- AI drives over 40% of new US unicorns in 2024’s first half.

- AI unicorns add $116 billion to total venture-backed valuations, with xAI alone contributing $24 billion.

- Overall US unicorn value grows by $162 billion this year.

- AI’s share of venture capital rises from 15%-17% to about 20% by 2023.

- Challenges include unrealized expectations among AI-focused startups funded during the bull market.

- Companies like Inflection and Adept struggle with business model sustainability.

Main AI News:

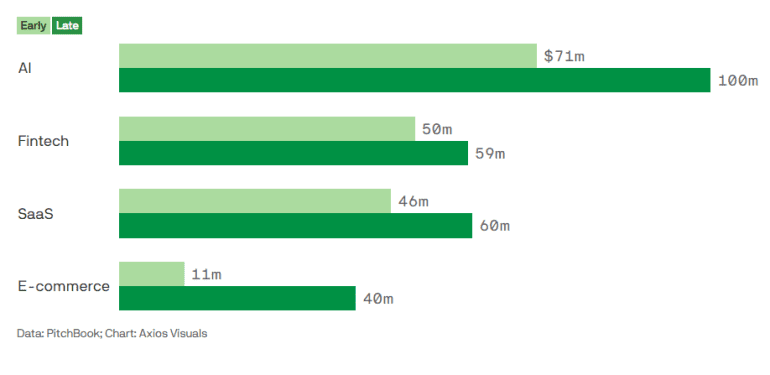

Artificial intelligence continues to dominate the venture capital landscape, playing a pivotal role in shaping the market’s trajectory. According to data from PitchBook, AI accounted for more than 40% of new US “unicorns” in the first half of this year, contributing significantly to the sector’s growth. These AI-driven companies collectively added a staggering $116 billion in aggregate value, with notable contributions from Elon Musk’s xAI alone boosting valuations by $24 billion.

The rapid expansion of AI within the venture capital sphere underscores its pivotal role in bolstering overall unicorn valuations, which have surged by $162 billion in 2024 so far. Analysts, including PitchBook’s Brendan Burke, highlight a marked increase in AI’s share of venture dollars, rising from 15%-17% in recent years to approximately 20% by 2023 and continuing to ascend in 2024.

However, despite AI’s ascendancy, challenges persist. The euphoria of 2021’s bull market left many AI-focused startups struggling to meet their lofty expectations. Brendan Burke notes that while thousands of companies integrated machine learning into their platforms, not all have realized their growth potential. Many megadeals from the previous bull market have failed to sustain their initial valuations, reflecting a sobering reality amidst AI’s rapid expansion.

Zooming in on specific cases, companies like Inflection, valued at $4 billion after a $1.3 billion funding round, have faced hurdles in establishing sustainable business models. Similarly, Adept, valued at $1 billion, has yet to launch a product publicly, underscoring the risks associated with early-stage valuations in the AI sector.

Despite these challenges, venture capitalists remain bullish on AI’s long-term prospects. The sector’s ability to innovate and drive technological advancements continues to attract significant investment interest, fueling optimism for future growth and evolution within the venture capital ecosystem. As AI matures and adapts, its transformative impact on industries across the board promises to sustain investor enthusiasm and drive further capital inflows.

Conclusion:

The surge of AI-driven unicorns and their substantial contribution to venture capital valuations underscore AI’s pivotal role in shaping market dynamics. Despite challenges in sustaining high valuations and achieving business viability, the growing investment in AI reflects confidence in its transformative potential across industries. As AI technologies evolve, their impact on venture capital strategies will likely deepen, influencing future investment trends and market developments.