- Hedge funds are divesting from software stocks amid rising concerns about the AI boom.

- Software equities accounted for over 60% of the recent sell-off, reflecting a significant pivot.

- Hedge funds are strategically reallocating towards sectors poised to benefit from AI, particularly semiconductors.

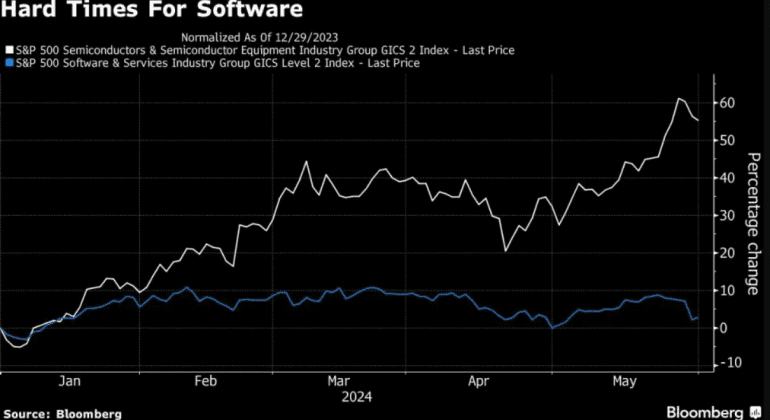

- Disparities in sector performance are evident, with semiconductor stocks outperforming software counterparts.

- Analysts caution against expectations of widespread AI benefits for large-cap software companies.

- Software stocks related to AI face challenges amid macroeconomic and geopolitical uncertainties.

- Nvidia’s dominance in the AI space underscores the continued allure of semiconductor investments for hedge funds.

Main AI News:

The hedge fund landscape is witnessing a significant reshuffle as concerns over the trajectory of the artificial intelligence revolution intensify. According to a recent report from Goldman Sachs Group Inc.’s prime brokerage desk, hedge funds are offloading software stocks at a rapid pace, marking the most substantial sell-off in 11 weeks. Notably, software equities accounted for over 60% of the divestment, highlighting a notable pivot away from this segment of the market.

Jon Caplis, CEO of hedge fund research firm PivotalPath, noted, “A number of managers spoken to by PivotalPath have rotated out of software as a service (SaaS) stocks in favor of AI/semis.” This shift reflects a broader trend driven by escalating interest in AI capabilities and a concurrent slowdown in SaaS subscriptions.

Moreover, hedge funds are not merely reducing exposure to mega-cap technology stocks; they are actively seeking opportunities in sectors poised to benefit from the AI boom. Semiconductors and semiconductor equipment emerged as the sole net-purchased tech subsector last week, according to Goldman’s data, signaling a strategic realignment within hedge fund portfolios.

Despite the broader rally in the S&P 500 Information Technology Index, marked disparities in performance exist at the sectoral level. Notably, the S&P Semiconductors and Semiconductor Equipment index has surged by a staggering 57% this year, far outpacing the modest 2.2% uptick in the S&P Software and Services index.

Anurag Rana, senior technology analyst at Bloomberg Intelligence, offered insights into the future trajectory of large-cap software companies, cautioning, “Apart from Microsoft Corp., we don’t expect the majority of large-cap software companies to benefit from AI in the near term.”

Echoing these sentiments, analysts at D.A. Davidson highlighted the impending “trough of disillusionment” for software stocks linked to artificial intelligence. This sentiment is compounded by macroeconomic headwinds and geopolitical uncertainties, prompting companies to defer their upgrade plans.

As the demand for AI technologies continues unabated, with Nvidia Corp. leading the charge, hedge funds are finding solace in semiconductor investments, at least for the foreseeable future. Jay Woods, chief global strategist of Freedom Capital Markets, emphasized, “Chip stocks should continue to be the story heading into the second half of 2024 as the demand remains high and innovation in the space continues at a rapid pace. Nvidia continues to lead, and the others are following.”

Conclusion:

The shifting dynamics in hedge fund investments, marked by a departure from software stocks and a pivot towards sectors aligned with the AI surge, underscore the evolving market landscape. While semiconductor stocks continue to enjoy robust investor interest, concerns linger over the outlook for software companies amidst broader economic and geopolitical uncertainties. This strategic realignment reflects a nuanced assessment of market trends and underscores the importance of adapting investment strategies in response to emerging technological shifts.