- Construction industry faces significant delays in payments, averaging 2-3 months due to procedural complexities and budget overruns.

- Delayed payments in 2023 amounted to $273 billion, comprising 14% of total project costs.

- Adaptive, founded in 2021 by Matthew Calvano, Henry Bradlow, and Francisco Enriquez, addresses these challenges with innovative financial management tools tailored for contractors.

- Recently closed a $19 million Series A funding round led by Emergence Capital to expand its automated solutions.

- Offers comprehensive automation for budgeting, expense tracking, accounts payable, and electronic payments, leveraging AI algorithms.

- Competes with Briq, Beam, and MakersHub in the automated financial workflow sector.

- Boasts a clientele of over 280 construction firms, aiming for further growth in subcontractor markets.

- Plans to monetize through integrated payment solutions and additional financial services.

Main AI News:

The construction industry grapples with a longstanding issue of delayed payments, often taking an average of two to three months for firms to receive compensation. This delay, attributed to various factors such as procedural bottlenecks, multi-layered payment structures, and budget overruns, has significantly impacted the sector. In 2023 alone, the cumulative cost of delayed payments in construction skyrocketed to a staggering $273 billion, representing a substantial 14% of total project expenditures for the year.

Identifying the root cause as inefficiencies within back-office operations, Matthew Calvano, Henry Bradlow, and Francisco Enriquez founded Adaptive in 2021. Their mission: to streamline and simplify payment processes and financial management specifically tailored for general construction contractors.

“The complexity of the construction payment ecosystem involves numerous stakeholders, from financial institutions and developers to general contractors and subcontractors,” explained Calvano in an interview. “This intricate network, coupled with the financial constraints typically faced by small- and medium-sized enterprises (SMEs) in the industry, creates significant challenges that contribute to prolonged payment cycles.”

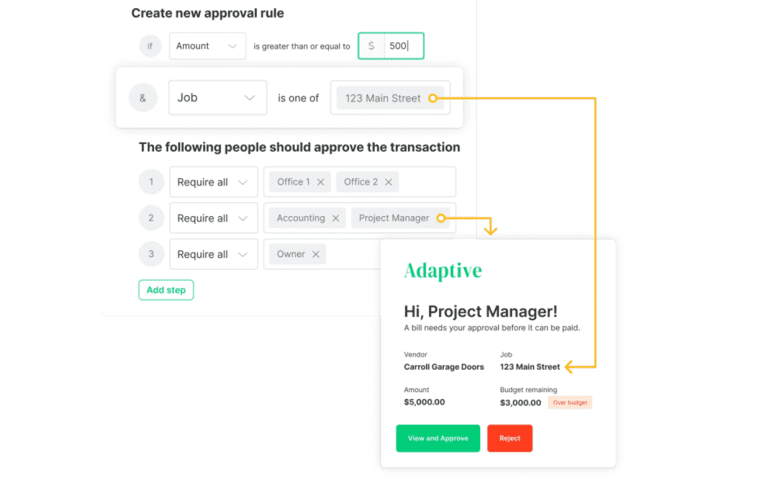

Recently, Adaptive closed a successful $19 million Series A funding round led by Emergence Capital. The platform offers a comprehensive suite of automated financial management tools, encompassing budgeting, expense tracking, accounts payable management, and electronic payment solutions. Through Adaptive’s innovative platform, users can seamlessly upload and manage critical documents such as insurance agreements and payment requests in various formats, including SMS and PDF. Leveraging advanced automation capabilities, these documents can be processed efficiently, streamlining approval workflows and enhancing overall financial transparency.

“Our proprietary generative AI algorithms are specifically designed to automate and optimize financial and accounting workflows tailored for the nuances of the construction industry,” noted Calvano. “Our primary competition lies in the traditional manual methods of financial management, often reliant on email exchanges, spreadsheet software like Excel, file-sharing platforms, and outdated project management software functionalities.”

In addition to its primary offerings, Adaptive faces competition from several other notable players in the industry. Briq, for instance, provides a similar suite of financial workflow automation tools, while Beam specializes in streamlining payment processing, invoicing, and receipt management for contractors. MakersHub focuses on deciphering complex accounts payable data specifically for construction companies.

Despite the competitive landscape, Adaptive has established a robust foothold in the market, boasting a clientele of over 280 construction firms ranging from bespoke homebuilders to large-scale commercial contractors and real estate developers.

Looking forward, Adaptive aims to expand its market reach by targeting subcontractor clients with tailored product enhancements. Over the medium term, the company plans to explore additional revenue streams through integrated payment solutions, insurance offerings, and payroll services.

“With our comprehensive approach to managing the entire financial workflow of our clients, we see significant opportunities to integrate embedded financial services, particularly catering to the underserved SME sector,” added Calvano.

Investors, recognizing Adaptive’s potential, have rallied behind the company. Andreessen Horowitz, Definition, Exponent, 3kvc, Box Group, and Gokul Rajaram, alongside Emergence Capital, participated in Adaptive’s Series A funding round. This infusion of capital, totaling $26.4 million, will fuel Adaptive’s ambitious growth plans. A substantial portion of these funds will support the expansion of Adaptive’s workforce in New York, increasing staff numbers from 29 to 45 by the end of the year, as outlined by Calvano.

Conclusion:

Adaptive’s strategic focus on automating financial workflows within the construction sector not only addresses critical pain points of delayed payments but also positions the company favorably for capturing market share in a segment traditionally underserved by comprehensive financial management solutions. The successful funding round underscores investor confidence in Adaptive’s potential to innovate and scale within the industry, paving the way for future growth and expansion into new market segments.