- Linq, a startup, raises $6.6 million in funding led by InterVest and Atinum, with participation from TechStars, Kakao Ventures, Smilegate Investment, and Yellowdog.

- Founded by MIT alumni Jacob Chanyeol Choi and Subeen Pang, Linq aims to streamline financial analysis and research using AI.

- Linq’s AI agent automates various tasks in financial analysis, including scheduling, communication, scanning research reports, and building financial models.

- The startup plans to develop consumer-facing tools for AI equity research, empowering users with data synthesis capabilities for informed investment decisions.

- Despite competition from established players like Bloomberg and S&P, Linq believes its end-to-end service and proprietary data-gathering system provide a competitive edge.

- Backed by experienced founding members and a roster of esteemed clients, including Samsung Financial Network and KPMG US, Linq is poised for geographical expansion.

Main AI News:

The emergence of generative AI tools, notably after the debut of ChatGPT in late 2022, sparked significant interest in the finance sector, recognizing the potential for accelerating data gathering and research processes. Rapid response to market shifts is crucial in advising investors, hence the eagerness to embrace innovative technologies.

A newcomer, Linq, steps into this arena with an AI-driven agent poised to automate various financial analysis and research tasks. Recently, Linq announced a successful funding round totaling $6.6 million, spearheaded by InterVest and Atinum, and backed by prominent investors including TechStars, Kakao Ventures, Smilegate Investment, and Yellowdog.

Founded by MIT alumni Jacob Chanyeol Choi and Subeen Pang, Linq traces its origins to their victory in the Samsung Open Collaboration program in 2023, an initiative by Samsung Financial Network. Inspired by this achievement, Choi embarked on developing large language models (LLMs) tailored for enterprises, particularly in finance.

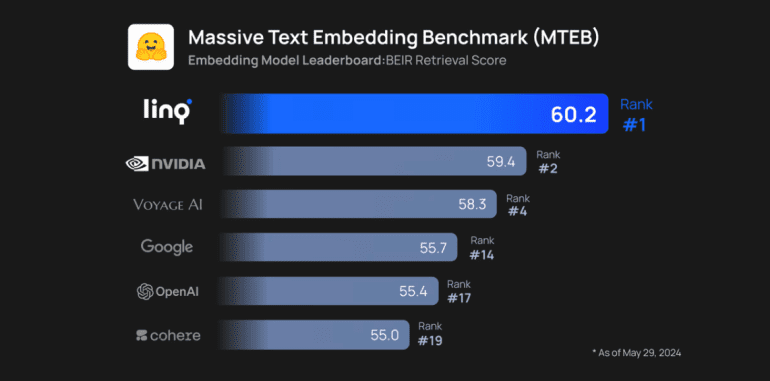

Choi elaborated on Linq’s approach, emphasizing the integration of AI seamlessly into a company’s data ecosystem. This approach led to the creation of Linq, focusing on data transformation into vectors and leveraging techniques such as vector search and retrieval-augmented generation (RAG) to deliver generative AI services.

Based in Boston, Linq’s AI agent utilizes domain-specific expertise in finance to automate tasks ranging from scheduling and communication to analyzing research reports and constructing financial models. Notably, it excels in summarizing critical documents like securities filings, earnings reports, and call transcripts.

Choi emphasized the significance for hedge fund analysts and institutional investors, underscoring the productivity enhancement, particularly in digesting earnings call transcript summaries. He highlighted Linq’s unique value proposition compared to general AI tools like ChatGPT.

Beyond catering to enterprise clients, Linq plans to develop consumer-facing tools for AI equity research, empowering users to synthesize extensive datasets for informed investment decisions. Despite facing competition from established players like Bloomberg and S&P, as well as emerging startups, Linq remains confident in its competitive edge.

Choi cited the company’s comprehensive service offering, encompassing workflow management and process streamlining, as a key differentiator. Moreover, Linq’s proprietary data-gathering system provides investors with access to a diverse range of structured and unstructured data globally, including multilingual earnings call transcriptions.

Backing Linq’s technological prowess are its founding members’ expertise: Jin Kim’s background in quantitative finance and Hojun Choi’s experience in investment banking bring valuable insights to the team. The startup boasts a roster of esteemed clients, including Samsung Financial Network and KPMG US, signaling a promising trajectory.

With plans for expansion into the Americas, Asia, and the Middle East, fueled by the recent funding injection, Linq is poised for growth. The capital will fuel product development, talent acquisition, and geographical expansion, cementing Linq’s position as a trailblazer in AI-driven financial analysis and research.

Conclusion:

Linq’s successful funding round underscores the growing importance of AI in streamlining financial analysis processes. With its comprehensive service offering and notable clientele, Linq is well-positioned to carve a significant niche in the market, challenging established players and driving innovation in AI-driven financial research.