TL;DR:

- Cap VC introduces an AI-driven tool for VC firms and startups to enhance investment decision-making.

- The startup aims to convert complex PDFs and financial data into structured information, becoming the “operating system” for VCs.

- Cap VC plans to provide contextual insights into portfolio companies, enabling a comprehensive view of their history and performance.

- They are also collaborating with auditing firms to develop a fund management tool for various stakeholders, including regulatory bodies.

- CEO Patrick Theander emphasizes a small, efficient team as the key to rapid and superior development.

- The text explores why VCs haven’t built similar platforms themselves, attributing it to the need for a nuanced understanding of the tech startup ecosystem.

- Cap VC’s user-friendly approach may disrupt the VC industry’s complacency and drive innovation.

Main AI News:

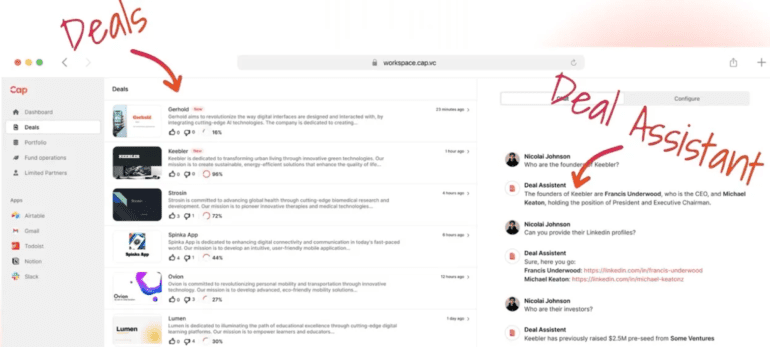

Cap VC, a startup born out of a venture capital fund, is poised to become the premier “operating system” for the VC industry. In an era where artificial intelligence is rapidly advancing, Cap VC aims to empower VC firms and startups with cutting-edge tools to expedite investment decisions and streamline operations.

Venture capital is traditionally a people-centric business, but as AI technologies inch closer to human capabilities, a new wave of tools is emerging. Some, like Connetic Ventures’ proprietary solutions, give VCs a competitive edge, while others, such as DeckMatch and Headline, originate from VC firms themselves to navigate the startup investment landscape.

Cap VC identified a significant gap in the venture capital industry – the overwhelming influx of complex PDF files. Their mission is clear: to transform unstructured data from PDFs, balance sheets, income statements, and P&L accounts into structured, actionable information. Patrick Theander, CEO of Cap VC, aptly describes their vision as creating an “operating system for VCs.” The company is developing native apps for both Mac and Windows, along with an API for developers to build upon. Their aim is to provide a comprehensive suite of ecosystem tools tailored to the VC industry’s unique needs.

But Cap VC’s ambitions don’t stop at data transformation. They aspire to offer valuable context to portfolio companies, enabling VCs to access the complete historical records of startups they’re interested in. This contextual insight encompasses funding rounds, historical data, and more, providing VCs with a holistic view of their investments.

In addition to its platform, Cap VC is forging a more accessible space for limited partners (LPs) and auditors. Collaborations with auditing firms like Deloitte are enabling the development of a fund management tool that benefits all stakeholders, including regulatory bodies.

Despite Cap VC’s growth, Theander remains committed to maintaining a lean, efficient team. He believes that the right team, rather than sheer size, is the key to rapid, high-quality development.

A pertinent question arises: Why haven’t VCs developed similar platforms themselves? Theander speculates that building such a platform requires a nuanced understanding of the tech startup ecosystem, a skill set that may not be readily available within VC firms. While VCs do invest heavily in gaining a competitive edge, there’s also an argument that they may have become complacent. Cap VC’s straightforward and user-friendly approach to innovation may just be the wake-up call the industry needs.

Conclusion:

Cap VC’s innovative AI-driven platform is poised to redefine the venture capital market. By simplifying data management and offering valuable context, it addresses industry inefficiencies and challenges VCs to adapt to a more streamlined approach. The startup’s user-friendly approach could encourage broader industry adoption, potentially reshaping how investments are made and managed.