- PhonePe, valued at $12 billion, is a leader in adopting AI, particularly machine learning (ML), for fraud detection in the fintech sector.

- ML models are pivotal for risk management and fraud detection, handling daily transactions exceeding $230-240 million.

- The company secured nearly $1 billion in funding in 2023, enabling aggressive expansion efforts, including the launch of new offerings and an app store.

- Revenue surged by 77% in FY23 to INR 2,913.7 crore, driven by the successful introduction of new products and business verticals.

- PhonePe extends its global footprint with digital payment offerings in the UAE, leveraging the Unified Payments Interface (UPI) infrastructure.

Main AI News:

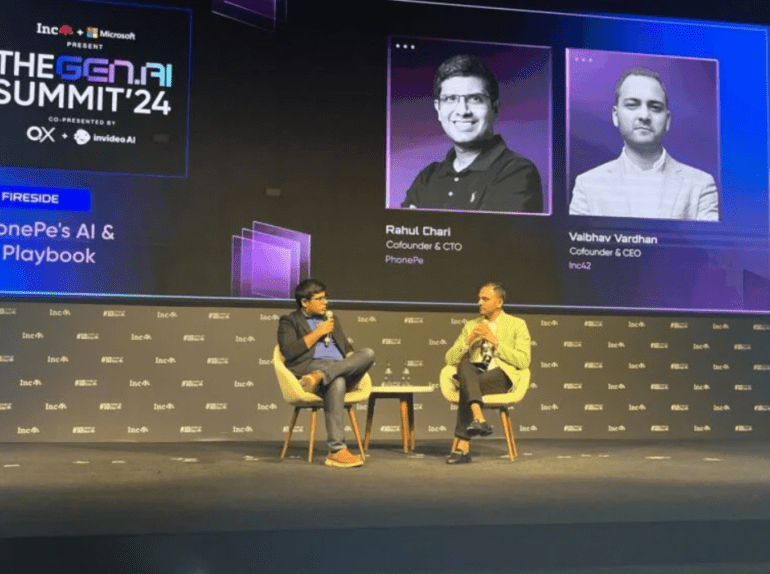

In the dynamic realm of fintech, Indian startups are capitalizing on the potential of artificial intelligence (AI) to drive operational efficiency and elevate performance. PhonePe, boasting a substantial valuation of $12 billion, stands as a frontrunner in embracing AI within the fintech domain. At the recent Inc42 ‘The GenAI Summit,’ PhonePe’s CTO and co-founder, Rahul Chari, shed light on the prevalent confusion between AI and generative AI (GenAI). Chari emphasized PhonePe’s concerted efforts to leverage AI, particularly through machine learning (ML) methodologies.

According to Chari, machine learning models employed by PhonePe are predominantly focused on enhancing risk management and fraud detection capabilities. He underscored the indispensability of ML models, labeling them as the cornerstone across various operational facets, especially in fraud detection scenarios. Given the staggering daily transaction volumes exceeding $230-240 million, even a marginal fraction of fraudulent activities could entail substantial losses, accentuating the critical role of robust fraud detection mechanisms.

Delving into the realm of GenAI, Chari articulated its potential to generate value-added content tailored to business requirements. He expressed optimism regarding the productivity-enhancing facets of GenAI, underlining its significance in driving innovation and content creation endeavors.

In the wake of the funding winter, PhonePe demonstrated resilience by securing close to $1 billion in funding during 2023, with notable contributions from key investors such as GIC and General Atlantic. This influx of capital facilitated PhonePe’s aggressive expansion initiatives, manifesting in the introduction of diverse offerings, including dedicated apps for e-commerce (Pincode) and investment technology (Share.Market), alongside the establishment of its proprietary app store, Indus Appstore.

The financial year 2023 witnessed a remarkable surge in PhonePe’s revenue, catapulting by 77% to INR 2,913.7 crore from INR 1,646.2 crore in the preceding fiscal year. This remarkable growth trajectory was underpinned by the successful launch and scaling of new products and business verticals, encompassing domains such as smart speakers, rent payments, and insurance distribution.

In a strategic move aimed at bolstering its global presence, PhonePe recently unveiled its foray into the UAE market, enabling users to seamlessly conduct digital payments leveraging the Unified Payments Interface (UPI) infrastructure. The GenAI Summit served as a pivotal congregation, uniting thought leaders and industry stalwarts to deliberate on funding avenues, as well as the transformative impact of GenAI across diverse sectors.

Conclusion:

PhonePe’s strategic emphasis on leveraging machine learning for fraud detection underscores its commitment to operational excellence and risk mitigation within the fintech landscape. The substantial funding injections and robust revenue growth signify confidence from investors and validate PhonePe’s innovative approach, positioning it as a formidable player poised for continued expansion and market dominance.