TL;DR:

- AI adoption varies across firms, with larger and more productive firms being more likely to use AI.

- Younger firms show a higher propensity for AI adoption, driven by their inclination for radical innovations.

- Information and Communication Technology (ICT) and Professional Services sectors have the highest AI adoption rates.

- The presence of complementary assets such as digital capabilities and infrastructure is crucial for AI adoption.

- AI users tend to be more productive on average, but this advantage is influenced by complementary assets.

- Policymakers should focus on inclusive digital transformation policies to bridge gaps between firms and sectors.

Main AI News:

The pervasive influence of artificial intelligence (AI) on economies and societies worldwide cannot be understated. However, our understanding of its adoption across firms, particularly on an international scale, is still in its nascent stages. This article delves into the intricate dynamics of AI utilization in 11 countries, exploring firm characteristics, the significance of complementary assets, and the consequential relationship between AI deployment and productivity. The findings reveal a pattern of polarized adoption, with larger and more productive firms exhibiting a higher propensity for AI integration. This discrepancy underscores the potential for expanding gaps between industry leaders and other firms, necessitating the implementation of inclusive policies that foster a comprehensive digital transformation.

The transformative power of AI has already begun reshaping economies and societies. Its impact on the demand for skills has been profound, as evidenced by studies conducted by Restrepo et al. (2018) and Taska (2020). Furthermore, AI-driven products and services have seamlessly integrated into people’s daily lives, often without their full awareness, as highlighted by Tamura (2019).

AI, often regarded as a general-purpose technology (GPT), possesses the capacity to deliver significant improvements to adopters (Brynjolfsson et al., 2018). Its potential extends to addressing critical societal challenges such as healthcare and climate change, stimulating breakthrough innovations (Agrawal et al., 2018). However, it is crucial to acknowledge that while AI presents promising opportunities for enhancing productivity and well-being, it also entails inherent risks. These risks manifest in domains such as financial markets, societal inequalities, and democratic values (Danielsson, 2018; Pastorello et al., 2019; Acemoglu, 2021).

Despite the centrality of AI in economic and policy debates (Gans et al., 2018; Bholat, 2020), empirical research on its diffusion among firms remains limited, especially at the international level. Acemoglu et al. (2022) provide evidence on AI adoption in the United States, while Calvino and Fontanelli (2023) offer a comprehensive literature review of the subject. However, our study goes beyond these existing works by focusing on representative data from 11 countries and examining the unique characteristics of firms embracing AI, the role of complementary assets, and the correlations between AI adoption and productivity.

To conduct this study, we employ a distributed microdata approach, leveraging a standardized statistical code developed by the OECD. This code is executed in a decentralized manner, utilizing official firm-level surveys and benefiting from the collaborative efforts of experts across participating countries as part of the AI Diffuse Project. The data sources used to possess a high degree of representativeness and encompass information on digital technology usage, including AI, as well as firm characteristics and outcomes such as employment, turnover, and labor productivity. The analysis encompasses the following 11 countries: Belgium, Denmark, France, Germany, Ireland, Israel, Italy, Japan, Korea, Portugal, and Switzerland. Detailed information on the data, survey questions, and definitions can be found in Calvino and Fontanelli (2023).

Cross-country analysis pioneers the adoption of a common statistical code developed by the OECD. This code is executed in a decentralized manner, where country-specific surveys are processed by national experts. The outputs of these surveys are then consolidated for cross-country analysis, with thorough consistency checks and metadata validation performed in close collaboration with experts from each country.

