- Robovision, a Belgian computer vision startup, targets US expansion to combat labor shortages in manufacturing and agriculture.

- The company offers a user-friendly “no-code” AI platform, simplifying deep learning tools for non-tech businesses.

- A recent $42 million Series A funding, co-led by Astanor Ventures and Target Global, boosts Robovision’s valuation to $180 million.

- Despite challenges in diversifying market messaging, Robovision’s adaptable approach stems from its consultancy studio roots.

- While agtech remains a significant focus, Robovision sees growing traction in sectors like life sciences and tech.

- Partnering with industry giants like Hitachi underscores Robovision’s broad industrial applicability.

- Apple’s acquisition of DarwinAI highlights the rising demand for versatile AI solutions in manufacturing.

Main AI News:

In response to labor shortages, industries like manufacturing and agriculture are increasingly turning to AI for automation. Computer vision startups are seizing this opportunity, offering solutions ranging from data collection to crop monitoring. However, a significant challenge remains: ease of implementation. If these solutions aren’t user-friendly, they won’t be adopted.

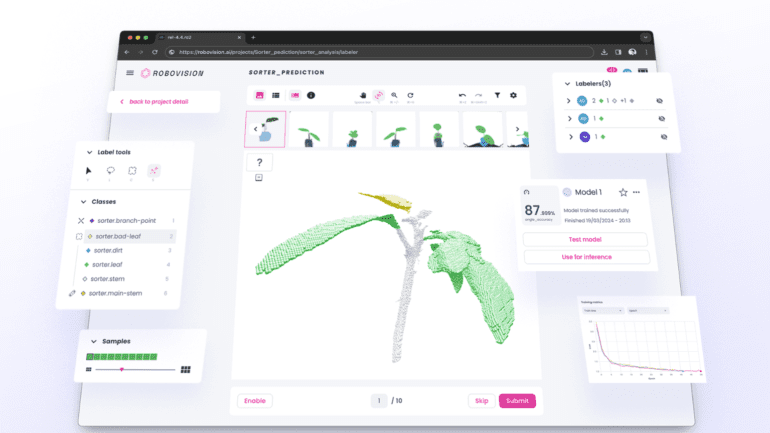

Belgian startup Robovision believes it has overcome this hurdle. With a vision to industrialize deep learning tools, Robovision aims to make them accessible to non-tech businesses. Their “no-code” computer vision AI platform eliminates the need for software developers or data scientists at every stage. While not producing robots themselves, Robovision collaborates with robotics companies, facilitating the development of AI-enabled machines.

Practically, Robovision’s platform enables customers to upload, label, test, and deploy data for various purposes. Whether it’s identifying supermarket fruits or detecting faults in electrical components, Robovision’s model proves versatile. With a presence in 45 countries already, CEO Thomas Van den Driessche reveals plans for US expansion, backed by recent substantial funding.

The $42 million Series A round, co-led by Astanor Ventures and Target Global, propels Robovision’s post-money valuation to $180 million. Despite external investment, founders and staff retain over 50% ownership. Challenges lie ahead, particularly in messaging and go-to-market strategy diversification across sectors. However, Robovision’s adaptable approach draws from its consultancy studio roots, evolving into a B2B platform over the years.

While agtech remains significant, other sectors like life sciences and tech are gaining momentum. Partnering with companies like Hitachi for semiconductor wafer production underscores Robovision’s broader industrial applicability. Apple’s recent acquisition of DarwinAI further validates the need for versatile AI solutions in manufacturing.

Robovision’s journey from its Belgian origins to global prominence showcases the importance of innovation and strategic evolution. Raising capital from beyond Benelux highlights the company’s growth trajectory. Leveraging talent from Ghent University and constant technological evolution, Robovision stays ahead in today’s competitive landscape, where efficiency and innovation are paramount.

Conclusion:

Robovision’s strategic US expansion and versatile AI solutions position it as a frontrunner in addressing global labor shortages across various industries. With substantial funding and a proven track record, Robovision’s adaptable approach and broad market applicability signal promising growth potential in the evolving landscape of industrial automation.