- Morgan Stanley predicts AI boom to boost green debt sales in US.

- AI data centers’ energy needs drive demand for renewable sources.

- Global green debt issuance on track to exceed 2021 levels.

- Climate concerns and 2030 targets drive sustainable bond markets.

- US corporate issuance steady, focusing on decarbonization and AI demands.

- Green convertible bonds gain traction for energy transition firms.

- Latin America, led by Brazil, emerges as a growth hub for ESG bonds.

Main AI News:

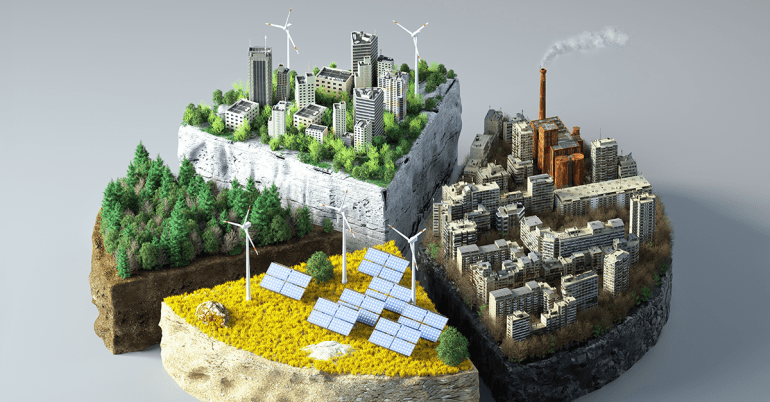

Despite recent setbacks in ESG-linked bonds within the US market, Morgan Stanley remains optimistic about the potential growth in green debt sales driven by the burgeoning global AI boom and its increasing demand for energy-intensive data centers. Melissa James, Vice Chair of Global Capital Markets at Morgan Stanley, emphasized this trend in a comprehensive report to BNN Bloomberg, highlighting that the escalating electricity needs of AI data centers could catalyze renewed interest in renewable energy sources and significantly bolster green debt issuance. Despite a slowdown observed in the US market, global green debt issuance is currently projected to exceed previous records, with Morgan Stanley anticipating sales to approach or even surpass the trillion-dollar mark set in 2021 by the end of the year.

James underscored the pivotal role of climate concerns and imminent 2030 emission reduction targets in driving sustainable bond markets on a global scale. She noted that while corporate issuance in the US has shown relative stability, particularly for projects aimed at decarbonization and meeting escalating energy demands driven by the AI sector, perennial issuers continue to periodically issue bonds, albeit at reduced volumes.

Furthermore, James highlighted the growing appeal of green convertible bonds, particularly among high-growth companies within the energy transition sector. These bonds offer advantages such as reduced interest costs by leveraging perceived equity upside and are typically issued in the 144A market, providing additional benefits to borrowers.

Beyond the US market, Latin America, with its unique geographical characteristics and abundant natural resources, is emerging as a significant growth area for ESG-labeled bond issuance. Countries like Brazil, leveraging their plentiful water resources, are poised to become global leaders in low-cost green hydrogen production. This comes amidst mounting concerns over the climate crisis and geopolitical conflicts, which have prompted a reevaluation of supply chain strategies and presented opportunities for countries like Mexico through nearshoring or “friend-shoring.”

Conclusion:

The escalating demand from AI-driven data centers presents a significant opportunity for the green debt market in the US, despite recent challenges in ESG-linked bonds. As global concerns over climate change intensify and emission reduction targets approach, the market’s focus on sustainable financing solutions, including green and convertible bonds, is poised to strengthen. Latin America’s emergence as a key region further underscores the growing international appeal of ESG-labeled investments amidst shifting geopolitical landscapes and supply chain dynamics.