TL;DR:

- Shield AI secures an additional $300 million in equity and debt for its Series F funding round.

- The total Series F funding now stands at $500 million, boosting the company’s valuation to $2.8 billion.

- The funding breakdown includes $200 million in equity from November, $100 million in new equity, and $200 million in debt from Hercules Capital.

- Shield AI’s flagship product, Hivemind, empowers autonomous aircraft operations without reliance on remote operators or GPS.

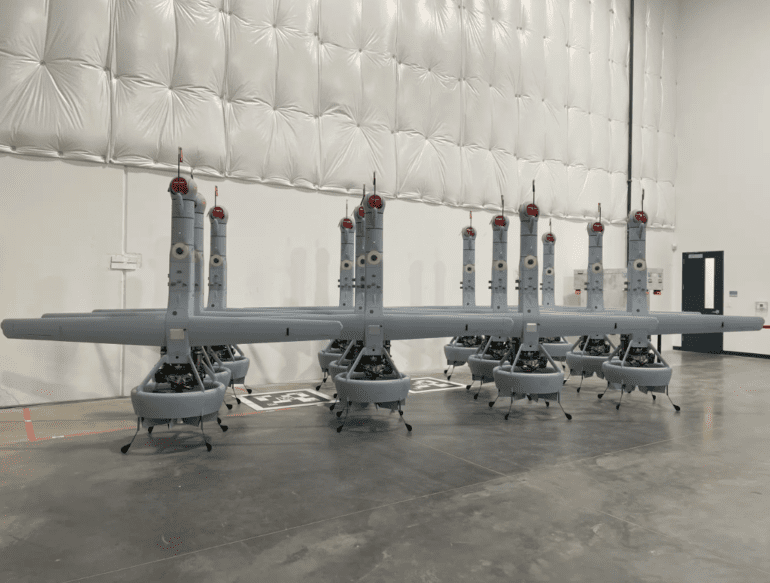

- The company launches V-BAT Teams, enhancing autonomous drone mission capabilities.

- Co-founder Brandon Tseng emphasizes the strategic importance of AI-piloted systems in defense.

- Venture debt plays a significant role in supporting Shield AI’s growth.

Main AI News:

In an exclusive update, Shield AI, the pioneering defense tech startup, has significantly expanded its latest funding round, now totaling an impressive $500 million, marking a substantial milestone for the company. This latest injection of capital includes an additional $300 million in both equity and debt, a testament to the confidence investors have in Shield AI’s groundbreaking innovations.

The breakdown of this latest funding round includes $200 million in equity, which was successfully secured in November, a further $100 million in new equity raised at the Series F price point, and an additional $200 million in debt financing, with Hercules Capital stepping in as the debt provider. This substantial boost in funding has propelled Shield AI’s valuation to a remarkable $2.8 billion, up from its valuation of $2.7 billion just a few short months ago.

Shield AI’s core mission revolves around developing an “AI pilot” that can effectively transform aircraft into autonomous systems. At the forefront of their product portfolio is Hivemind, a revolutionary platform that empowers teams of aircraft to operate independently, without the need for remote operators, external communications, or reliance on GPS. Shield AI’s CEO and co-founder, Ryan Tseng, attributes this remarkable achievement to recent advancements in computing technology.

Ryan Tseng emphasized the strategic significance of AI pilots, stating, “AI pilots are evolving into a strategic conventional deterrent, comparable in class to our aircraft carriers and guided missile submarines. What makes this truly fascinating is that it represents the first strategic deterrent that is entirely software-defined, made possible by the remarkable strides in AI and computing power. This marks a profound paradigm shift in the aerospace and defense industry.”

Venture debt, often misconstrued, plays a pivotal role in Shield AI’s growth strategy. For mature companies in the late stages of development, seeking capital to achieve key milestones such as profitability or a successful exit, venture debt can be a strategically sound choice. In contrast to its role as a last-resort option for struggling startups, venture debt, when utilized appropriately in the later stages, provides a valuable avenue for capitalizing on late-stage growth opportunities.

In a recent development, Shield AI unveiled V-BAT Teams, a cutting-edge software product that seamlessly integrates with Hivemind. This innovation enables teams of V-BAT drones to execute missions autonomously and with coordinated precision, marking yet another milestone in the company’s mission to reshape the future of defense technology.

Addressing the critical role of AI-piloted systems in the nation’s overall deterrence strategy, Brandon Tseng, president, and co-founder, emphasized, “We firmly believe that AI-piloted systems will be the most potent military deterrent of our generation. Getting this right is paramount.” However, he acknowledged the challenges associated with integrating AI pilots into the Department of Defense’s force structure, describing the process as “difficult and murky.”

As warfare evolves and the threat landscape changes, there is an urgent need for the DoD to adapt its approach. Brandon Tseng urged a shift away from traditional strategies and a greater focus on embracing the game-changing technological assets of the future. He concluded with a call to action, stating, “Delaying the adoption of AI pilots is not an option; bold actions are required if we are to emerge victorious.”

Conclusion:

Shield AI’s substantial funding expansion and increased valuation underscore its leading position in the defense tech sector. The successful Series F round, driven by investor confidence, positions the company for further innovation and growth, with AI-piloted systems emerging as a pivotal component of modern defense strategies. This development reinforces Shield AI’s influence and competitiveness in the market, making it a formidable player to watch in the aerospace and defense industry.