TL;DR:

- Q4 2023 witnessed a significant revenue boost in the cloud infrastructure market.

- Generative AI, driven by ChatGPT, played a pivotal role in this surge.

- Q4 revenue reached $74 billion, a $12 billion YoY increase and a $5.6 billion QoQ rise.

- Full-year 2023 revenue soared to $270 billion, up from $212 billion in 2022.

- Market growth is set to stabilize, leading to consistent annual increases.

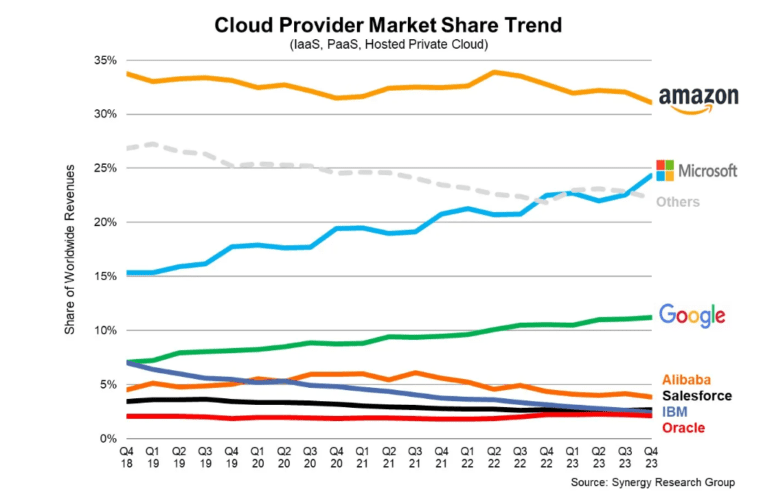

- Microsoft gained a 2% market share, challenging Amazon’s leadership.

- Amazon, Microsoft, and Google collectively account for 67% of the market.

- Microsoft’s aggressive AI investments reshaped the market dynamics.

Main AI News:

In recent quarters, the cloud infrastructure market has been experiencing a subdued growth trend, marked by lower figures compared to its historical performance. However, the tide turned dramatically in the fourth quarter of 2023, largely fueled by the fervor surrounding generative AI technologies. This newfound revenue surge, sparked initially by the ChatGPT phenomenon, propelled the cloud infrastructure sector to remarkable heights. With the fourth quarter raking in an astonishing $74 billion in revenue, this represents a staggering $12 billion increase over the same period the previous year and a remarkable $5.6 billion upswing from the third quarter. Such a staggering quarter-over-quarter surge in revenue is unprecedented in the history of the cloud market, as reported by Synergy Research.

The cloud infrastructure market’s full-year performance for 2023 culminated in a jaw-dropping $270 billion, marking a substantial leap from the $212 billion recorded in 2022. John Dinsdale, an analyst at Synergy, anticipates that the growth witnessed in the past year is poised to persist, even as the market matures and the law of large numbers begins to exert its influence. Dinsdale stated, “Cloud is now a massive market and it takes a lot to move the needle, but AI has done just that. Looking ahead, the law of large numbers means that the cloud market will never return to the growth rates seen prior to 2022, but Synergy does forecast that growth rates will now stabilize, resulting in huge ongoing annual increases in cloud spending.”

Jamin Ball, a partner at Altimeter Capital, echoed this optimism in his insightful Clouded Judgement newsletter, asserting that hyperscale cloud providers are now reaping the benefits of an influx of new workload opportunities, which are beginning to outweigh the challenges of optimization. These new workloads encompass a spectrum of AI-related tasks and classic cloud migrations. The hyperscale cloud giants leverage their enormous scale, extensive distribution networks, unwavering trust, and profound customer relationships, attributes that set them apart from all other software companies. Notably, they are also witnessing earlier returns on AI-related revenue, primarily in the realm of computational services.

Ball’s data aligns with Dinsdale’s conclusions regarding the diminishing growth rates, highlighting that in a market as colossal as this, pursuing growth purely for its sake takes a backseat.

Currently, it appears that Microsoft’s strategic investment and partnership with OpenAI are providing it with a competitive edge in the market. This partnership propelled Microsoft’s market share to surge by a remarkable two percentage points, reaching 25% in the fourth quarter – a remarkable one-quarter increase. While Amazon still maintains its leadership position with a 31% share, albeit down by two points from the previous quarter, it’s essential to recognize that attributing Amazon’s loss entirely to Microsoft’s gain oversimplifies the dynamics at play in this multifaceted market. In the meantime, Google remains steady, hovering around an 11% market share.

Synergy’s research underscores that the three tech giants – Amazon, Microsoft, and Google – collectively account for a commanding 67% of the overall market share, equivalent to approximately $50 billion in total cloud revenue generated by these behemoths in a single quarter.

From a financial perspective, the figures are nothing short of staggering. Amazon reports revenue of $23 billion, Microsoft follows closely with $18.5 billion, and Google contributes around $8 billion. Discrepancies in the reported numbers may arise due to the inclusion of various types of cloud revenue, such as IaaS, PaaS, and hosted private cloud services, with some companies also factoring in SaaS and other revenue streams not considered by Synergy.

Examining quarterly percentage growth, AWS experienced a 13% increase, Azure surged by 30%, and Google Cloud recorded an approximately 25% uptick, although it’s important to note that this figure doesn’t differentiate SaaS revenue.

One thing became abundantly clear last year: Microsoft successfully applied pressure on Amazon, putting the e-commerce giant on the defensive for the first time. Microsoft’s assertive collaborations, particularly its partnership with OpenAI, have played a pivotal role in this shift. Scott Raney, a partner at Redpoint, observed at re:Invent in December that Amazon found itself in the unusual position of playing catch-up in the AI race. He remarked, “This might be the first time where people looked and said that Amazon isn’t in the pole position to capitalize on this massive opportunity. What Microsoft’s done around Copilot and the fact Q comes out [this week] means that in reality, they’re absolutely 100% playing catch-up.”

While the potential of generative AI presents a colossal opportunity for all cloud providers, it’s important to recognize that we are still in the nascent stages of its development. The prevailing wisdom suggests that being the first to market confers a significant advantage, a principle that has notably favored Amazon over the years. Whether Microsoft’s aggressive approach to AI can similarly secure it a dominant position remains uncertain. However, it’s challenging to overlook the impressive two-percentage-point market share increase within a single quarter. For the time being, Microsoft appears to have taken the lead in the realm of AI in enterprise computing, but both Google and Amazon still have ample opportunity to navigate this evolving landscape.

Conclusion:

The cloud infrastructure market experienced a remarkable resurgence in Q4 2023, driven by the influence of generative AI technologies, particularly ChatGPT. This surge in revenue, reaching $74 billion in the quarter, signals a shift in market dynamics. While Amazon maintains its dominance, Microsoft’s aggressive approach to AI investments has secured its position as a formidable competitor. The market is poised for continued growth, albeit at a stabilized rate, with Microsoft leading the charge in the AI-driven future of cloud computing.