TL;DR:

- Nvidia’s CEO, Jensen Huang, acknowledges that even with a $1.1 trillion market cap, the company is never safe from existential threats.

- The semiconductor giant has a tumultuous history, including near-bankruptcy in 1995.

- Huang advocates for a balanced approach between aspiration and desperation.

- Nvidia faces challenges due to tightened U.S. tech export rules to China and the risk of losing billions.

- Competing with reduced-capability chips in China exposes Nvidia to swift local competition.

- Despite recent success, analysts warn of intensifying competition from rivals like AMD.

- Huang draws inspiration from Andrew Grove’s book, “Only the Paranoid Survive,” emphasizing the importance of recognizing vulnerabilities.

Main AI News:

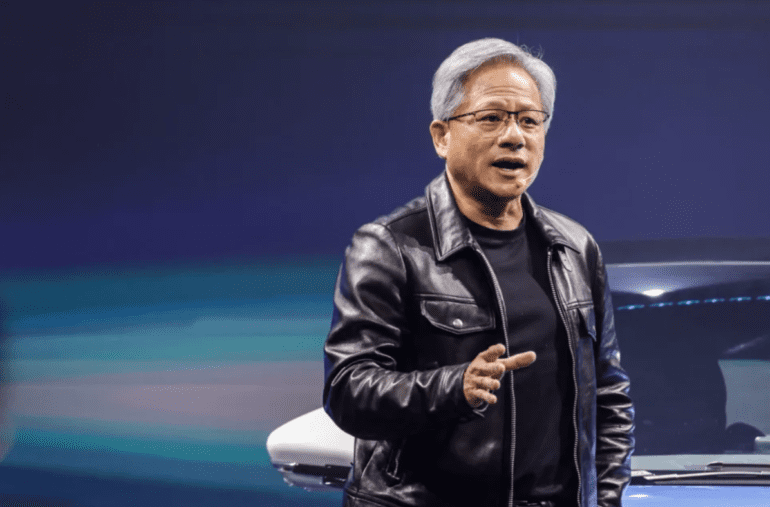

In the fast-paced world of technology, even a titan like Nvidia, with its staggering $1.1 trillion market cap, is not immune to the constant ebb and flow of uncertainty. CEO Jensen Huang, a billionaire at the helm of this semiconductor giant, acknowledges this reality. While Nvidia’s processors power gaming, data centers, and autonomous vehicles, making it a linchpin in the artificial intelligence revolution and revitalizing Silicon Valley, Huang emphasizes that no company can ever rest assured of its survival.

Speaking at the Harvard Business Review’s Future of Business event, Huang reminded us that Nvidia’s 30-year history is marked by numerous existential threats. Reflecting on this, he remarked during a recent Acquired podcast interview that “nobody in their right mind” would embark on the journey of starting a company. The early days were especially precarious, with a near-bankruptcy in 1995 following the NV1 chip’s failure to gain traction. Only the success of the RIVA 128 chip a few years later spared Nvidia from collapse.

Huang underscores the importance of recognizing the company’s perpetual state of vulnerability. “We don’t have to pretend the company is always in peril. The company is always in peril, and we feel it,” he candidly states. Yet, Huang does not advocate for perpetual anxiety. Instead, he believes that striking a balance between aspiration and desperation is more fruitful than adopting a stance of unwavering optimism or unending pessimism.

One of the challenges on Nvidia’s horizon is the tightening of U.S. regulations on tech exports to China, potentially resulting in the cancellation of planned deliveries to Chinese companies, leading to significant revenue losses. Huang frames this as a capability restriction rather than an absolute prohibition and emphasizes the need for compliance and adaptability.

However, competing in China with chips of reduced capabilities exposes Nvidia to fierce rivalry from local competitors, and Huang acknowledges the necessity of vigilance and the pursuit of excellence in this dynamic landscape.

Despite Nvidia’s recent impressive performance, industry analysts caution against complacency. Competition from rivals like AMD looms large, reminiscent of the challenges faced by Tesla in the electric vehicle market. Just as Tesla’s early lead led to increased competition and margin pressures, Nvidia could face a similar scenario in the AI arena.

Huang’s perspective is influenced by the wisdom of former Intel CEO Andrew Grove, particularly his book “Only the Paranoid Survive.” In line with Grove’s philosophy, Huang emphasizes the value of recognizing one’s vulnerabilities. “If you don’t think you are in peril,” he asserts, “that’s probably because you have your head in the sand.”

Conclusion:

Nvidia’s acknowledgment of perpetual vulnerability, despite its market dominance, highlights the volatile nature of the tech industry. The company’s history of surviving existential threats and CEO Jensen Huang’s emphasis on balancing ambition with adaptability reflect the ongoing challenges faced by tech giants. The tightening of export rules to China and competition from local rivals pose significant risks. For the market, this underscores the need for constant innovation and adaptability to thrive in the ever-evolving tech landscape.