- Super Micro Computer surged 13.5% in extended trading upon its inclusion in the S&P 500.

- The company, along with Deckers Outdoor Corp, replaces Whirlpool Corp and Zion Bancorporation in the index.

- Super Micro’s integration reflects the increasing influence of tech-driven entities in investment strategies.

- Index funds worth $7.8 trillion are compelled to acquire shares of Super Micro and Deckers to realign portfolios.

- Super Micro’s success stems from its AI-optimized servers featuring Nvidia’s top-of-the-line processors.

- With a market value exceeding $50 billion, Super Micro’s inclusion was anticipated, reflecting investor confidence.

- After-hours trading saw Super Micro’s stock surge by 4.5%, while Deckers experienced a 2.7% increase.

- Whirlpool and Zion Bancorporation observed slight declines of 1.7% and 2%, respectively.

Main AI News:

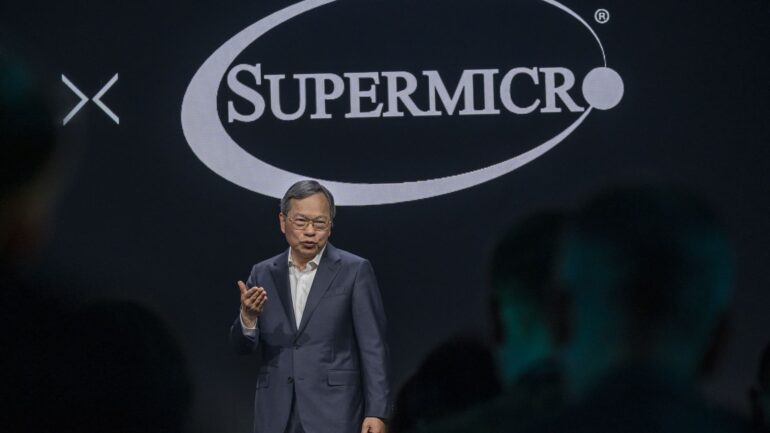

Super Micro Computer witnessed a remarkable surge of 13.5% during extended trading hours on Friday, propelled by the announcement of its inclusion in the prestigious S&P 500 index. Alongside Deckers Outdoor Corp, Super Micro is set to be integrated into the S&P 500, effective Monday, March 18, marking a significant milestone in the realm of AI-optimized servers and Wall Street dynamics.

The decision, unveiled in a press release by S&P Dow Jones Indices, signifies a strategic reshuffling as Super Micro and Deckers Outdoor Corp step in to replace Whirlpool Corp and Zion Bancorporation within the index. This move underscores the evolving landscape of the stock market and the growing influence of technology-driven entities in shaping investment strategies.

The integration of Super Micro into the S&P 500 presents a compelling opportunity for investors, particularly those engaged in index funds tracking the benchmark. With assets totaling approximately $7.8 trillion, these funds are compelled to realign their portfolios, necessitating the acquisition of shares in Super Micro and Deckers Outdoor Corp.

Super Micro’s ascent is underpinned by its prowess in crafting high-end servers infused with Nvidia’s cutting-edge AI processors. The company’s stock has surged by over threefold this year, reflecting the market’s recognition of its technological innovations and strategic positioning within the AI ecosystem.

With a market value exceeding $50 billion, Super Micro’s inclusion in the S&P 500 was widely anticipated by investors attuned to its meteoric rise. Notably, trading volumes for Super Micro surpassed $10 billion on Friday, surpassing those of industry titans like Microsoft and Amazon.

The surge in Super Micro’s stock extends beyond the trading floor, with after-hours trading witnessing a notable uptick of 4.5%. Concurrently, Deckers experienced a 2.7% increase in extended trading, while Whirlpool and Zion Bancorporation observed marginal declines of 1.7% and 2%, respectively.

Conclusion:

Super Micro’s induction into the S&P 500 marks a significant milestone, underscoring its transformative impact on the technology landscape. This move not only reflects investor confidence but also signals a broader shift towards tech-centric investment strategies. As Super Micro continues to innovate in AI-optimized servers, its inclusion in the S&P 500 amplifies its visibility and solidifies its position as a key player in the market.