TL;DR:

- OnlyFake, a service utilizing AI “neural networks,” offers fake IDs for $15 each, successfully bypassing KYC checks on crypto exchanges.

- The platform generates realistic IDs from 26 countries, with payments accepted in cryptocurrencies via Coinbase.

- Implications extend to potential misuse by crypto scammers and hackers, enabling them to operate anonymously and evade detection.

- OKX denies involvement in fraudulent activities but acknowledges the challenge posed by AI-driven fraud.

- OnlyFake claims its services are for entertainment, yet concerns persist regarding their misuse and ease of generation.

- Additional features include image metadata spoofing, further complicating identity verification processes.

Main AI News:

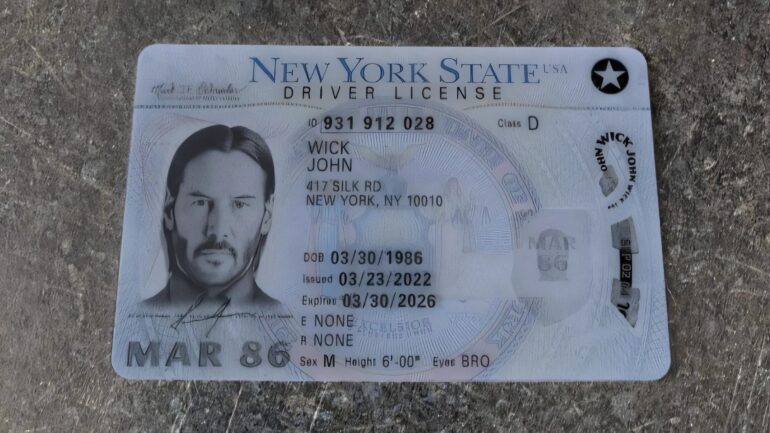

A burgeoning market for AI-generated counterfeit IDs, purportedly capable of circumventing cryptocurrency exchange KYC protocols, is flourishing with IDs available for a mere $15 each. Operating under the moniker OnlyFake, this service utilizes artificial intelligence techniques, including “neural networks” and “generators,” to fabricate realistic driver’s licenses and passports from 26 countries. Strikingly, these counterfeit documents have been reported successful in passing KYC verifications on various crypto exchanges.

OnlyFake’s platform boasts a wide array of fake IDs from countries such as the United States, Canada, Britain, Australia, and multiple European Union nations. Payments are facilitated through Coinbase’s commercial payments service, with transactions accepted in various cryptocurrencies. Notably, a recent report by 404 Media detailed how a British passport generated via OnlyFake managed to bypass KYC verification on the OKX crypto exchange.

The implications of this service extend beyond mere convenience for individuals seeking anonymity. With the ability to sidestep identity verification processes, crypto scammers and hackers are presented with an opportunity to operate with impunity, shielding their true identities and complicating tracking efforts. Notably, OnlyFake’s operator, known only as “John Wick,” claimed that these fake IDs could potentially bypass KYC checks on major exchanges such as Binance, Kraken, Bybit, Huobi, Coinbase, and OKX, as well as the crypto-friendly neobank Revolut.

In response to these revelations, OKX has adamantly denied any involvement or endorsement of fraudulent activities. The exchange has reiterated its commitment to combatting fraudulent behavior on its platform and ensuring strict compliance with regulatory standards. However, the pervasive use of AI to perpetrate fraudulent activities poses an ongoing challenge that necessitates comprehensive measures.

While OnlyFake asserts that its services are intended solely for entertainment purposes, concerns regarding the misuse of these counterfeit documents persist. The platform’s purported disclaimer states that its templates are intended for use in media productions, rather than for illicit purposes. However, the ease with which these fake IDs can be generated, coupled with their potential to evade verification processes, raises significant regulatory concerns.

Moreover, OnlyFake offers additional features such as image metadata spoofing, allowing users to manipulate GPS coordinates, timestamps, and device information associated with the fabricated IDs. Such capabilities further exacerbate the challenges faced by identity verification services, which rely on metadata to authenticate documents.

As the crypto industry grapples with escalating threats posed by fraudsters and hackers, the proliferation of AI-driven deep fake technologies adds another layer of complexity to identity verification processes. With the potential for deep fakes to deceive even human operators, stringent measures must be implemented to safeguard against fraudulent activities and protect the integrity of crypto exchanges.

Conclusion:

The proliferation of AI-generated fake IDs poses a significant challenge to the integrity of crypto exchange KYC protocols. With the potential for these counterfeit documents to evade verification processes and enable fraudulent activities, regulatory authorities must take proactive measures to address this emerging threat. Moreover, crypto exchanges need to enhance their security measures to detect and prevent the use of fake IDs, safeguarding the integrity of their platforms and protecting investors from potential fraud.