TL;DR:

- Arteria AI, a data-driven company, is revolutionizing the financial services industry.

- They focus on structuring unstructured data in financial contracts.

- The platform streamlines contract drafting, approvals, and insights for large-scale enterprises.

- Recent growth saw Arteria AI acquire major financial institution clients, tripling its recurring revenue.

- The company’s $30 million Series B funding, led by GGV Capital U.S., brings their total funding to $50 million.

Main AI News:

In the ever-evolving landscape of financial data, success hinges on harnessing information effectively. Yet, with approximately 90% of enterprise data existing in an unstructured form and merely less than 1% of this data being leveraged for decision-making, enterprises are confronted with an imposing challenge.

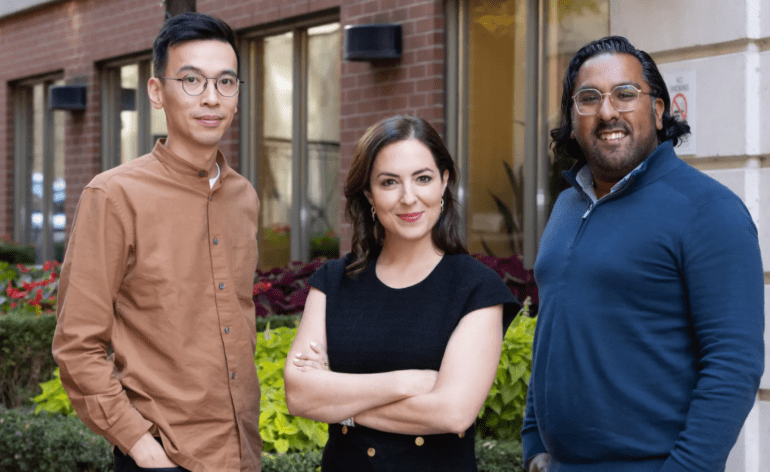

Enter Arteria AI, a company spearheading a data-driven revolution with a particular focus on institutional finance contracts. The brainchild of co-founders Shelby Austin, Abrar Huq, and Jonathan Wong, who previously collaborated at Deloitte Canada, Arteria AI has embarked on a mission to reshape the financial services industry’s modus operandi. Their vision is to infuse artificial intelligence (AI) into the realm of large-scale enterprises, catering to the colossal financial sector, which oversees trillions in assets and is poised to invest approximately $20 trillion in technological transformation.

Austin, the CEO, noted that the problem of manually sifting through voluminous documentation to extract vital data has persisted for years. However, recent advancements in technology have finally provided a solution. Arteria AI’s approach involves assembling a team of experts, technologists, scientists, and legal minds. Established in 2020, the Toronto-based company is constructing a data-centric foundation for modern documentation processes. Their platform transforms data during contract drafting, streamlining approvals, negotiations, and decision-making. Simultaneously, an insights layer offers valuable information, such as process bottlenecks, edit counts, and suggestions for enhancing future contracts.

The past year witnessed remarkable growth for Arteria AI, marked by substantial customer acquisition. The company successfully onboarded esteemed financial institutions like Goldman Sachs and Citi, resulting in a threefold increase in recurring revenue during the same period.

Now, Arteria AI proudly announces a $30 million Series B financing round led by GGV Capital U.S., with the enthusiastic participation of existing major investors, including Illuminate Financial, Information Venture Partners, BDC Capital, and Citi. This funding injection raises Arteria AI’s total funding to an impressive $50 million to date.

Chelcie Taylor, an investor at GGV, emphasized Arteria AI’s distinctive approach in addressing the unstructured data challenge within the banking and financial sector. Unlike traditional methods reliant on legal functions, Arteria AI recognizes the need to empower various business units, including asset management, trading, derivatives, and commodities, by offering a robust and digitally-driven data solution. Taylor also praised the company’s effective utilization of AI, citing its ability to swiftly identify critical information buried within lengthy contracts.

Arteria AI’s plans include deploying the newly acquired funds for expanding go-to-market activities and further enhancing AI technology tailored for financial services. Despite its modest workforce of fewer than 100 employees, the company aims to double its headcount in the coming year. Notable additions to the leadership team, such as John Wallace as CFO, Bailey Dougherty as Global Head of Professional Services, and Larry Lawrence and Donna Mansfield to lead growth, underscore Arteria AI’s commitment to its vision.

Austin affirmed the company’s commitment to research, ensuring that they deliver highly relevant models to their customers. As the company gains recognition for its functional impact, the demand for its services continues to grow across the entire banking sector. Arteria AI is well-poised to meet these demands and drive transformative change in the financial industry.

Conclusion:

Arteria AI’s successful funding round and rapid customer acquisition underscore the growing demand for data-driven solutions in the financial sector. Their innovative approach to handling unstructured data and strong partnerships with major financial institutions position them as a key player in modernizing financial documentation processes. This development highlights the increasing importance of AI-driven solutions in the market, as financial institutions seek ways to harness data for improved decision-making and operational efficiency.