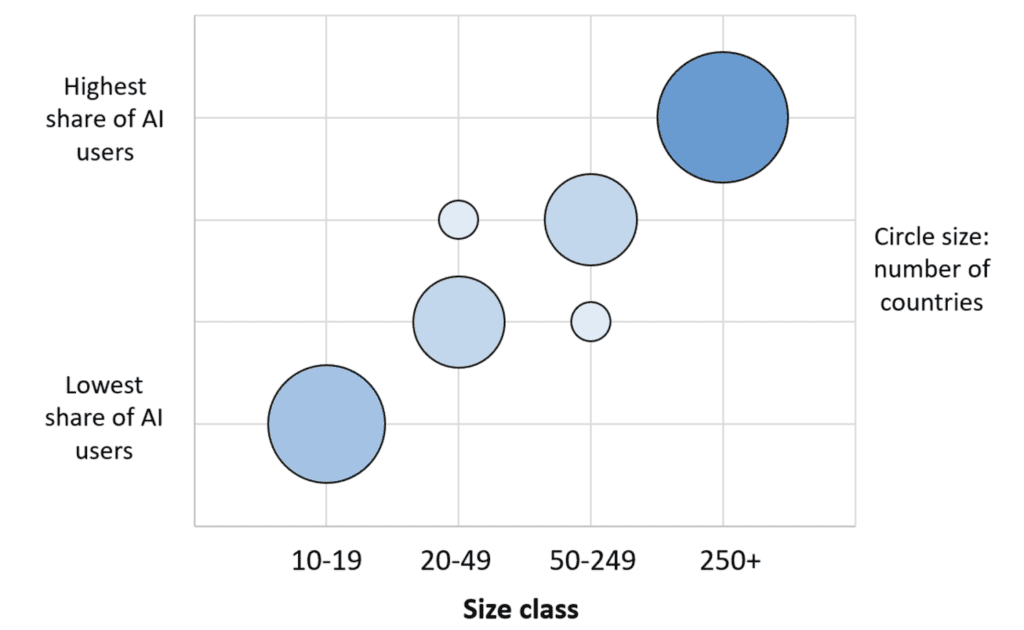

Based on data for Belgium, Denmark, France, Germany, Israel, Italy, Japan, Korea, Portugal, and Switzerland. The y-axis shows the ranking for shares of AI users. Circles’ size is proportional to the number of countries for which the relation holds. See Calvino and Fontanelli (2023) for additional details. Source: elaborations based on Calvino and Fontanelli (2023).

The analysis of cross-country patterns in AI adoption by firms reveals five key findings:

1. Firm Size: AI adoption is more prevalent among larger firms. This trend can be attributed to their superior resources and capabilities in harnessing intangible assets and other complementary factors necessary to fully exploit the potential of AI. Figure 1 visually depicts the positive relationship between the proportion of firms using AI and their size across different countries.

2. Firm Age: Younger firms exhibit a higher propensity for AI adoption. Start-ups, in particular, are more inclined to introduce radical innovations, particularly in the context of emerging technological paradigms.

3. Firm Sector: Information and Communication Technology (ICT) and Professional Services sectors exhibit the highest proportions of AI users. This indicates that the distribution of AI adoption is not yet uniform across all sectors of the economy. Considering AI’s relatively early stage of diffusion, this suggests that its full potential as a GPT is yet to be fully realized.

4. Firms’ Complementary Assets: The utilization of AI is significantly linked to the presence of complementary assets, including ICT skills and training, firm-level digital capabilities (measured through the adoption of other digital technologies), and digital infrastructure. Furthermore, general skills and innovative activities demonstrate positive associations with AI adoption.

5. Firm Productivity: On average, firms utilizing AI tend to be more productive than non-users, with larger firms experiencing more pronounced productivity gains. However, it is important to note that this productivity advantage is not solely attributable to AI adoption.

