- SARS intensifies the use of AI and machine learning to combat non-compliance and criminal activities in the tax system.

- The compliance program contributes R293.7 billion to revenue, marking a 26.7% increase from the previous year.

- Preliminary results show a total revenue of R1.74 trillion for the 2023/24 fiscal year, exceeding expectations.

- The agency collected R21.6 trillion in net tax revenue since its inception, focusing on expanding the tax base and voluntary compliance.

- Successful initiatives include debt collection, voluntary disclosures, and combatting syndicate crimes.

- SARS emphasizes the recruitment of skilled professionals in technology and data management.

- Commissioner highlights the importance of partnerships and investment in technology for future growth.

Main AI News:

In a strategic move to bolster its revenue generation efforts, the South African Revenue Service (SARS) is intensifying its utilization of artificial intelligence (AI) and machine learning technologies. These innovative tools play a pivotal role in detecting and combating criminal activities and non-compliance within the tax system.

The latest figures released by SARS indicate a substantial increase in revenue, with the compliance program contributing a noteworthy R293.7 billion to the fiscal results as of the end of March. This represents a significant surge of R61.9 billion, marking a remarkable 26.7% rise from the previous fiscal year’s revenue of R231.8 billion.

Central to SARS’s approach is the integration of data-driven strategies and advanced algorithms powered by AI and machine learning. These sophisticated systems not only identify instances of criminal behavior and intentional non-compliance but also ensure the fair processing of legitimate refunds while safeguarding against fraudulent claims.

In its recent announcement of preliminary revenue results, SARS revealed a total revenue collection of R1.74 trillion for the 2023/24 fiscal year, surpassing earlier projections by nearly R10 billion. This translates to a year-on-year increase of R54 billion, representing a growth rate of 3.2% compared to the previous fiscal period.

Since its establishment, SARS has amassed a total net tax revenue of R21.6 trillion for the national treasury. The agency remains steadfast in its commitment to imposing strict penalties on taxpayers who deliberately evade their obligations, underscoring the compliance program as a cornerstone of its tax enforcement efforts.

Noteworthy achievements of the program include the successful collection of R91.3 billion in outstanding debt from 2.6 million cases, along with R420 million recovered from 895,000 overdue returns. Additionally, voluntary disclosures contributed R3.5 billion, with 1,435 applications processed.

SARS’s proactive measures extend to combating syndicate crimes, resulting in the recovery of R20.1 billion and the dismantling of illicit financial schemes. Moreover, the agency conducted 230,000 customs compliance inspections, resulting in R8.4 billion in customs-related assessments and the collection of R2 billion in outstanding debt.

Following a period marked by challenges such as state capture, SARS leadership has embarked on a transformative journey to enhance the organization’s technological capabilities. Emphasizing the importance of leveraging emerging technologies and data analytics, SARS aims to optimize its tax collection processes and reinforce its position as a leading revenue authority.

In alignment with its strategic objectives, SARS is actively recruiting skilled professionals in areas such as IT, data management, legal services, and audit and risk management. The agency’s vision encompasses broadening the tax base, fostering a culture of voluntary compliance, and leveraging synergies between people, data, and technology to fulfill its mandate effectively.

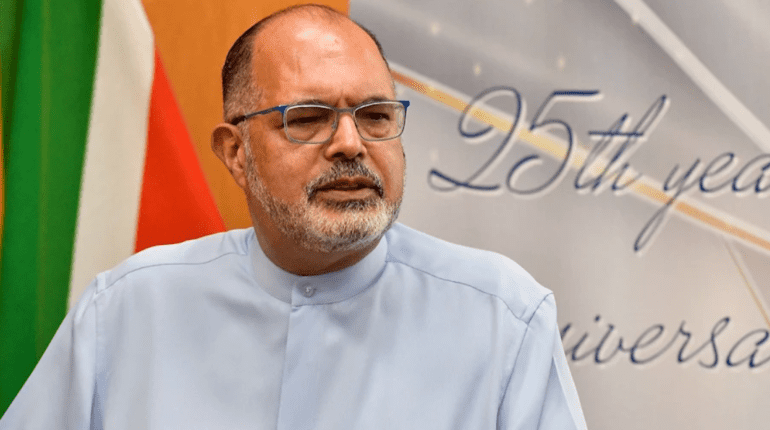

SARS Commissioner Edward Kieswetter emphasized the pivotal role of effective partnerships in achieving revenue milestones, acknowledging the contributions of compliant stakeholders in the tax ecosystem. With a long-term focus on innovation and efficiency, SARS remains committed to leveraging data science, technology, and AI to streamline tax compliance processes and drive sustainable revenue growth.

Conclusion:

The strategic integration of AI and machine learning technologies by SARS has resulted in significant revenue gains and enhanced enforcement capabilities within the tax system. This signals a shift toward a more technologically driven approach to revenue generation and compliance enforcement, potentially setting a precedent for other revenue authorities globally. Businesses operating within this market should anticipate increased regulatory scrutiny and a greater emphasis on data-driven compliance measures.