TL;DR:

- Nvidia surpasses estimates for Q2 earnings, reporting $2.70 per share (adjusted) compared to Refinitiv’s projected $2.09.

- Q2 revenue hits an impressive $13.51 billion, outshining Refinitiv’s anticipated $11.22 billion.

- Nvidia forecasts Q3 revenue of around $16 billion, a substantial increase from Refinitiv’s estimate of $12.61 billion.

- Net income jumps remarkably to $6.19 billion, an exponential rise from the previous year’s $656 million.

- Nvidia’s A100 and H100 AI chips become pivotal in driving generative AI applications.

- Data center business, including AI chips, records $10.32 billion in revenue, up 171% YoY.

- Adjusted gross margin surges to 71.2%, reflecting a 25.3 percentage point growth due to data center sales.

- Gaming division revenue increased by 22% YoY to $2.49 billion, surpassing estimates.

- High-end graphics application chips’ revenue contracts by 24% YoY to $379 million.

- Nvidia’s board authorizes $25 billion in share buybacks following a $3.28 billion repurchase.

Main AI News:

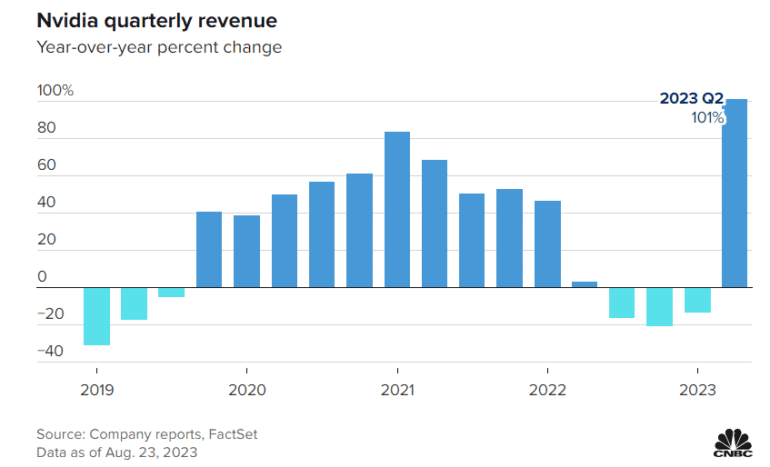

In a sweeping revelation that has sent ripples through the tech industry, Nvidia has outperformed expectations for its fiscal second quarter and delivered an optimistic outlook for the ongoing period, leading to a 6% surge in its extended trading shares on Wednesday. The company’s ascent to new heights has been underscored by a burgeoning demand for AI chips, serving as a testament to its strategic prowess and market acumen.

The fiscal quarter culminating on July 30 showcased Nvidia’s financial prowess in vivid detail:

- Earnings: The company’s adjusted earnings per share stood at $2.70, a striking feat that outshone the projected $2.09 per share estimated by Refinitiv.

- Revenue: The revenue figure reached an impressive $13.51 billion, far surpassing the $11.22 billion prediction posited by Refinitiv.

Nvidia’s foresight and strategic planning are further illuminated by their projection for the fiscal third quarter, with anticipated revenues hovering around $16 billion. This projection notably overshadows the Refinitiv forecast of $12.61 billion, indicating a staggering 170% growth in sales in comparison to the corresponding period from the preceding year.

Astonishingly, net income has experienced a seismic leap, vaulting to an impressive $6.19 billion, equating to $2.48 per share, in contrast to the $656 million, or 26 cents per share, reported a year prior.

At the core of Nvidia’s resounding success lies its Graphics Processing Units (GPUs), with the A100 and H100 AI chips emerging as pivotal players driving the generative AI surge. These chips have become indispensable components for constructing and powering AI applications, exemplified by OpenAI’s ChatGPT and analogous services that seamlessly generate textual responses and images.

The statistics affirm Nvidia’s triumphant stride: Second-quarter revenue exhibited an astounding twofold increase from the previous year, surging from $6.7 billion to an impressive $13.51 billion. This remarkable 88% increment from the previous quarter paints a vivid picture of Nvidia’s upward trajectory.

CEO Jensen Huang, speaking during an earnings call with analysts, expounded on this transformational phase, remarking, “The world is witnessing an unparalleled installation of data centers, spanning the spheres of cloud, enterprise, and beyond. This trillion-dollar landscape is undergoing a paradigm shift towards accelerated computing and generative AI.”

Addressing potential concerns over proposed export restrictions on chips by the Biden administration, Colette Kress, the finance chief, asserted, “Given the robust global demand for our products, we are confident that any additional export restrictions would not yield an immediate substantial impact on our financial standing.”

This remarkable narrative has further propelled Nvidia’s stock price, which has already tripled within the year, catapulting it to the zenith of the S&P 500 performance spectrum. Notably, the post-trading hours saw a surge to approximately $500, a pinnacle that would etch a new record if sustained at the close of Thursday’s session. The prior closing zenith of $474.94, reached on July 18, now stands overshadowed.

Nvidia’s ascent rests on the bedrock of its data center business, featuring the AI chips that have become sought-after commodities by cloud service behemoths and tech giants like Alphabet, Amazon, and Meta. The group reported a staggering $10.32 billion in revenue, a remarkable 171% escalation compared to the previous year and notably eclipsing the StreetAccount’s $8.03 billion approximation.

A testament to its strategic brilliance, Nvidia showcased an augmented adjusted gross margin of 71.2%, reflecting an impressive 25.3 percentage point growth. This remarkable stride can be attributed to the surge in profit-rich data center sales, fortifying the company’s financial foothold.

Although the gaming division, once Nvidia’s cornerstone, witnessed a 22% year-on-year revenue hike to $2.49 billion, exceeding the $2.38 billion consensus estimate, the high-end graphics application chips observed a 24% contraction, dwindling to $379 million. However, the automotive revenue stood at a commendable $253 million, marking a 15% growth from the previous year.

With resounding confidence in its trajectory, Nvidia’s board of directors has authorized a colossal $25 billion in share buybacks, an endeavor spurred by the company’s preceding quarter repurchase of $3.28 billion worth of shares.

Conclusion:

Nvidia’s extraordinary performance underscores the company’s dominance in AI chips and generative AI applications. Its soaring revenues and net income, coupled with strategic projections, fortify its pivotal role in the evolving tech landscape. As data centers transition towards accelerated computing and generative AI, Nvidia’s strategic foresight and technological innovations position it as a driving force in shaping the market’s future.