TL;DR:

- Mythos Ventures, led by Vishal Maini, closes $14 million for its debut fund, exclusively focused on AI investments.

- Notable backers include Metaplanet, Delphi Ventures, The Operating Group, and individual investors like Phil Black and Walter Kortschak.

- Maini, along with partners Jonathan Eng and Paul Gu, brings deep industry experience to Mythos Ventures.

- Maini emphasizes the uniqueness of “transformative AI” as Mythos Ventures’ differentiator.

- The venture capital market witnessed increased interest in AI investments.

- Despite the competitive landscape, Mythos Ventures successfully secured double its initial funding target.

Main AI News:

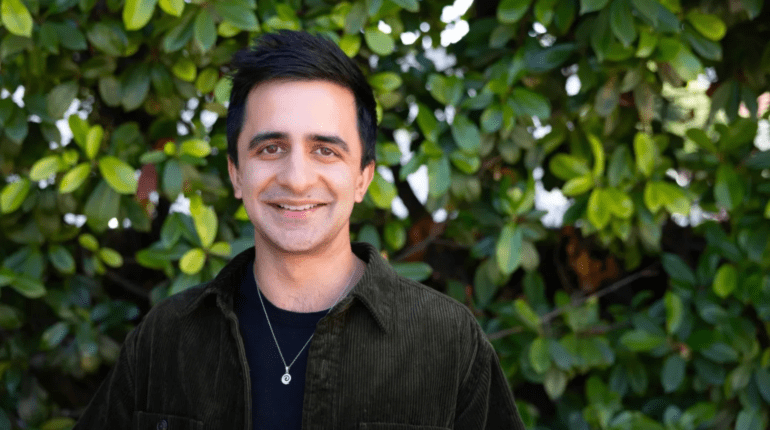

In a significant move within the world of venture capital, Mythos Ventures, led by visionary founder Vishal Maini, has successfully closed a $14 million capital commitment for its debut fund, exclusively dedicated to investing in groundbreaking AI enterprises. Backed by notable investors including Metaplanet, Delphi Ventures, The Operating Group, and a consortium of individual backers such as Phil Black, co-founder of True Ventures; Walter Kortschak, managing director of Summit Partners; Tom Shaughnessy, co-founder of Delphi Digital; and Anna Counselman, co-founder of Upstart, this solo general partner firm, headquartered in San Francisco, has made a resounding entry into the investment landscape.

This remarkable achievement places Mythos Ventures in the esteemed company of Connect Ventures, Fuse, and Unconventional Ventures, all of which have recently announced the launch of new funds this month. Vishal Maini, accompanied by partners Jonathan Eng and Paul Gu, with whom he shares a lifelong camaraderie forged during their time at Yale, where they pursued their studies together. Having previously collaborated at Gu’s fintech startup, Upstart, which focused on lending, the trio brings a wealth of experience and expertise to Mythos Ventures. Maini, in particular, comes from a stint at DeepMind, where he was instrumental in advancing safety and the deployment of artificial general intelligence.

Maini acknowledges the competitive landscape of the venture capital scene and the ever-growing interest in AI-focused investments. He candidly admits that it may not be an ideal time to launch a fund, especially one centered around AI. The rationale behind this assertion is the saturation of the AI sector, with numerous players vying for a piece of the pie.

However, Maini has a compelling vision that sets Mythos Ventures apart. He firmly believes that the next decade will usher in a wave of transformative companies that will redefine history in terms of technological advancements. This belief served as the impetus for assembling a team to embark on this ambitious journey.

But how did Mythos Ventures manage to secure over double its initial target of $6 million in a less-than-ideal climate? The answer lies in its unique value proposition of “transformative AI.” This term, as Maini explains, draws inspiration from Open Philanthropy, an early supporter of OpenAI. The concept revolves around two core aspects: the first pertains to the impact of advanced AI systems, while the second focuses on achieving AI capabilities that are on par with human cognitive abilities. Though the term is still gaining traction, Maini is confident that it will become the standard nomenclature for the field, surpassing the prevalent “generative AI” designation.

Conclusion:

Mythos Ventures’ $14 million funding achievement for its AI-focused inaugural fund reflects the continued allure of AI investments in the venture capital market. Despite the intensifying competition, their emphasis on “transformative AI” positions them as a forward-thinking player ready to support and shape the future of AI-driven companies. This underscores the growing importance of AI in the business landscape and the willingness of investors to support innovative ventures in this field.