TL;DR:

- Darrow, an AI-driven startup, raises $35 million in funding.

- The company utilizes AI to identify potential class action lawsuits in areas such as data privacy and environmental contamination.

- Darrow’s data-driven insights have already initiated active cases amounting to $10 billion in claims.

- The funding will be used to expand the team, diversify legal domains, and enhance technology assets.

- The Series B funding round was led by B2B specialist Georgian, with participation from F2 and previous investors.

- Darrow is committed to empowering law firms to discover impactful cases and broaden access to justice.

- The company operates as a “justice intelligence” platform, analyzing publicly available information to predict legal violations and potential litigation.

- Darrow’s founders envision future expansion to include consumers in their mission.

- The investment reflects the growing interest and potential in the class action and mass action market.

Main AI News:

In a country renowned for its litigious culture, where the legal industry thrives, Darrow, an AI-powered startup, is seizing the opportunity to revolutionize the landscape. With the United States boasting the highest number of lawsuits globally, Darrow has developed an AI data engine designed to sift through vast repositories of publicly-accessible documents, pinpointing potential class action lawsuits in areas such as data privacy breaches and environmental contamination. The company has just announced a successful funding round, securing $35 million to further its mission.

Darrow’s journey has been marked by significant success in recent years. Leveraging its data-driven insights, the startup has initiated active cases that collectively claim a staggering $10 billion. Now, with a fresh injection of capital, Darrow plans to expand its workforce, welcoming additional engineers and business development professionals. Moreover, it aims to broaden the scope of its search and analytics tools, incorporate new legal domains into its repertoire, and invest in the enhancement of its large language models and technology assets.

This Series B funding round was spearheaded by B2B specialist Georgian, with participation from F2 and previous backers Entrée Capital and NFX. Darrow’s total investment now stands just shy of $60 million, with notable contributions from Y Combinator, where it was a part of the W21 batch and R-Squared Ventures.

Established in 2020 during the onset of the COVID-19 pandemic, Darrow’s inception coincided with a shift in the legal profession’s modus operandi. As lawyers increasingly turned to online platforms to seek leads and new cases, Darrow’s founders, Evyatar Ben Artzi and CTO Gila Hayat, recognized the need for a proactive solution.

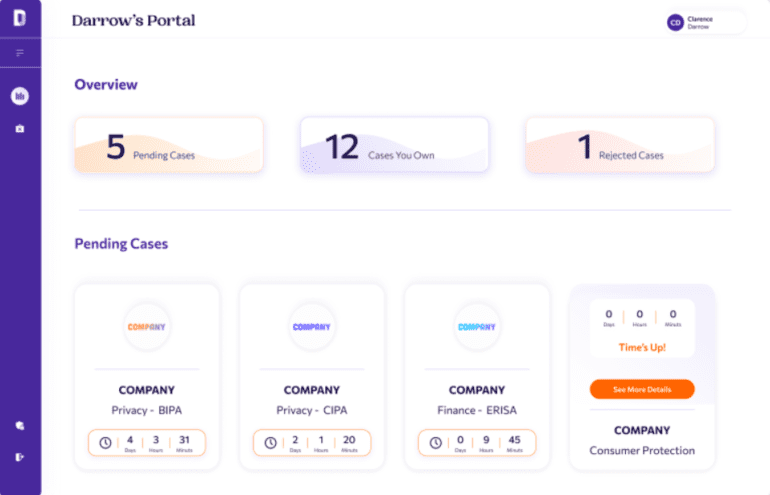

While Darrow refrains from disclosing its valuation and revenue details, Ben Artzi disclosed that approximately 50 law firms, comprising hundreds of lawyers, currently utilize their product. Their platform empowers legal professionals to identify and cultivate impactful cases.

Ben Artzi emphasizes Darrow’s commitment to addressing pressing societal issues. “There are a lot of other violations out there. We are not finding everything yet. So we want to scale our Large Language Model to detect other egregious activity,” he stated. Darrow aspires to be the go-to platform for law firms, where they can uncover cases that truly make a difference.

The concept of a firm actively seeking opportunities to litigate may raise eyebrows, but Darrow approaches it with a distinct perspective. While class action lawsuits are typically associated with significant costs and risks and are only accessible to larger law firms, Darrow believes that every lawyer should have the chance to fight for justice. The startup’s name pays homage to Clarence Darrow, the renowned civil liberties lawyer, reflecting its moral compass.

Darrow’s technology operates as a “justice intelligence” platform, specializing in predictive analytics tailored for legal violations and potential litigation. It systematically scours thousands of publicly available sources, from newsfeeds to social media discussions and regulatory complaints, connecting the dots to uncover evidence of wrongdoing or the potential for it. Furthermore, it offers a predicted legal outcome and estimates the case’s value.

To maintain transparency and quality, Darrow employs a team of legal data specialists, including former lawyers, to review insights and patterns. The platform has already identified a range of violations, including environmental infractions, data breaches, workplace discrimination, fraud, and antitrust violations.

Initially targeting lawyers as its primary customer segment, Darrow capitalizes on the legal industry’s increasing familiarity with AI tools. These law firms pay upfront on a per-case basis for access to Darrow’s data, in contrast to a pro bono model.

As the company aims to amplify individuals’ legal voices, it envisions creating a portal and business model for individuals to access relevant data and report their own findings. Gila Hayat highlights the importance of consumers in their long-term vision, emphasizing their role as a crucial driving force.

“Darrow’s founders recognized a gap in the $63 billion class and mass action market and developed an innovative language model to transform the scale and impact of litigation teams,” stated Margo Wu, lead investor from Georgian, underscoring the company’s mission-driven approach. With a committed team of lawyers, technologists, and product developers, Darrow is poised to make a significant impact in the legal landscape.

Conclusion:

Darrow’s substantial funding success underscores the growing significance of AI-driven solutions in the legal industry. Their ability to democratize access to potential class action cases and empower law firms to pursue impactful litigation positions them as a key player in the evolving legal landscape. This investment signals a promising future for the class action and mass action market, as technology continues to reshape traditional legal practices.