- OpenEnvoy introduces an advanced AI model for automating accounting tasks and combating fraud in Accounts Payable.

- The deep neural network is trained on financial data from diverse industries, enhancing accuracy in GL account coding without reliance on POs.

- Customers benefit from 100% capture of supplier invoices, enabling seamless integration with NetSuite and other ERP systems.

- OpenEnvoy forms a strategic partnership with NetSuite, amplifying its commitment to innovation and client satisfaction.

- CEO Matthew Tillman emphasizes the importance of AI accuracy in driving scalability and efficiency in accounting processes.

- OpenEnvoy unveils refreshed brand identity, reflecting its commitment to clarity, simplicity, and effectiveness in Finance.

Main AI News:

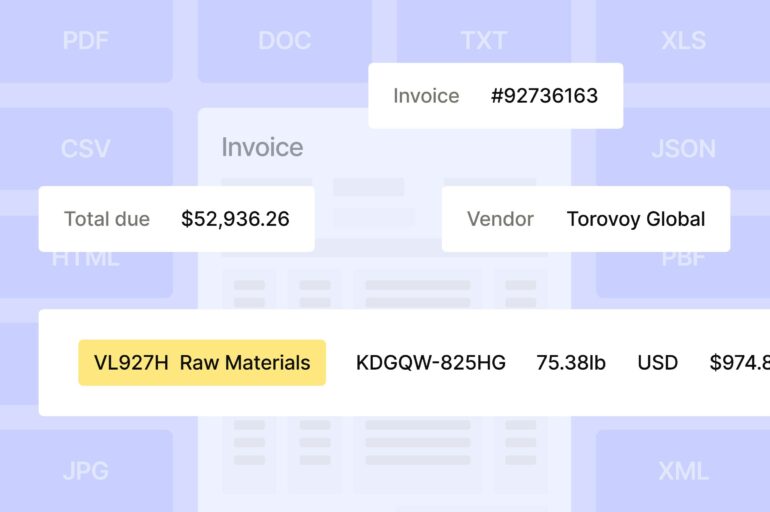

OpenEnvoy, a frontrunner in Finance and Accounts Payable streamlining, has introduced an innovative AI solution aimed at automating routine tasks and mitigating fraud risks. Persistent challenges within Accounts Payable operations, such as supplier change management and the reliance on Purchase Orders (POs) with inconsistent adoption rates, can now be effectively addressed through AI-driven technologies.

The cutting-edge AI model, a deep neural network, has undergone rigorous training using financial data sourced from intricate sectors, including media, manufacturing, and logistics. This breakthrough empowers customers to precisely assign General Ledger (GL) account codes at the invoice line level, obviating the necessity for POs. “The level of accuracy achieved by OpenEnvoy is truly remarkable,” remarked a satisfied early adopter. “We’ve unearthed discrepancies that eluded our team for years,” she added.

Furthermore, this milestone launch enables OpenEnvoy to scale its unparalleled capability of capturing 100% of supplier invoices, ensuring cost efficiency even for a global clientele. The platform seamlessly reconciles non-PO invoices with supplier quotes and ancillary documents using multi-way matching protocols. Consequently, finance teams are liberated from mundane tasks, redirecting focus towards strategic decisions such as disputing or adjusting overbillings identified by OpenEnvoy. The processed invoices are seamlessly integrated into NetSuite, other ERP systems, or Procure-to-Pay (P2P) platforms for prompt payment processing.

In tandem with the introduction of autonomous GL Coding, OpenEnvoy has forged a strategic alliance with Netsuite, a testament to its commitment to innovation and client-centric solutions.

When asked about the rationale behind OpenEnvoy’s burgeoning popularity within the competitive AP Automation landscape, CEO Matthew Tillman emphasized the pivotal role of accuracy in AI adoption. “The credibility of AI hinges on its accuracy, particularly in minimizing false positives. Our model boasts an exceptionally low false positive rate, empowering customers to achieve scalability from day one and refocus their teams on high-value accounting tasks,” Tillman affirmed.

In conjunction with the groundbreaking release and strategic partnership, OpenEnvoy has unveiled a revamped corporate identity. “Our refreshed brand identity embodies the clarity and efficacy that OpenEnvoy epitomizes in the realm of Finance. It exudes directness, simplicity, and a sense of urgency,” remarked Parker Moore, co-founder, and Chief of Design at OpenEnvoy.

Conclusion:

OpenEnvoy’s groundbreaking AI model and collaboration with NetSuite signal a transformative shift in the accounting automation landscape. By addressing longstanding challenges and emphasizing accuracy and efficiency, OpenEnvoy is poised to disrupt the market, offering businesses unparalleled solutions for streamlining financial operations and combating fraud. As companies increasingly prioritize digital transformation and operational efficiency, OpenEnvoy’s innovative approach positions it as a frontrunner in the evolving landscape of Finance and Accounts Payable automation.