- Tenderd secures $30 million in Series A funding led by A.P. Moller Holding.

- New investors include Quadri Ventures and Saurya Prakash, alongside continued support from existing backers.

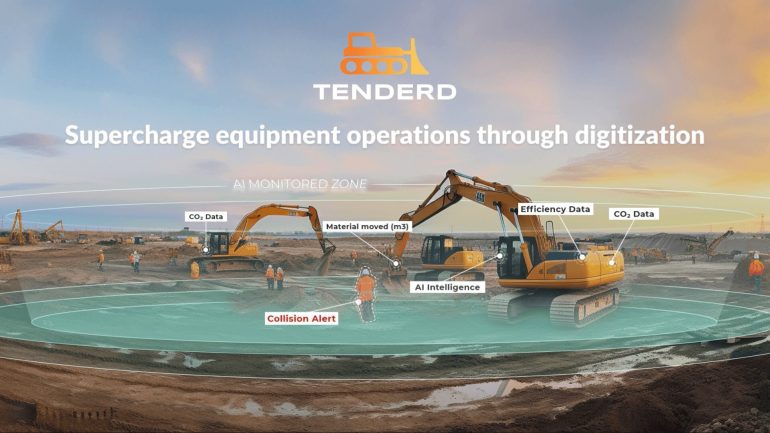

- Funding aims to expand Tenderd’s AI-powered telematics platform for heavy equipment management.

- Focus on enhancing operational efficiencies, safety, and environmental sustainability in construction, manufacturing, and logistics.

- Significant market presence in Saudi Arabia highlighted for future growth.

Main AI News:

Tenderd, a prominent player in digital transformation for managing and operating heavy equipment, has successfully concluded a $30 million Series A funding round. A.P. Moller Holding, a $32 billion investment firm and parent entity of A.P. Moller Group, including A.P. Moller – Maersk, spearheaded the round.

Quadri Ventures and Saurya Prakash, a product leader at Stripe, joined as new investors. Current investors Wa’ed Ventures, Nakhla Ventures, SOMA Capital, and Liquid 2 Ventures also reinvested, reaffirming their steadfast confidence in Tenderd’s trajectory. Notable backers like Peter Thiel, Paul Graham, and Y Combinator have been instrumental in Tenderd’s journey.

Tenderd’s advanced platform revolutionizes heavy equipment data in construction, manufacturing, and logistics into actionable insights. Their telematics platform offers project owners and contractors AI-powered tracking, enhancing equipment productivity, safety, and environmental sustainability. This pioneering approach sets a benchmark for operational excellence and decarbonization, solidifying Tenderd’s leadership in industrial operations.

Chetan Mehta, Head of Growth Equity at A.P. Moller Holding, praised Tenderd’s telematics solutions for real-time visibility and efficiency across various industries. He expressed enthusiasm about contributing to Tenderd’s future growth.

Muhammed Zeeshan Hassan, Chief Investment Officer at Wa’ed Ventures, highlighted their increased investment in Tenderd, underscoring the company’s role in AI adoption in construction.

Turki Al Nowaiser, Managing Partner of Nakhla Ventures, emphasized Saudi Arabia’s strategic market position for Tenderd. He noted the pivotal role Tenderd’s technology plays in supporting Saudi Arabia’s infrastructure development.

The funding will drive technological innovations and expand Tenderd’s global presence, integrating AI into construction, mining, and industrial sectors. The backing from partners in logistics, ports, energy, construction, and technology underscores the wide-ranging applicability of Tenderd’s technology and its unique position in sector-specific AI development, distinguishing it from generic models in industry transformation.

Chris James, Managing Partner at Quadri Ventures, commended Tenderd’s AI analytics platform for its adaptability and impact across asset-heavy industries.

Arjun Mohan, CEO of Tenderd, expressed gratitude for their partners’ support and outlined Tenderd’s commitment to revolutionizing traditional industries with efficiency, safety, and sustainability at its core.

Conclusion:

Tenderd’s successful $30 million Series A funding, led by A.P. Moller Holding, underscores growing investor confidence in AI-driven solutions for heavy equipment management. This investment not only bolsters Tenderd’s technological capabilities but also positions the company at the forefront of transforming traditional industrial operations with advanced telematics and AI integration.