TL;DR:

- ForwardLane introduces EMERGE, a pioneering generative decision intelligence platform.

- EMERGE addresses data transparency, privacy, and security issues in wealth, asset management, and insurance industries.

- The platform empowers professionals with generative AI insights, reducing reliance on data science teams.

- It combines EMERGE-GPT and Visual Insight Generator for seamless insight creation and delivery.

- EMERGE enhances client prioritization, real-time intelligence access, and workflow integration.

- The platform ensures data privacy, transparency, and compliance with regulations.

- Enterprises can deploy EMERGE on a white-label basis with cloud flexibility.

- EMERGE is in limited beta testing, with wider availability expected in Q3’23.

Main AI News:

In a significant stride towards revolutionizing the financial landscape, ForwardLane, a trailblazer in AI-powered intelligence solutions, has unveiled EMERGE, a cutting-edge platform set to reshape the dynamics of wealth, asset management, and insurance industries. This sophisticated generative decision intelligence platform is poised to tackle complex enterprise challenges ranging from data transparency and privacy concerns to data security issues.

After insightful dialogues with C-Suite executives and adept Data & Analytics teams across the financial services sector, ForwardLane identified a pressing need to address the intricate deployment of private, secure, and precise generative AI. This challenge, often an exhaustive drain on resources, has paved the way for the development of EMERGE.

EMERGE ushers in a new era for professionals in a multitude of domains, including advisory, distribution, sales, marketing, business intelligence, management, and product development. By seamlessly harnessing the potential of generative AI, these professionals can now effortlessly explore, create, preview, publish, and engage with novel insights—while maintaining the paramount values of privacy, security, and accuracy.

This visionary platform eliminates the over-reliance on data science teams, affording them the opportunity to scale Data & Analytics capabilities strategically throughout the organization. No longer encumbered by the intricacies of analytics aggregation, data processing, insight formulation, Large Language Model fine-tuning, or the ultimate delivery of insights and Next Best Actions, these teams can devote their energies to more strategic endeavors.

Incorporating ForwardLane’s state-of-the-art composite AI—EMERGE-GPT—and the Visual Insight Generator, an intuitive zero-code tool, EMERGE heralds a paradigm shift in insight generation. This novel approach effortlessly transforms data into natural language insights without necessitating expertise in Large Language Models. Bolstered by ForwardLane’s Next Best Action platform, this symbiotic amalgamation facilitates a seamless journey from insight inception to orchestration, culminating in the efficient delivery and utilization of actionable insights.

Nathan Stevenson, the visionary Founder and CEO of ForwardLane, expounded, “Having been at the forefront of AI innovation since 2016, we’ve made substantial strides in cultivating an enterprise-grade Next Best Action platform tailored for wealth, asset management, and insurance domains. EMERGE epitomizes an applied Generative AI solution purpose-built for the financial services sector. It marries the salient features of ForwardLane’s ViGOR with the privacy-centric EMERGE-GPT. This synergy furnishes financial institutions with the means to swiftly activate their existing data reservoirs and data science investments, thereby empowering their frontline advisory and sales professionals with invaluable insights.“

EMERGE extends an invaluable array of capabilities to Wealth, Asset Management, and Financial Services Professionals:

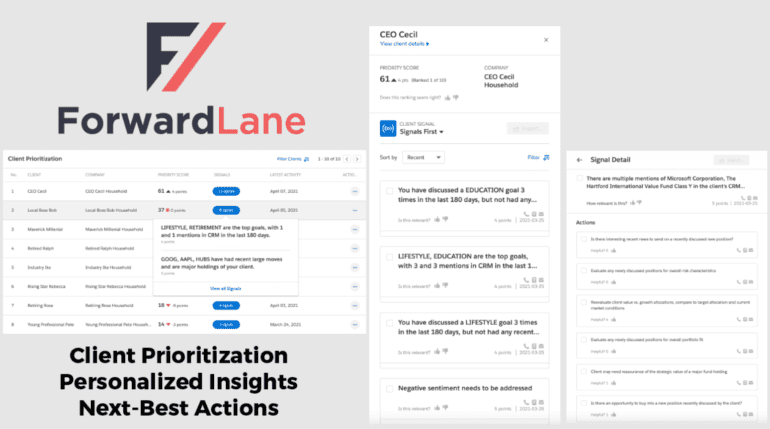

- Prioritization of clients, identification of opportunities, and mitigation of risks across client portfolios.

- Real-time access to client intelligence and analytics accompanied by actionable Next Best Actions.

- Integration of Next Best Action recommendations through APIs, seamlessly linking with workflows and facilitating personalized content delivery, marketing campaigns, and strategic actions.

- Enhanced daily workflows, enabling accelerated reading speeds and interaction with a variety of document formats, ensuring access to crucial takeaways, action items, and insights to share with clients.

- Detailed insights into buying behaviors, advisor priorities, opportunity and risk scores, amalgamating data from internal and external sources without violating enterprise data licensing terms—an asset for fund wholesalers.

Enterprises can seamlessly integrate the EMERGE platform, opting for a white-label deployment approach. The platform can be hosted either on their preferred cloud infrastructure or by ForwardLane itself, ensuring complete control and adherence to data licensing and transfer prerequisites.

Crafted with an emphasis on transparency, adaptability, swift deployment, and adherence to financial regulations, EMERGE is currently undergoing limited beta testing with premier partners. For those keen on experiencing the future of financial services, the waitlist is open, with broader availability slated for Q3’23.

Conclusion:

ForwardLane’s EMERGE platform introduces a transformative paradigm in the financial services landscape. By effectively addressing complex data challenges and enabling professionals with advanced generative AI capabilities, the platform is poised to revolutionize client interactions, decision-making processes, and operational efficiency across the industry. Its fusion of EMERGE-GPT and the Visual Insight Generator sets a new benchmark for insight creation, offering the unparalleled potential to reshape how financial services are delivered and experienced. As EMERGE enters wider availability, it signifies a pivotal moment that is likely to reshape market dynamics and establish new industry standards.