TL;DR:

- Huawei, Intel, and semiconductor startups pose formidable competition to Nvidia in AI chip production.

- CEO Jensen Huang acknowledges intense rivalry and emphasizes global competition.

- Questions regarding China’s role in AI during Huang’s visit to Singapore.

- US restrictions on chip sales to China impact Nvidia’s business.

- Nvidia is committed to complying with trade regulations and adapting to the evolving US-China trade landscape.

- Historically, approximately 20% of Nvidia’s sales have come from China.

- Nvidia continues to serve Chinese customers in Singapore, contributing 15% of revenue.

- Singapore focuses on expanding its digital economy and hosts semiconductor manufacturing facilities.

- Nvidia’s primary AI accelerator manufacturers, TSMC and NXP, collaborate in Singapore.

- Jensen Huang advocates for Japan’s potential to build a domestic AI ecosystem.

Main AI News:

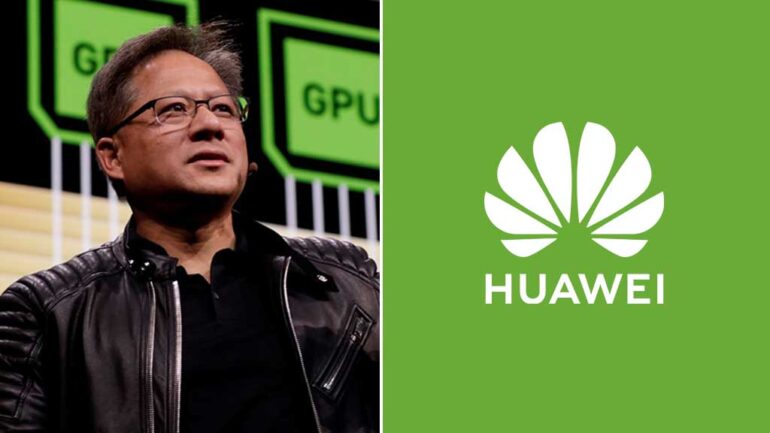

In the fiercely competitive arena of AI chip manufacturing, Huawei Technologies Co. stands as a prominent contender, according to Nvidia Corp.’s CEO. Alongside Intel Corp. and a growing cohort of semiconductor startups, Huawei poses a significant challenge to Nvidia’s dominant position in the artificial intelligence accelerator market.

During a recent press briefing in Singapore, Nvidia’s Chief Executive Officer, Jensen Huang, emphasized the formidable nature of the competition. Huawei, headquartered in Shenzhen, China, has emerged as a dominant force in chip technology and made waves this year with its remarkably advanced domestically-produced smartphone processor.

Huang acknowledged, “We have a lot of competitors in China and outside China. Most of our competitors don’t really care where I am. They want to compete with us everywhere we go.”

During his visit to Singapore, questions regarding China’s role in the AI landscape took center stage. Huang met with Prime Minister Lee Hsien Loong to discuss the city-state’s strategy for global AI competition. Nvidia’s chips have become highly sought-after in the AI industry, offering the most efficient means of training large data models, such as the one powering ChatGPT.

However, the United States has imposed restrictions on chip sales to China, further limiting Chinese access to Nvidia’s AI chips in mid-October. “We cannot let China get these chips. Period,” declared Commerce Secretary Gina Raimondo last Saturday.

Historically, China has accounted for approximately 20% of Nvidia’s sales, as noted by Huang. He reiterated the company’s commitment to complying with trade regulations and navigating the escalating trade tensions between the United States and China, which have identified Nvidia’s AI chips as strategically significant. The 60-year-old executive pledged to deliver a new line of products tailored to the Chinese market, aligned with the latest regulations emanating from Washington.

Nvidia, headquartered in Santa Clara, California, continues to serve Chinese customers in Singapore, as confirmed by Huang. Prominent Chinese companies, including ByteDance Ltd., with its TikTok business, and the international cloud divisions of Tencent Holdings Ltd. and Alibaba Group Holding Ltd., maintain a substantial presence in the city. Sales to customers in Singapore, encompassing Chinese enterprises, contributed to approximately 15% of Nvidia’s revenue in the three months ending in October, according to regulatory filings.

Singapore regards the expansion of its digital economy as a pivotal driver of broader economic growth. The city-state hosts semiconductor manufacturing facilities, including those operated by Globalfoundries Inc. and other global players. Notably, Nvidia’s primary AI accelerator manufacturers, Taiwan Semiconductor Manufacturing Co. and NXP Semiconductors NV, collaborate on a joint venture in Singapore.

Jensen Huang, a native of Taiwan, co-founded Nvidia in the mid-1990s. His return to Asia has been met with accolades, following his company’s ascent into the trillion-dollar echelons. In addition to his meeting with Singapore’s Prime Minister, he also engaged with Economy Minister Yasutoshi Nishimura in Tokyo to advocate for Japan’s potential to foster a domestic AI ecosystem.

Conclusion:

The emergence of Huawei as a potent AI chip competitor, coupled with increasing US-China trade tensions impacting Nvidia’s market access, underscores the heightened competition and geopolitical challenges in the AI chip industry. Nvidia’s commitment to adhering to trade regulations and adapting to evolving market dynamics will be crucial in maintaining its position in the face of formidable rivals.