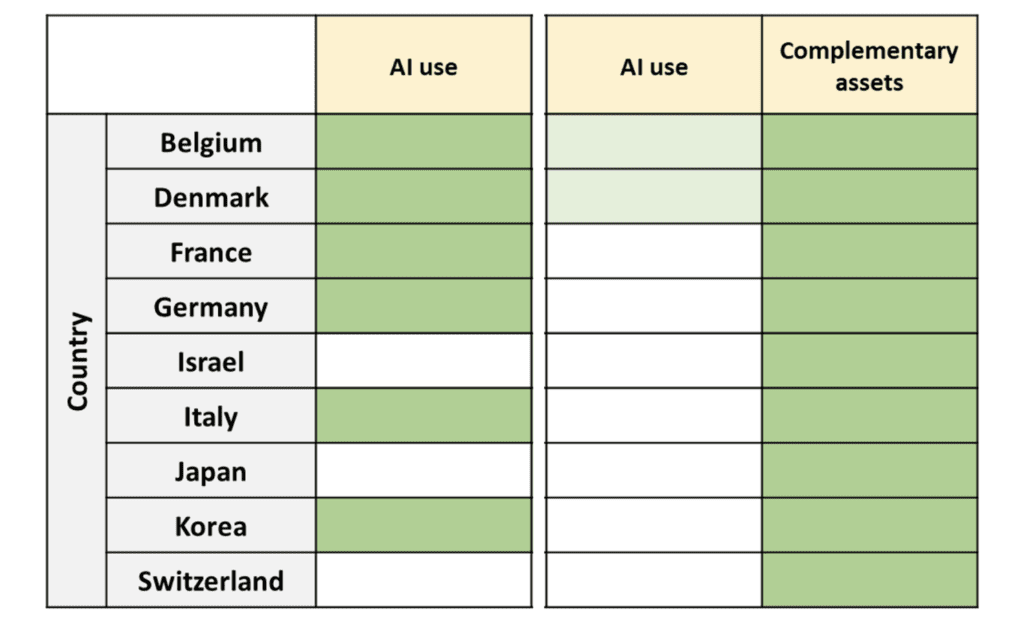

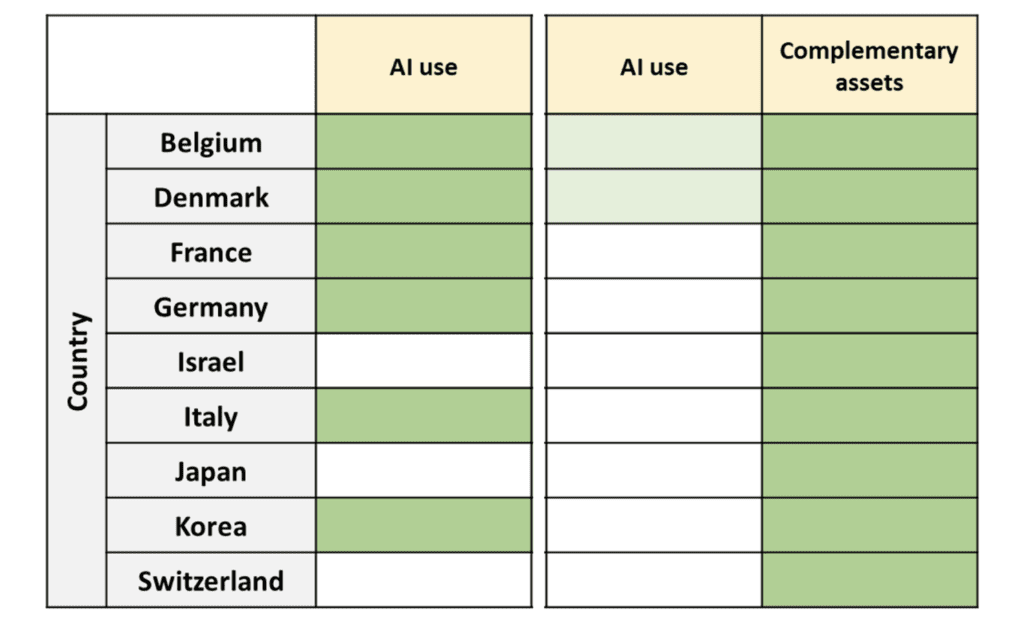

In fact, complementary assets, particularly those related to digital transformation, play a critical role in driving the productivity benefits observed among AI users. Figure 2 highlights that when accounting for the influence of these complementary assets through regression analysis, the productivity premiums associated with AI adoption significantly diminish or even disappear, while the link between complementary assets and productivity remains robust.

The study serves as a valuable complement to recent OECD analyses on AI diffusion among firms, utilizing microdata from various sources. Dernis et al. (2023) focus on companies and universities with an AI-related online presence across four countries, while Calvino et al. (2022) combine multiple microdata sources to identify and characterize different types of AI adopters in the United Kingdom, including intellectual property rights, online job postings, websites, and firm financials.

Policy implications arising from our findings are profound. The evidence suggests that certain firms, specifically those that are larger, possess stronger digital capabilities, and already demonstrate higher levels of productivity, are at the forefront of AI exploitation. Additionally, preliminary evidence from France indicates that firms developing their own AI algorithms, equipped with enhanced digital capabilities and complementary assets may experience direct effects of AI adoption on productivity.

The polarized adoption of AI, primarily by larger and more productive firms, combined with AI’s role in augmenting their competitive advantages, implies a potential widening of existing gaps between industry leaders and other firms. This divergence carries significant implications for social outcomes.

In this context, policymakers play a pivotal role in facilitating an inclusive digital transformation. They can achieve this by implementing a comprehensive policy mix that influences incentives and capabilities, while simultaneously capitalizing on synergies across various policy areas.

Such a policy mix should include measures to raise awareness about new technologies and enhance firms’ absorptive capacity. Additionally, providing appropriate financial tools, fostering competition, promoting knowledge production and sharing, and strengthening the foundations of digital infrastructure and skills are all crucial components.

By focusing on these complementary policy areas, we can promote the wider adoption of AI and ensure its benefits are more evenly distributed across firms and sectors, facilitating an inclusive digital transformation in the age of AI.

Based on the coefficients of regressions of (log) labour productivity (dependent variable) on AI use and additional controls. In the right panel the role of complementary assets is also taken into account. See Calvino and Fontanelli (2023) for additional details. Dark green: relation is positive and significant; light green: relation is positive and significant with lower magnitude with respect to the left panel. Source: elaborations based on Calvino and Fontanelli (2023).

Conclusion:

The analysis reveals that AI adoption is not uniform across firms and sectors. Larger and more productive firms are at the forefront of AI utilization, while younger firms and specific sectors show a higher propensity for AI adoption. The presence of complementary assets plays a critical role in driving AI adoption and productivity gains. Policymakers need to prioritize inclusive digital transformation policies to ensure a balanced and equitable AI-driven market, minimizing gaps between industry leaders and other firms.