TL;DR:

- AI is a potential game-changer for complex investment products risk management.

- Research explores RL agents’ effectiveness in hedging derivative contracts.

- Challenges in AI adoption include data scarcity and simulation fidelity.

- Innovative Deep Contextual Bandits approach enhances efficiency and adaptability.

- The model mirrors real-world operational needs, outperforming benchmarks.

- Simplifying risk management through AI offers transformative possibilities.

Main AI News:

Artificial Intelligence (AI) has emerged as a promising solution to tackle the intricate challenges associated with modeling complex financial products, particularly derivative contracts in the realm of investment banking. While AI has garnered considerable attention for its potential, concerns linger regarding its practicality in this arena.

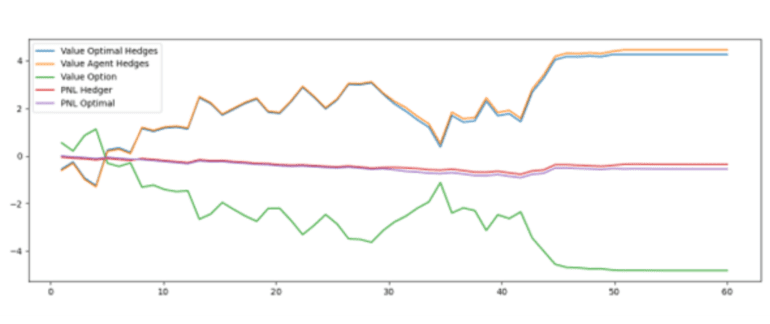

A recent research endeavor featured in The Journal of Finance and Data Science, conducted collaboratively by experts from Switzerland and the United States, delves into the realm of reinforcement learning (RL) agents to ascertain their effectiveness in hedging derivative contracts.

Loris Cannelli, the lead researcher from IDSIA in Switzerland, points out, “Training an AI on simulated market data is not a panacea; its efficacy largely hinges on the fidelity of the simulation and the resource-intensive nature of data consumption in AI systems.”

One persistent challenge faced by researchers is the scarcity of training data. To circumvent this limitation, they resort to creating precise market simulators for AI training. However, this approach introduces a classic financial engineering problem – selecting an appropriate model for simulation and calibrating it. This process closely mirrors the long-standing Monte Carlo methods utilized for decades.

Cannelli adds, “It’s important to recognize that such an AI cannot be deemed entirely model-free; true model freedom would only be attainable with an ample supply of market data, a rarity in realistic derivative markets.”

The study, a collaborative effort between IDSIA and the investment bank UBS, builds upon the concept of Deep Contextual Bandits, a well-established technique in RL known for its data-efficiency and resilience. This innovative approach integrates end-of-day reporting requirements, aligning it with the operational needs of real-world investment firms. Importantly, it significantly reduces the demand for extensive training data while remaining adaptable to dynamic market conditions.

Oleg Szehr, the senior author and a former staff member at various investment banks, clarifies, “In practice, the availability of data and adherence to operational necessities, such as end-of-day risk reporting, are the primary determinants shaping the effectiveness of AI in banking operations, as opposed to the idealized agent training process. The strength of our newly devised model lies in its alignment with the practical realities of investment firms.”

While the approach appears straightforward, rigorous assessments of its performance reveal its superiority over benchmark systems in terms of efficiency, adaptability, and precision within real-world scenarios. “Often, simplicity proves to be more effective, a principle that holds true in risk management as well,” concludes Cannelli.

Conclusion:

The adoption of AI, specifically the innovative Deep Contextual Bandits approach, has the potential to revolutionize risk management in investment banking. While challenges related to data scarcity and simulation fidelity persist, this research showcases the practical benefits of aligning AI with real-world operational needs. By enhancing efficiency, adaptability, and precision, this AI-driven model opens the door to transformative possibilities in the investment banking sector.