TL;DR:

- Observe raises $50 million in convertible debt financing led by Sutter Hill Ventures.

- The funding will support the expansion of Observe’s sales and R&D teams, with a goal of growing the workforce from 150 to 250 employees by the end of 2024.

- Observe’s unique approach centralizes raw observability data in a data lake and adds layered analytics through a “data graph” for enhanced usability.

- The company faces competition from established players like New Relic and Datadog, as well as emerging contenders such as Grafana and Honeycomb.

- Observe introduces generative AI features, including a chatbot, data structuring, Slack integration, and a natural language query system.

- The move toward generative AI aligns with the growing need to handle the increasing volume and complexity of telemetry data generated by modern digital applications.

- Observe’s platform also includes prebuilt packages for specific development environments and offers a public API and command line interface.

- The company’s shift in focus to mid-sized enterprises has resulted in significant client growth and exceeded annual contract value plans for 2023.

Main AI News:

The observability software sector is rapidly gaining traction among venture investors, with its potential to empower teams in monitoring, measuring, and comprehending the state of complex systems and applications. This burgeoning interest is unsurprising, as the observability market is projected to surge to a staggering $2 billion by 2026, a monumental climb from its 2022 valuation of $278 million, according to a report by 650 Group.

This exponential growth can be attributed to the significant benefits that advanced observability deployments offer. A 2022 survey conducted by the Enterprise Strategy Group revealed that such deployments can reduce downtime costs by a staggering 90%, resulting in annual savings of $2.5 million compared to $23.8 million for observability beginners.

Leading the charge in this promising industry is Observe, a software-as-a-service (SaaS) company specializing in observability tools designed for the storage, management, and analysis of machine-generated data and logs. Observe has recently secured an impressive $50 million in convertible debt financing, spearheaded by Sutter Hill Ventures. This infusion of capital is earmarked for the expansion of Observe’s sales and research and development teams, according to CEO Jeremy Burton. The company aims to grow its workforce from its current 150 employees to 250 by the close of 2024.

Burton emphasized that the decision to pursue debt financing was driven by a strategic effort to minimize dilution. He stated, “We anticipate initiating our Series B funding round early next year, at which point the debt will convert into equity. We’ve successfully operated the company on debt financing for the past three years.”

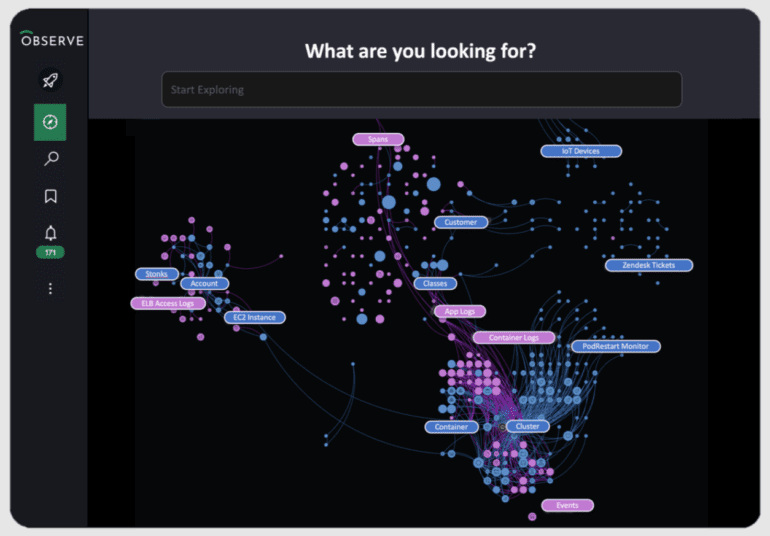

Based in San Mateo, Observe was established in 2017 by founders Jacob Leverich, Jon Watte, Jonathan Trevor, and Philipp Unterbrunner. The company distinguishes itself by housing all raw observability data in a centralized data lake, implementing a curated and layered analytics approach through what Burton refers to as a “data graph.” This innovative approach enhances the accessibility and comprehension of data for users.

Observe faces competition from app monitoring software, as well as monitoring and log analytics tools like New Relic, Splunk, Datadog, and Sumo Logic. Additionally, it contends with emerging players in the observability space, such as Grafana, Chronosphere, and Honeycomb. To maintain its competitive edge, Observe is continuously introducing new tools and capabilities.

One noteworthy achievement is Observe’s capability to ingest over a petabyte of data daily into a single customer’s instance while offering a “live” mode for interactive debugging. Furthermore, Observe has recently unveiled a suite of generative AI features designed to expedite specific observability tasks.

For instance, the newly introduced GPT Help module, essentially a chatbot, responds to natural language queries related to Observe’s features, instructional tasks, and error messages. Meanwhile, GPT Extract dynamically structures log data on the fly. GPT Slack Assistant integrates with Slack to assist users in troubleshooting issues and summarizing incident response threads. Lastly, OPAL Co-Pilot generates Opal code, Observe’s query language, in response to natural language inputs.

The question remains: Do organizations investing in observability have a genuine appetite for these cutting-edge generative AI capabilities? Jeremy Burton believes they do. He notes, “As organizations become increasingly digital, the volume of telemetry data generated by modern distributed applications is exploding. Legacy tools weren’t designed for either the volume of data or the complexity of investigating unknown problems in production. However, Observe has always viewed observability as a data problem – if data used for troubleshooting could be centralized and analyzed within a single tool, users would be able to resolve issues significantly faster.”

Observe’s platform also introduces Observe Apps, prebuilt packages containing Observe configurations and best practices tailored for specific development environments. Furthermore, the company is launching a public API and command line interface, along with options to export data to a CSV file or a Snowflake dashboard for more extensive analysis.

Burton acknowledges that Observe had to adapt its go-to-market approach due to the economic downturn and the pandemic. This shift involved a heightened focus on companies with 200 to 2,000 employees, ultimately leading to remarkable success. Observe’s client base has grown to encompass over 60 brands, with approximately 1,600 monthly average users.

“While we’re not disclosing our annual recurring revenue at this time, what we can share is that Observe has already exceeded its new annual contract value plan for 2023,” Burton revealed.

Conclusion:

Observe’s recent funding and introduction of generative AI features position the company to capitalize on the booming observability market, which is projected to reach $2 billion by 2026. The emphasis on data centralization and AI-driven solutions aligns with the industry’s need to handle ever-expanding data volumes and complexity, making Observe a competitive force in the sector.