TL;DR:

- Lemonade plans to incorporate generative AI technology for numerous business processes.

- The company expects significant cost reductions and anticipates an impact on its financials later this year.

- The revised outlook for adjusted EBITDA in 2023 shows a narrower loss range due to generative AI cost savings.

- If generative AI delivers substantial cost savings as projected, Lemonade’s path to profitability could accelerate.

- The company’s current price-to-sales ratio may not reflect its potential for rapid profitability.

- Generative AI adoption positions Lemonade as a pioneer in insurance industry disruption.

- The technology aims to optimize operations, improve efficiency, and reduce costs.

- Investors see an opportunity to invest in Lemonade’s transformative use of generative AI.

Main AI News:

Lemonade, the insurance company led by Chief Executive Officer Daniel Schreiber, is embarking on an ambitious initiative to revolutionize the insurance industry by integrating artificial intelligence (AI) into its operations. While skeptics have doubted the potential of AI in insurance, recent developments have reignited investor confidence in Schreiber and his company.

Over the past two years, Lemonade’s stock experienced a significant decline, plummeting 92% from its record high of $183.26 on January 11, 2021. During this period, there was limited evidence to support Schreiber’s belief that AI could reshape the insurance landscape. However, a recent positive shift in investor sentiment suggests that Lemonade might be turning the corner.

The first-quarter results unveiled a promising trend, a key metric that investors use to evaluate the viability of Lemonade’s AI-based insurance revolution as a replacement for traditional business models. Encouraging signs of progress have propelled the company’s stock price to an 11% increase this year, outperforming the S&P 500.

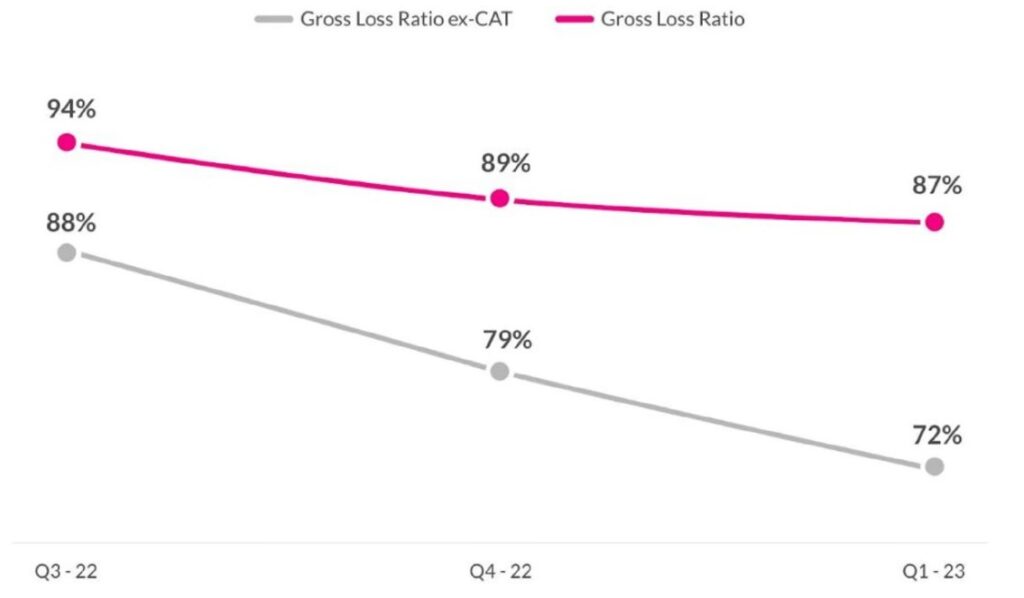

The pivotal factor in assessing an insurance company’s performance lies in its loss ratio. This crucial metric is derived by dividing the total claims paid by the premiums received. Ideally, a well-managed insurance firm should maintain a gross-loss ratio ranging between 60% and 70%, allowing ample margin for expenses, future claims, and profit generation.

When the loss ratio exceeds 100, the company pays out more in claims than it collects in premiums, signaling an urgent need to price in customer risk. Failure to do so threatens the insurer’s survival. Conversely, if premiums are set too high, customers may seek more affordable alternatives, resulting in lost business. Striking the right balance is crucial.

Lemonade’s founders envisioned AI as a means to establish more efficient and accurate premium pricing compared to human-led approaches. They set a long-term goal for their AI system to maintain a gross-loss ratio of less than 75%, paving the way for sustainable growth. One of the primary reasons behind the company’s stock decline was its consistently high gross-loss ratio, which exceeded the critical 75% threshold. This led investors to question the efficacy of Lemonade’s AI in correctly pricing premiums.

However, management’s internal projections indicate a positive shift, with the loss ratio projected to drop 75% below in the coming quarters. The latest earnings report provided compelling evidence, showcasing a promising trajectory for the loss ratio. This encouraging development has convinced more investors that AI has the potential to transform the insurance landscape.

Analyzing the gross-loss trends over the past three quarters, it’s important to acknowledge the impact of extraordinary weather events, referred to as CAT events, by the company. Excluding these events, the gross-loss ratio would have stood at 72%, as indicated by the ex-CAT trend line.

Adding to the positive outlook, Lemonade’s AI is acquiring valuable insights into premium pricing amid the current period of heightened inflation, the most severe in four decades. Pricing insurance premiums accurately during times of inflation is exceptionally challenging. If Lemonade’s AI can effectively reduce the loss ratio amidst these adverse conditions, it bodes well for its performance under less stressful circumstances.

In its latest shareholder letter, Lemonade’s management revealed an ambitious plan to leverage generative AI, the cutting-edge technology that powers ChatGPT, across a wide array of the company’s business processes. With aspirations to incorporate generative AI into as many as 100 processes, Lemonade aims to achieve significant cost reductions within a span of 18 months, positioning itself for a potentially transformative financial impact later this year.

Management’s confidence in generative AI’s potential to drive cost savings is reflected in their revised outlook for adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) for the full-year 2023. The company now projects a narrower adjusted EBITDA loss of $205 million to $200 million, compared to the previous forecast of $245 million to $240 million. This revision takes into account the expected cost reductions anticipated through the integration of generative AI.

Should Lemonade’s management prove accurate in their predictions of substantial cost savings from generative AI beyond 2023, the company’s path to profitability could accelerate far more rapidly than indicated by its current price-to-sales ratio of 3.7. By harnessing the power of generative AI, Lemonade positions itself at the forefront of technological innovation, poised to disrupt the insurance industry and expedite its journey toward financial success.

Source: Lemonade

Conlcusion:

Lemonade’s strategic implementation of generative AI technology for its insurance business processes signifies a significant step towards innovation within the market. By leveraging AI to drive cost reductions, optimize operations, and enhance efficiency, Lemonade aims to reshape the insurance industry and potentially accelerate its path to profitability.

This move highlights the growing importance of AI adoption as a competitive advantage and signals a broader trend of technological disruption in the market. As other companies observe Lemonade’s progress, we can expect increased interest and investment in AI-driven solutions, further driving the evolution of the insurance market toward a more technology-driven future.