- TSMC forecasts up to a 30% rise in second-quarter sales, driven by surging demand for AI semiconductors.

- CEO C.C. Wei emphasizes TSMC’s pivotal role in addressing the escalating demand for energy-efficient computing power in the AI sector.

- AI-related data center demand is robust, with a significant shift towards AI servers favoring TSMC’s business outlook.

- TSMC’s resilience amidst pandemic-induced challenges is attributed to the AI wave, propelling its stock to record highs.

- AI servers are expected to contribute a substantial portion of revenue by 2024, surpassing 20% by 2028.

- Anticipated decline in demand for automotive chips this year, partially offset by strong demand for 3nm and 5nm technologies.

- Sluggish demand for smartphones poses a potential challenge for TSMC’s second-quarter performance.

Main AI News:

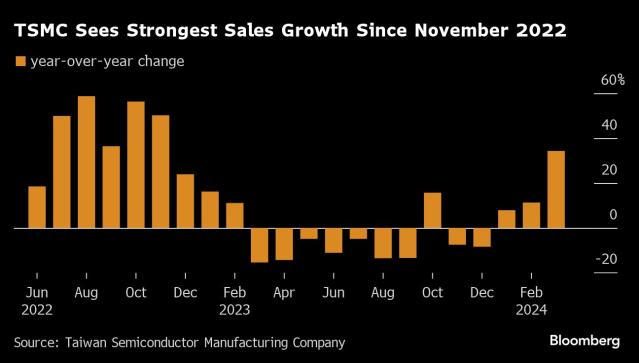

TSMC, the global leader in chip manufacturing and a vital supplier for tech giants like Apple and Nvidia, anticipates a potential surge in second-quarter sales, possibly soaring up to 30%. This projection comes amid a burgeoning demand for semiconductors tailored for artificial intelligence (AI) applications, signaling a robust market trend.

The escalating necessity for AI processors has been particularly evident at Taiwan Semiconductor Manufacturing Co (TSMC), often regarded as a barometer for the chip industry’s health. Executives at TSMC have emphasized the magnitude of this demand surge, highlighting the company’s pivotal role in catering to the insatiable need for energy-efficient computing power in the AI realm.

During the first-quarter earnings call, CEO C.C. Wei underscored TSMC’s collaborative efforts with leading AI innovators, stressing the relentless pursuit to meet the escalating demands of the AI landscape. “Almost all the AI innovators are working with TSMC to address the insatiable AI-related demand for energy efficient computing power,” Wei remarked, elucidating the company’s strategic positioning amidst the AI boom.

The momentum in AI-related data center demand has been formidable, according to Wei, who indicated a significant transition from traditional servers to AI servers, a shift deemed favorable for TSMC’s business outlook.

TSMC’s resilience amid the tapering off of COVID-19 pandemic-induced electronics demand has been buoyed by the AI wave, propelling the company’s stock to record highs. Notably, AI servers are poised to contribute a substantial portion of TSMC’s revenue in 2024, representing a significant uptick from the previous year. Moreover, projections indicate a progressive increase, with AI-related revenue expected to surpass 20% of the total revenue by 2028.

While the demand for automotive chips is projected to decline this year, TSMC remains optimistic about its prospects, particularly buoyed by the robust demand for its cutting-edge 3 nanometer (nm) and 5nm technologies. However, the company anticipates some offset due to sluggish demand for smartphones, underscoring the nuanced dynamics within the semiconductor market landscape.

Conclusion:

TSMC’s optimistic forecast amidst the AI surge underscores the company’s strategic positioning and resilience in meeting evolving market demands. The projected increase in AI-related revenue signals a transformative shift in the semiconductor landscape, with TSMC poised to capitalize on emerging opportunities while navigating through nuanced market dynamics, including fluctuations in automotive and smartphone chip demand.