TL;DR:

- Stephanie Song, with former Coinbase colleagues, launches Dili to automate investment due diligence using AI.

- Dili secures $3.6 million in venture funding from prominent investors.

- AI-driven due diligence is poised to dominate, with over 75% reliance predicted by 2025.

- Dili distinguishes itself with high accuracy and custom AI technology.

- Concerns persist regarding AI reliability and biases in investment decision-making.

- Dili addresses concerns through model refinement and data privacy measures.

Main AI News:

Stephanie Song, a former member of Coinbase’s corporate development and ventures team, understood firsthand the frustrations stemming from the sheer volume of due diligence tasks inundating her team on a daily basis.

“Investment analysts often find themselves burning the midnight oil, dedicating hundreds of hours to tasks that are often seen as burdensome,” Song explained in an email interview with TechCrunch. “Simultaneously, investment funds are seeking ways to enhance team efficiency and reduce operational costs while deploying capital more selectively.”

Motivated to address this challenge, Song collaborated with Brian Fernandez and Anand Chaturvedi, both former colleagues at Coinbase, to launch Dili, a groundbreaking platform designed to automate crucial investment due diligence and portfolio management processes for private equity and venture capital firms through the power of AI.

Having graduated from Y Combinator, Dili has secured $3.6 million in venture funding from notable backers such as Allianz Strategic Investments, Rebel Fund, Singularity Capital, and others.

“The advent of AI is transforming various aspects of investment funds, spanning from analysts to partners and back-office operations,” Song emphasized. “Investment professionals are increasingly seeking a competitive edge in decision-making, and by leveraging vast datasets, Dili offers a unique opportunity to optimize investment strategies in today’s challenging macroeconomic landscape.”

Indeed, the demand for innovative approaches to investment risk mitigation is palpable, with venture capitalists currently holding an estimated $311 billion in unallocated capital. Furthermore, the previous year witnessed the lowest fundraising total in seven years, as investors exercised greater caution with early-stage ventures.

While Dili isn’t the pioneer in utilizing AI for due diligence, industry analysts predict a significant shift toward AI-driven decision-making processes. According to Gartner, by 2025, over 75% of executive reviews in the venture capital and early-stage investment space will rely on AI and data analytics.

Despite existing players in the market, Song asserts that Dili distinguishes itself through its cutting-edge technology.

“We possess the capability to deliver exceptional accuracy in tasks such as extracting financial metrics from extensive unstructured documents,” Song noted. “Through custom indexing and retrieval pipelines tailored to specific documents, our AI models operate within a context of unparalleled quality.”

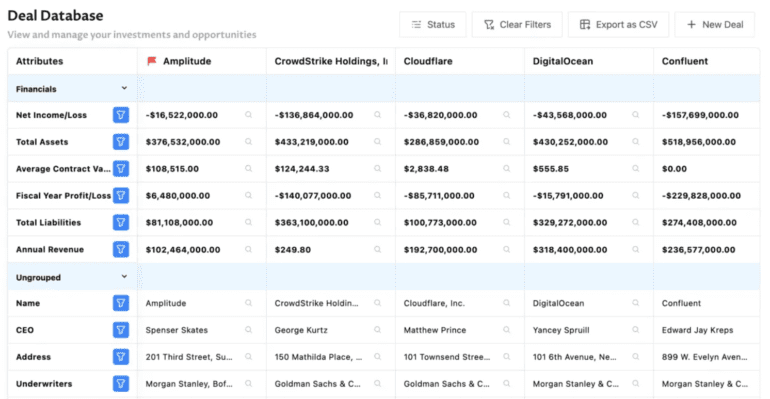

Dili harnesses GenAI, leveraging advanced language models akin to OpenAI’s ChatGPT, to streamline investor workflows. The platform systematically organizes a fund’s historical financial data and investment decisions within a knowledge base, subsequently employing AI models to automate tasks such as parsing private company databases and conducting comprehensive due diligence across online sources.

Recently, Dili introduced automated comparable analysis and industry benchmarking functionalities, enabling funds to compare current and historical investment opportunities effortlessly.

“Imagine receiving an email notification regarding a new investment opportunity or a portfolio update and instantly accessing AI-generated insights on deal red flags, competitive analysis, and industry benchmarks,” Song envisioned.

However, amidst the excitement surrounding AI-driven solutions, concerns persist regarding the reliability and biases inherent in such technologies. Fast Company’s evaluation of ChatGPT revealed instances of inaccuracies and misinterpretations, underscoring the importance of rigorous validation in due diligence processes.

Moreover, AI algorithms may inadvertently perpetuate biases, as demonstrated in a study by Harvard Business Review. Such biases could potentially exacerbate existing disparities in funding allocation across different demographic groups.

Addressing these concerns, Song affirmed Dili’s commitment to refining its models and ensuring transparency in its operations. Additionally, Dili aims to empower funds by facilitating the creation of proprietary models trained on offline fund data, thereby enhancing data privacy and control.

“While challenges persist, Dili remains dedicated to unlocking the untapped potential of private market data, ultimately reshaping the landscape of investment due diligence and portfolio management,” Song concluded.

Conclusion:

The emergence of Dili’s AI-powered platform signifies a significant shift in investment due diligence processes, with automation poised to dominate the industry. While opportunities abound for enhanced efficiency and data-driven decision-making, careful consideration of AI biases and reliability remains crucial for ensuring informed investment strategies in an evolving market landscape.