualize information through intuitive natural language queries.

Finpilot’s successful funding round, facilitated by Madrona Venture Labs and Ascend, utilized a Simple Agreement for Future Equity (SAFE) note. This approach aligns with the startup’s launch, which coincides with a surge of Wall Street firms investing heavily in AI tools and expertise. The financial sector anticipates that recent advancements in AI technology will streamline data processing and enhance risk modeling, providing a competitive advantage in an increasingly complex landscape.

Nevertheless, cautionary voices have emerged regarding the widespread adoption of AI in finance. Experts have raised concerns about the potential drawbacks, particularly regarding the accuracy of information provided by AI chatbots. Given their fiduciary duty to base investment decisions on reliable data, traders may face legal uncertainties when relying on AI-driven insights. Furthermore, tracing the training data of chatbots can prove challenging, potentially hindering the identification of false data points that may influence investment decisions.

Addressing these concerns head-on, Finpilot strives to provide users with the highest level of accuracy, speed, and reliability. John Alberg acknowledges the challenges associated with large language models, noting their tendency to generate fictional information and their limitations in handling complex tasks. He affirms, “We have developed numerous techniques to overcome these issues,” demonstrating Finpilot’s commitment to delivering a superior product.

Conclusion:

Finpilot’s AI chatbot tool represents a significant advancement in financial analysis. By leveraging artificial intelligence and natural language processing, the platform streamlines research processes and empowers analysts to make faster, more informed decisions. As the market increasingly embraces AI tools, Finpilot’s ability to provide accurate and efficient data analysis positions it as a game-changer in the finance industry.