TL;DR:

- Sparta, a startup, secures $17.5 million in a Series A funding round led by FirstMark and supported by Singular.

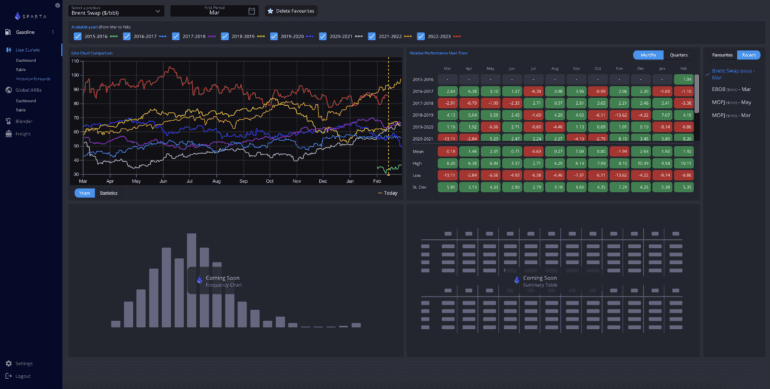

- The company specializes in live market intelligence and forecasting for commodity traders.

- Sparta’s platform utilizes AI, machine learning, and data science to transform non-liquid prices into forward-looking insights.

- Their goal is to modernize commodity trading, shifting from traditional methods to data-driven strategies.

- Plans include expanding into oil and gas products, other commodity markets and enhancing AI tools.

- Sparta aims for a global presence, with over 70 customers worldwide, including industry giants like Phillips 66 and Chevron.

- Their predictive pricing engine provides traders with a competitive edge by delivering accurate and timely information.

- Sparta envisions linking predictive pricing, market opinion, and news to shape future trading decisions.

Main AI News:

In a remarkable stride towards reshaping the landscape of commodity trading, Sparta, a dynamic startup specializing in live market intelligence and forecasting solutions, recently announced a triumphant Series A funding round, securing an impressive $17.5 million. This financing endeavor was spearheaded by the esteemed technology venture capital firm FirstMark and was further bolstered by the unwavering support of Singular, an existing shareholder.

At its core, Sparta has birthed a platform that seeks to revolutionize the conventional methods through which traders collect, process, analyze, and interpret data to fuel their real-time strategic decision-making processes. Powered by cutting-edge artificial intelligence (AI), machine learning (ML), and data science, this platform adeptly captures non-liquid prices, including physical premiums, OTC swaps, and freight, sourced from brokers and pricing analysts spanning the globe. These raw data inputs are then seamlessly transformed into forward-looking insights and predictive analytics, equipping traders with the prescient advantage of identifying trading opportunities well ahead of their competitors.

In a recent interview with VentureBeat, Felipe Elink Schuurman, the co-founder and CEO of Sparta, articulated the company’s overarching mission, stating, “Our key objective is to participate or be one of the main drivers in the transformation of how commodities are traded.” This transformation entails a shift from the archaic, merchant-type trading methods of the past to a far more sophisticated, data-driven, and intelligence-powered paradigm.

With the substantial infusion of capital from this funding round, Sparta is poised to broaden its product spectrum, expanding its current focus to encompass oil and gas commodities, including gasoline, diesel, jet fuel, and NAFTA. The company has set ambitious goals to encompass every facet of the oil and gas sector by the close of the upcoming year. Beyond that, Sparta intends to venture into other commodity markets, such as agriculture and metals. Concurrently, the company aims to develop premium insights, optimize workflow processes, and craft AI tools that offer forward-looking predictions and comprehensive reports.

Sparta’s vision extends beyond the realms of product expansion. The company harbors aspirations of bolstering its global footprint, transcending its current presence in Geneva, London, Houston, Singapore, and Madrid. It envisions further consolidation within these existing territories while simultaneously establishing a stronghold in new regions. Presently, Sparta proudly serves over 70 esteemed customers worldwide, counting industry titans like Phillips 66, Chevron, Trafigura, Equinor, and many others among its valued clientele.

Sparta’s AI-driven forecasting tool is poised to redefine the dynamics of commodity trading. The predictive pricing engine and market opinion layer engineered by the company aim to confer traders with a distinct competitive edge by furnishing them with pinpoint accurate and timely information. Felipe Elink Schuurman confidently predicts that the swiftness and precision of the insights provided by Sparta will become indispensable in the world of trading, rendering those without it at a pronounced disadvantage.

As Sparta advances its mission of revolutionizing the commodity trading arena, it envisions a seamless convergence of predictive pricing, market opinion, and news. Schuurman paints a compelling vision, stating, “Imagine that all of these things are linked, and you can immediately see how future news will impact prices.” The next five years promise to be a captivating journey, with the enablement and co-pilot capabilities assisting individuals in making astute trading decisions.

Conclusion:

Sparta’s innovative approach to commodity trading, powered by AI and predictive analytics, signifies a significant transformation in the industry. This shift towards data-driven strategies and real-time insights will likely set new standards and enhance decision-making capabilities for market participants. The expansion into oil and gas products, diversification into other commodity markets, and global expansion underscore Sparta’s commitment to reshaping the future of trading.