TL;DR:

- Intuit has launched “Intuit Assist,” an AI assistant powered by GenOS, offering personalized financial recommendations and decision support within its software suite.

- Available to all TurboTax users and select clients of Intuit’s other products, with a broader rollout planned.

- Intuit Assist aims to simplify tax filing, expedite refunds, and provide tailored financial advice.

- It also targets small and medium-sized businesses, enhancing their financial capabilities.

- Intuit emphasizes robust testing to ensure the accuracy of AI models.

- The platform goes beyond GPT-4 API integration, utilizing GenOS for specialized financial language models.

- Intuit Assist combines conversational prompts with real-time customer data for customized responses.

- Users across TurboTax, Credit Karma, QuickBooks, and Mailchimp benefit from tailored AI assistance.

- Human expert support is available through the Live Platform.

- Additional features are expected for the 2023 tax season.

Main AI News:

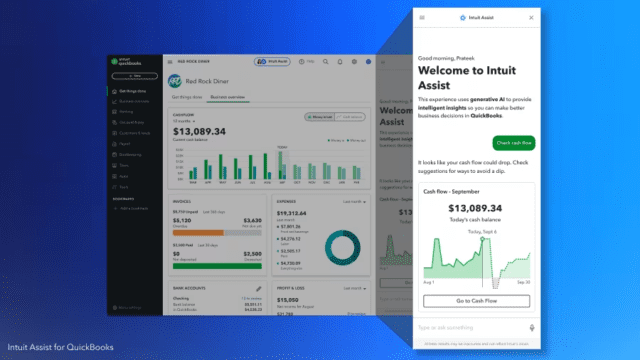

In a strategic move aimed at revolutionizing the financial landscape, TurboTax creator Intuit has unveiled its cutting-edge AI assistant, aptly named “Intuit Assist.” This groundbreaking AI solution harnesses the power of a proprietary platform known as GenOS to deliver AI-generated financial insights and enhance decision-making processes within the company’s suite of software offerings. As reported by Reuters, Intuit Assist is now readily available to all TurboTax users and select clients of Intuit’s other flagship products, including Credit Karma, QuickBooks, and Mailchimp. A broader release is in the pipeline, set to unfurl in the ensuing months.

The enticing promise from Intuit is clear: “Consumers will find it easier than ever to manage and improve their financial lives.” This newfound ease is facilitated by a constant stream of personalized recommendations throughout the year, coupled with actionable steps to optimize tax refunds and streamline tax filing processes using TurboTax. Beyond tax-related matters, users are also bestowed with the tools to navigate their financial journey prudently, thanks to Credit Karma.

In addition to enhancing individual financial well-being, Intuit envisions Intuit Assist as a leveling force in the business world, particularly for small and medium-sized enterprises that often grapple with resource constraints when compared to their corporate counterparts. The AI assistant is poised to significantly reduce the time spent on tax filing procedures, expediting access to refunds, and delivering bespoke financial counsel. According to Intuit’s Chief Data Officer, Ashok Srivastava, the company’s AI models have notched up commendable results in internal accuracy assessments, standing toe-to-toe with other AI systems.

This introduction of generative AI features comes as no surprise, given the burgeoning interest in AI technology, notably fueled by the meteoric ascent of ChatGPT in recent times. Much akin to the fervor surrounding blockchain experiments in 2021, AI language models are being seamlessly integrated into various applications, regardless of their appropriateness.

However, the specter of accuracy looms large in the realm of AI language models, as they have a propensity to concoct information. Intuit, however, remains unperturbed, citing a rigorous testing mechanism that melds the power of AI and human scrutiny to evaluate and ascertain model accuracy, as Srivastava elucidated to Reuters.

Notably, Intuit Assist stands apart from the crowd, transcending the boundaries of a mere GPT-4 API embellishment that characterizes many contemporary AI applications. The company asserts that Intuit Assist leverages GenOS, a bespoke platform meticulously tailored to complement their own extensive portfolio of financial large language models (LLMs), fine-tuned to tackle challenges spanning tax, accounting, cash flow management, personal finance, and marketing.

Years of tireless research and development culminated in the creation of Intuit Assist, underpinned by the principles of generative AI. GenOS blends conversational prompts with real-time customer data to deliver bespoke responses, enabling Intuit to craft specialized AI models tailored to each product category within its purview, thanks to its rich and diverse datasets.

Within TurboTax, Assist empowers users by simplifying the tax filing process through deduction calculations, navigating ever-evolving tax codes, and facilitating interactions with human experts when needed. Credit Karma users benefit from personalized credit card recommendations and financing options, all derived from their financial data. QuickBooks users gain invaluable business insights, from profit and loss assessments to tracking overdue invoices and identifying top-selling products. Meanwhile, Mailchimp users are equipped to create and optimize AI-driven marketing campaigns, expertly personalized using customer data, all through a user-friendly natural language interface.

To complement the capabilities of the AI assistant, Intuit customers can engage in real-time discussions with human experts via the company’s Live Platform, ensuring comprehensive support when required. Anticipate a slew of additional features from Intuit Assist, set to be unveiled in time for the 2023 tax season, as per the company’s forward-looking vision.

Conclusion:

Intuit’s launch of “Intuit Assist” signifies a significant advancement in the financial technology sector. This innovative AI assistant, coupled with robust accuracy testing and the utilization of GenOS for specialized models, is poised to transform financial management for both individuals and businesses. Its broad applicability across Intuit’s product suite and the promise of additional features in the future make it a noteworthy development that can empower users and level the playing field for businesses of all sizes.